Abacus Life Inc Surpasses Revenue Expectations, Faces Net Loss in Q4 Amid Strategic Expansions

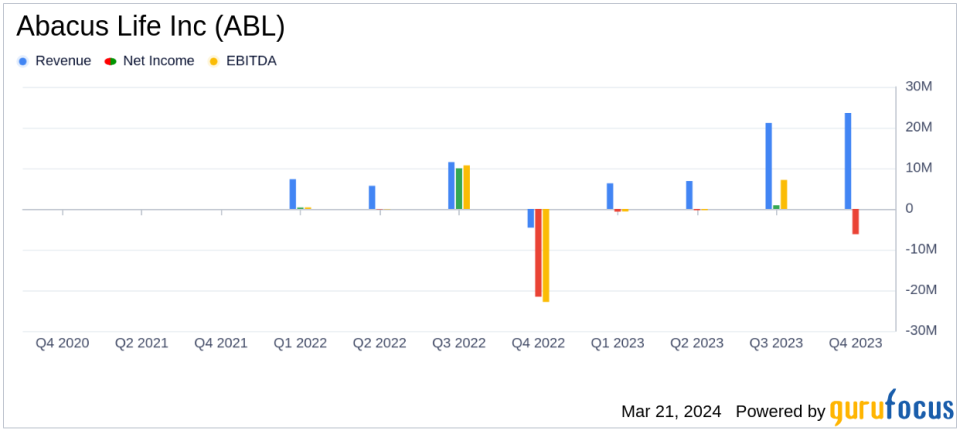

Total Revenue: Q4 revenue grew 25% year-over-year to $23.6 million, with full-year revenue up 14% to $79.6 million.

Capital Deployment: Originations capital deployment surged by 92% in Q4 to $68.3 million, with a 46% increase for the full year to $218.9 million.

Net Income: Q4 saw a GAAP net loss of $6.2 million, attributed to non-cash and one-time expenses, while full-year GAAP net income was $8.5 million.

Adjusted EBITDA: Full-year adjusted EBITDA rose 13% to $39.3 million, with Q4 adjusted EBITDA marginally changing to $11.0 million.

Stock Repurchase and Debt Management: Implemented a $15 million stock repurchase program and reduced interest rates through a successful public bond offering.

On March 21, 2024, Abacus Life Inc (NASDAQ:ABL), a leader in the life insurance secondary market and alternative asset management, unveiled its financial achievements for the fourth quarter and full year of 2023 through its 8-K filing. The company reported a significant 25% increase in Q4 revenue year-over-year, reaching $23.6 million, and a 14% rise in full-year revenue to $79.6 million. This growth is primarily attributed to enhanced active management revenue, increased capital deployment, and a higher number of policies sold directly to third parties.

Abacus Life Inc is renowned for its comprehensive approach to the life insurance market, offering innovative solutions for policyholders and investors alike. The company's strategic focus on leveraging technology and data analytics has positioned it as a pivotal player in the industry, catering to the needs of pension funds and financial services sectors.

Financial Highlights and Strategic Moves

The year 2023 marked a period of strategic expansion for Abacus, with a notable 92% increase in Q4 capital deployment to $68.3 million and a 46% rise for the full year to $218.9 million. Despite facing a GAAP net loss of $6.2 million in Q4 due to non-cash expenses and one-time charges, the company's full-year GAAP net income stood at $8.5 million. Adjusted net income for the year was $29.4 million, slightly below the previous year's $32.4 million, reflecting the company's resilience amidst strategic investments and expansions.

Abacus also announced a $15 million stock repurchase program, demonstrating confidence in its long-term value proposition. The successful completion of a public bond offering and the reduction of interest rates by approximately 275 basis points further underscore the company's prudent financial management and strategic foresight.

Looking Ahead

CEO Jay Jackson highlighted the company's solid performance and strategic initiatives, including the launch of its technology subdivision, ABL Tech, and the raising of an additional $25 million through 9.875% Notes. These moves are aimed at sustaining growth and delivering long-term value to shareholders.

With a strong foundation in data and technology, Abacus Life Inc is well-positioned to navigate the complexities of the life insurance market and capitalize on emerging opportunities. The company's focus on innovation, coupled with its strategic investments, sets the stage for continued success and value creation for its stakeholders.

For more detailed financial information and future updates, investors and interested parties are encouraged to visit Abacus Life Inc's investor relations website.

Explore the complete 8-K earnings release (here) from Abacus Life Inc for further details.

This article first appeared on GuruFocus.