The Aarons Co Inc (AAN) Faces Revenue Decline and Net Loss in Q4; Optimistic About 2024 Growth

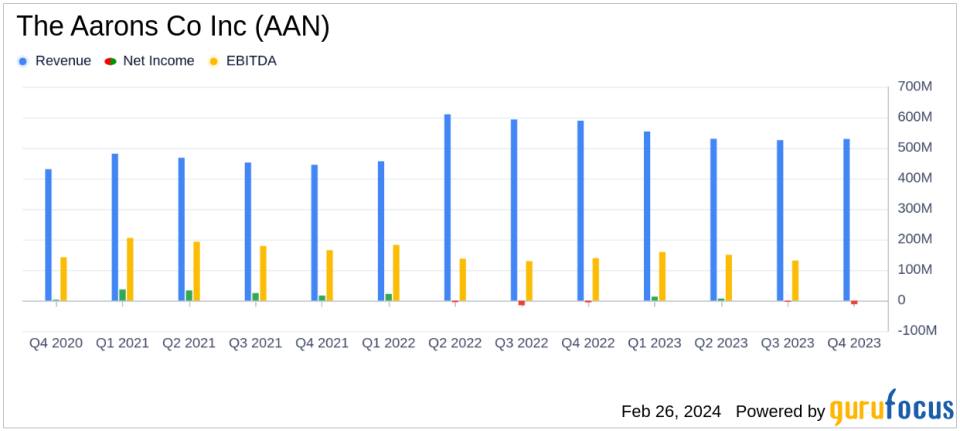

Revenue: Q4 revenue decreased by 10.2% year-over-year to $529.5 million.

Net Loss: Q4 reported a net loss of $12.4 million, with a loss per share of $0.41.

Adjusted EBITDA: Experienced a 25.2% decrease to $22.4 million in Q4.

Free Cash Flow: Adjusted free cash flow increased by 10.5% to $102.3 million for the full year.

Debt Reduction: Net debt was reduced by 37.2%, lowering by $79.8 million.

E-commerce Growth: Aaron's Business e-commerce recurring revenue written surged by 60.0% in Q4.

2024 Outlook: Revenue projected between $2.055 billion to $2.155 billion with adjusted EBITDA of $105.0 million to $125.0 million.

On February 26, 2024, The Aarons Co Inc (NYSE:AAN), a specialty retailer known for its lease-to-own model for home goods, released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The company, which operates through Aaron's Business and BrandsMart segments, reported a decrease in revenues and adjusted EBITDA, alongside a net loss for the quarter. However, the company's e-commerce segment showed significant growth, and it achieved a notable increase in adjusted free cash flow for the year.

Financial Performance and Challenges

The Aarons Co Inc (NYSE:AAN) faced a challenging quarter with a 10.2% decrease in revenues, amounting to $529.5 million. The adjusted EBITDA also fell by 25.2% to $22.4 million. The company reported a loss per share of $0.41, with a non-GAAP loss per share of $0.26. These declines reflect ongoing pressures in key product categories and a competitive retail environment.

Despite these challenges, The Aarons Co Inc (NYSE:AAN) improved its adjusted free cash flow by 10.5% to $102.3 million for the full year and reduced its net debt by 37.2%, indicating a strong balance sheet and liquidity position. The company's focus on e-commerce growth, as evidenced by a 60% increase in recurring revenue written in this segment, demonstrates its adaptability and potential for recovery.

CEO Commentary and Strategic Outlook

In response to ongoing pressure in our key product categories at Aaron's and BrandsMart during 2023, we took strong actions to drive demand and reduce costs. In Q4, we launched a new omnichannel lease decisioning and customer acquisition program, which led to robust e-commerce growth that has continued into 2024. Also, I'm pleased that we exceeded our cost savings target in 2023, and we remain focused on driving further efficiencies. While the lower lease portfolio size to start the year will impact adjusted earnings in 2024, we expect our actions will generate lease portfolio growth. Given the investments we've made to innovate our business and the strength of our balance sheet, we are better positioned than ever to drive long-term profitable growth. Our management team and Board are highly engaged and committed to taking actions that will deliver additional value for our shareholders.

CEO Douglas A. Lindsay expressed optimism for 2024, citing the company's strategic actions to drive demand and reduce costs. The Aarons Co Inc (NYSE:AAN) anticipates revenue growth and is focused on further improving its e-commerce capabilities and cost structure to support long-term profitability.

2024 Outlook and Investor Relations

The Aarons Co Inc (NYSE:AAN) projects its 2024 revenues to be between $2.055 billion and $2.155 billion, with adjusted EBITDA ranging from $105.0 million to $125.0 million. The company's non-GAAP diluted EPS is expected to be between $(0.10) and $0.25. These projections reflect the company's strategic initiatives and market positioning.

Investors and analysts can look forward to the earnings conference call hosted by CEO Douglas A. Lindsay, President Steve Olsen, and CFO C. Kelly Wall, providing further insights into the company's performance and outlook.

For more detailed financial information and future updates, interested parties can visit investor.aarons.com or contact Investor Relations and Media Relations at The Aarons Co Inc (NYSE:AAN).

Explore the complete 8-K earnings release (here) from The Aarons Co Inc for further details.

This article first appeared on GuruFocus.