AB InBev (BUD) Q2 Earnings Beat, Revenues Miss Estimates

Anheuser-Busch InBev SA/NV BUD, alias AB InBev, reported mixed results in second-quarter 2023. The company’s earnings beat the Zacks Consensus Estimate, while revenues missed. Earnings declined on a year-over-year basis, while sales improved.

Top and bottom-line growth reflected business momentum, owing to relentless execution, investment in its brands and accelerated digital transformation. Results also benefited from continued consumer demand for its brand portfolio. Backed by the ongoing business momentum, the company retained its view for 2023.

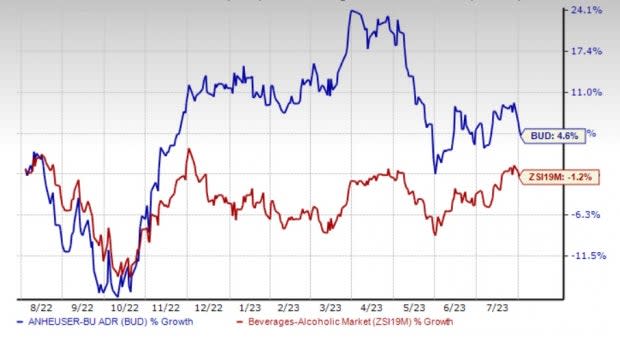

Shares of the Zacks Rank #3 (Hold) company have gained 4.6% in the past year against the industry’s decline of 1.2%.

Image Source: Zacks Investment Research

Q2 Highlights

AB InBev reported underlying EPS (normalized EPS, excluding mark-to-market gains and losses related to the hedging of share-based payment programs, and the impacts of hyperinflation) of 72 cents in second-quarter 2023, down 1.4% from the 73 cents earned in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate of 66 cents.

Revenues of $15,120 million improved 2.2% from the year-ago quarter. However, revenues missed the Zacks Consensus Estimate of $15,329 million. The company registered organic revenue growth of 7.2%, primarily driven by robust revenue per hectoliter (hl) growth and improvement across more than 85% of its markets. Revenues benefited from pricing actions, continued premiumization and other revenue-management initiatives. Accelerated digital transformation also contributed to top-line growth in the quarter.

Revenues reflected strong performances of its three global brands — Budweiser, Corona and Stella Artois — which advanced 18.4% outside their home markets in the second quarter.

Revenue per hl was up 9% on an organic basis, backed by revenue-management initiatives, the expansion of the beer category across the company’s key markets and premiumization efforts. However, the company’s total organic volume declined 1.4% as growth across most of the markets was offset by a decline in the United States. The total organic volume included a 1.8% decline in the own-beer volume, offset by 0.5% growth in the non-beer volume.

Anheuser-Busch InBev SA/NV Price, Consensus and EPS Surprise

Anheuser-Busch InBev SA/NV price-consensus-eps-surprise-chart | Anheuser-Busch InBev SA/NV Quote

AB InBev has been keen on making the most of investments in its portfolio over the years, as well as rapidly growing its digital platform, including BEES and Zé Delivery. The company’s digital transformation initiatives have been on track, with the B2B digital platforms contributing about 64% of its revenues in the second quarter. The company noted that the monthly active user base of BEES reached 3.3 million users as of Jun 30, 2023. Its omnichannel direct-to-consumer ecosystem generated more than $385 million in revenues in second-quarter 2023.

The company has been focused on expanding its Beyond Beer portfolio, which has also been aiding the top line. Notably, the Beyond Beer portfolio contributed more than $385 million to the total revenues in second-quarter 2023.

The cost of sales increased 3.3% on a reported basis and 9.2% on an organic basis to $7,019 million in the second quarter.

The company’s normalized earnings before interest, taxes, depreciation and amortization (EBITDA) were $4,909 million, which fell 3.7% year over year on a reported basis and improved 5% on an organic basis. The normalized EBITDA margin contracted 190 basis points (bps) on a reported basis and 69 bps organically to 32.5%. The decline in organic EBITDA can be attributed to commodity cost headwinds and increased sales and marketing investments.

SG&A expenses declined 4.6% year over year to $4,707 million but increased 9.4% on an organic basis. Higher SG&A expenses can be attributed to elevated supply-chain costs.

Outlook

For 2023, AB InBev expects year-over-year EBITDA growth of 4-8%, in line with its medium-term outlook. It anticipates revenue growth to be higher than EBITDA growth, driven by strong volume and pricing.

The company expects net pension interest expenses and accretion expenses of $200-$230 million, based on currency and interest rate fluctuations. It anticipates an average gross debt coupon of 4% for 2023.

Management anticipates a normalized effective tax rate of 27-29% for 2023. Net capital expenditure is projected to be $4.5-$5 billion for 2023, driven by higher investments in innovation and other consumer-centric initiatives to fuel the ongoing momentum.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Molson Coors TAP, The Duckhorn Portfolio NAPA and The Boston Beer Company SAM.

Molson Coors currently sports a Zacks Rank #1 (Strong Buy). TAP has a trailing four-quarter earnings surprise of 34.2%, on average. It has a long-term earnings growth rate of 7.1%. The company has rallied 27.3% in the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Molson Coors’ current financial-year sales and earnings suggests growth of 8.4% and 19.5%, respectively. The consensus mark for TAP’s earnings per share has moved up 2.5% in the past seven days.

Duckhorn currently has a Zacks Rank #2 (Buy) and an expected long-term earnings growth rate of 6.6%. NAPA has a trailing four-quarter earnings surprise of 14.2%, on average.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings suggests growth of 8.3% and 4.8%, respectively, from the year-ago reported numbers. Shares of NAPA have declined 33.5% in the past year.

Boston Beer currently carries a Zacks Rank #2. SAM has a trailing four-quarter negative earnings surprise of 74.9%, on average. The company has declined 5.2% in the past year.

The Zacks Consensus Estimate for Boston Beer’s current financial year’s sales suggests a decline of 4.1% from the year-ago reported number, whereas the same for earnings per share indicates growth of 7%. The consensus mark for SAM’s earnings per share has moved up 7.7% in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Anheuser-Busch InBev SA/NV (BUD) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report