Abbott (ABT) Gets FDA Clearance for FreeStyle Libre 3 Reader

Abbott Laboratories ABT recently announced the FDA clearance of a standalone reader for its FreeStyle Libre 3 integrated continuous glucose monitoring system (iCGM). Through the reader, diabetes patients can have access to lifesaving technology that is smaller and easier to use without bearing the high-cost burdens of other systems.

The newest development uplifts the company’s efforts to add the FreeStyle Libre 3 system to Medicare's list of covered systems at the earliest.

Significance of Freestyle Libre 3

Abbott’s FreeStyle Libre 3 is currently the most prescribed and affordable iCGM system in the United States. The latest in the FreeStyle Libre portfolio features a glucose sensor, which is noted as the world's smallest, thinnest and most discreet.

Image Source: Zacks Investment Research

The FreeStyle Libre 3 reader is a small handheld device that displays real-time glucose readings directly from a small sensor worn on the back of a person's upper arm. This allows the patient to manage diabetes quickly and easily by viewing glucose readings on a large, bright and easy-to-see screen.

The reader uses a rechargeable lithium-ion battery, which is commonly found in many other electronic devices like mobile phones. The reader comes with the user manual, which provides details on how to safely store, charge and use the device through the Abbott-provided USB cable and power adapter.

People who use the FreeStyle Libre 3 system will also have the option to use the current FreeStyle Libre 3 smartphone apps. However, these apps are only compatible with certain mobile devices and operating systems.

Industry Prospects

Per a Research report, the global blood glucose monitoring device market was valued at $11.71 billion in 2021. It is expected to witness a CAGR of 8% up to 2030.

The rising incidence of diabetes and the increasing awareness regarding diabetes preventive care and new products are expected to fuel market growth.

Recent Developments

In March 2023, Abbott’s latest addition to the Epic surgical valve platform, the Epi Max stented tissue valve, received FDA approval. The design of the device is optimized to improve valve blood flow and will be used in the treatment of aortic regurgitation or stenosis.

In the same month, ABT also announced new data from the meta-analysis of three randomized, controlled trials (CHAMPION, GUIDE-HF and LAPTOP-HF) presented at the Technology and Heart Failure Therapeutics Conference in Boston, MA. The studies revealed that the remote monitoring of patients with hemodynamic pressure sensing technology, such as its CardioMEMS HF System, can significantly improve survival in heart failure patients with reduced ejection fraction.

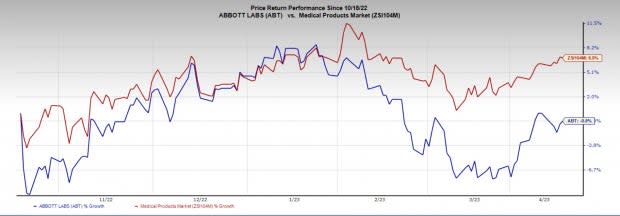

Price Performance

In the past six months, Abbott’s shares have declined 0.9% compared to the industry’s rise of 6.9%.

Zacks Rank and Key Picks

Abbott Laboratories currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Lantheus LNTH, Avanos Medical AVNS and Insulet PODD. Lantheus sports a Zacks Rank #1 (Strong Buy), while Avanos Medical and Insulet each carry a Zack Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lantheus’ stock has risen 45.9% in the past year. Earnings estimates for Lantheus have remained constant at $4.79 per share for 2023 and $5.32 for 2024 in the past 30 days.

LNTH’s earnings beat estimates in all the last four quarters, delivering an average surprise of 50%. In the last reported quarter, it posted an earnings surprise of 42.71%.

Estimates for Avanos Medical in 2023 have remained constant at $1.68 per share in the past 30 days. Shares of the company have declined 3.7% in the past year compared with the industry’s fall of 10.8%.

Avanos Medical’s earnings beat estimates in all the trailing four quarters, the average surprise being 11.01%. In the last reported quarter, AVNS delivered an earnings surprise of 25%.

Insulet’s stock has increased 24.1% in the past year. The company has an estimated earnings growth rate of 56.59% for the next year.

Insulet’s earnings beat estimates in three of the trailing four quarters and missed the same in one, the average surprise being 59.81%. In the last reported quarter, PODD delivered an earnings surprise of 129.17%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report