Abbott (ABT) Gains From Global Expansion Amid Macro Woes

Abbott’s ABT branded generics within Established Pharmaceuticals Division (EPD) and diabetes businesses should drive growth in the coming quarters. New product launches should boost sales. However, the business environment continues to be challenging globally. The stock carries a Zack Rank #3 (Hold).

Abbott is expanding its Diagnostics business foothold (consisting of 24% of the company’s total revenues in the third quarter of 2023). Although, over the past few quarters, there has been a decline in demand for Abbott’s rapid diagnostic tests to detect COVID-19, it is largely being offset by higher growth across other businesses.

In the United States and internationally, Abbott is experiencing increased demand for routine diagnostics. Further, in the United States, Abbott is registering strong growth within the blood transfusion testing business, which is consistently recovering from the impact of lower plasma donations that occurred during the COVID-19 pandemic. Within Rapid Diagnostics, in the third quarter, the base business gained from increased demand for respiratory tests in anticipation of an earlier-than-normal start to the flu season in the Northern Hemisphere.

Abbott’s EPD business operates solely in emerging geographies, with leading positions in many of the largest and fastest-growing pharmaceutical markets for branded generics in the world. These markets include India, Russia, China and Latin America. The company recently noted that banking on the successful execution of its Branded Generic operating model, EPD is well positioned for sustained growth in many of these growing pharmaceutical markets.

Over the past two years, this business has managed to sustain low double-digit growth and has successfully positioned itself as one of the best-positioned large healthcare companies in emerging markets. In September, Abbott entered into an agreement with global biotech leader mAbxience to commercialize several biosimilars in emerging markets. This collaboration will help introduce cutting-edge medicines in the areas of oncology, women's health and respiratory diseases in countries that have historically lacked access to these treatment options.

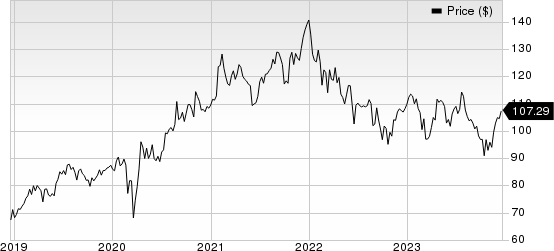

Abbott Laboratories Price

Abbott Laboratories price | Abbott Laboratories Quote

On the flip side, during the COVID-19 public health emergency, Abbott’s diagnostic tests witnessed stupendous revenue growth backed by increased demand for testing as well as government-enacted favorable policies to expedite or promote access to healthcare in order to slow down or stop the spread of the virus. However, in the last few months of 2022 and following the official ending of the public health emergency in May, Abbott experienced a continuous decline in COVID testing-related demand.

In the third quarter of 2023, Abbott’s Rapid Diagnostics sales decreased 59.2% from the year-ago period due to lower demand for COVID-19 tests. The 27.3% decline in Molecular Diagnostics sales in the third quarter of 2023 was due to lower demand for laboratory-based molecular tests for COVID-19 as well as respiratory testing compared to significantly high demand in the year-ago period when the severity of the pandemic was quite prominent.

In the upcoming months too, this year-over-year decline in testing demand is expected to mar Abbott’s overall Diagnostics business sales.

Further, foreign exchange is a major headwind for Abbott due to a considerable percentage of its revenues coming from outside the United States. The strengthening of the euro and some other developed market currencies has constantly been hampering the company’s performance in the international markets.

In the third quarter, foreign exchange had an unfavorable year-over-year impact of 1.4% on sales.

Over the past year, shares of Abbott have declined 2.3% compared with the industry’s 3.6% decline.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have decreased 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 for 2023 and from $4.07 to $4.11 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report