Abbott (ABT) Closes Acquisition Deal of Bigfoot Biomedical

Abbott Laboratories, Inc. ABT recently completed its previously announced acquisition of Bigfoot Biomedical — a developer of intelligent insulin management systems for people with diabetes. Financial details were kept under wraps.

Following the completion of the transaction, Bigfoot was converted into an Abbott wholly-owned subsidiary by the provisions of the merger agreement.

More on the News

To provide suggestions for insulin dose, Bigfoot developed Bigfoot Unity, a smart system for managing insulin that includes connected insulin pen caps that use information from an integrated continuous glucose monitor (iCGM) and guidance from a healthcare provider. The dosage guidelines are shown on the digital pen cap screen to assist users in determining how much insulin to take.

Bigfoot's Unity system features a customer smartphone app linked to a cloud-based internet portal utilized by healthcare providers to support their patients, including remote care, and it solely integrates with Abbott's FreeStyle Libre technology. The system is compatible with FreeStyle Libre 2 sensors and all popular disposable basal and bolus insulin pen brands in the United States.

Rationale Behind Acquisition

Abbott's footprint in the diabetes care market is increased by the Bigfoot Biomedical acquisition, which builds on the company's market-leading FreeStyle Libre portfolio of continuous glucose monitoring technologies and advances its ambitions to create linked solutions that will make diabetes management even more precise and individualized.

Image Source: Zacks Investment Research

Both companies aim to offer affordable and simple-to-use products to patients with diabetes. The acquisition of Bigfoot Biomedical will combine two industry leaders in CGM and insulin dosing support. Combining the two companies will enable Abbott to create more interconnected solutions to improve the personalization and accuracy of diabetes control.

Industry Prospects

Per a Research report, the global CGM devices market was valued at $7.82 billion in 2022 and is expected to witness a CAGR of 4.4% by 2030.

Progress Within Diabetes Business

Abbott’s Diabetes Care business continued to benefit from the growing sales of its flagship, sensor-based continuous glucose monitoring system, FreeStyle Libre. In a relatively short span, FreeStyle Libre has achieved global leadership among continuous glucose monitoring (CGM) systems for Type 1 and Type 2 users.

In 2023, as a significant milestone for the company, Libre became the first and only CGM system to be nationally reimbursed in France. In 2023, Libre received FDA clearance for connectivity with automated insulin delivery systems. Abbott is working with leading insulin pump manufacturers to integrate their systems with Libre 2 and Libre 3.

In June 2023, Abbott partnered with the American Diabetes Association (“ADA”) to launch a therapeutic nutrition program for people with diabetes. The first-of-its-kind project will evaluate how diabetes technology, like continuous glucose monitoring (CGM) systems, can help people with diabetes make informed decisions about their food and activity.

Price Performance

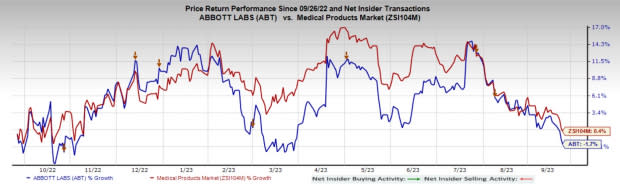

In the past year, ABT’s shares have declined 1.7% against the industry’s rise of 0.4%.

Zacks Rank and Key Picks

Abbott currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 17% against the industry’s 1.6% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 2.8% against the industry’s 5.1% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 29.1% compared with the industry’s 2.8% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report