Abbott (ABT) Rides on Nutrition Recovery Amid Low Testing Sales

Abbott’s ABT branded generics and international diabetes businesses continue to drive growth for the company. Yet, the business environment continues to be challenging. The stock carries a Zacks Rank #3 (Hold).

Abbott is expanding its Diagnostics business foothold (consisting of nearly 30% of the company’s total revenues in the second quarter of 2023). Although, over the past few quarters, there has been a decline in demand for Abbott’s rapid diagnostic tests to detect COVID-19, it is largely being offset by higher growth across other businesses. Particularly, in the United States and Europe, Abbott is experiencing increased demand for routine diagnostic testing.

Following the massive setback related to the voluntary recall and production stoppage of certain infant powder formula products manufactured at its facility in Sturgis, MI last year, Abbott’s Nutrition business has started showing signs of recovery since the beginning of 2023. Per the last update on the second-quarter earnings call, the company has made good progress in increasing manufacturing production. It has now recovered approximately 75% of the market share in the infant formula business. Adult nutrition is also gaining momentum, backed by the strong global sales performance of Abbott's complete and balanced nutrition brand, Ensure.

Further, Abbott’s Established Pharmaceuticals Division (EPD) operates solely in emerging geographies, with leading positions in many of the largest and fastest-growing pharmaceutical markets for branded generics in the world. These markets include India, Russia, China and Latin America. The company recently noted that banking on the successful execution of its Branded Generic operating model, EPD is well positioned for sustained growth in many of these growing pharmaceutical markets.

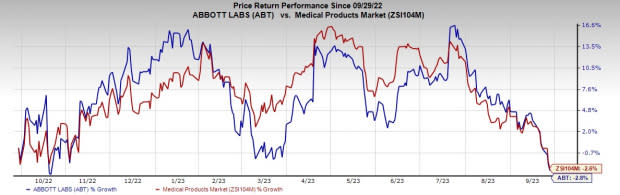

Image Source: Zacks Investment Research

On the flip side, during the COVID-19 public health emergency, Abbott’s diagnostic tests witnessed stupendous revenue growth backed by increasing demand for testing as well as government-enacted favorable policies to expedite or promote access to healthcare in order to slow down or stop the spread of the virus. However, through the last few months of 2022 and following the official ending of the public health emergency in May, Abbott experienced a continuous decline in COVID testing-related demand.

Meanwhile, Abbott, in trying to expand its nutrition business in emerging markets, is facing weakness in Greater China due to challenging market dynamics. In pediatric nutrition, the company is apprehensive about the new food safety regulations and a consequent oversupply of products in the market. In December 2022, Abbott initiated steps to exit its pediatric nutrition business in China. The withdrawal of business from the Chinese market, which holds a significant share of Abbott’s pediatric nutrition sales, is going to significantly impact Abbott’s overall Nutrition business in the coming period.

Shares of Abbott have underperformed the industry over the past year. The stock has lost 2.8% compared with the industry’s 2.6% decline.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Intuitive Surgical ISRG and Quanterix QTRX.

Haemonetics has an estimated earnings growth rate of 26.1% for fiscal 2024 compared with the industry’s 18.7%. HAE’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.39%. Its shares have rallied 18.3% against the industry’s 0.5% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical, carrying a Zacks Rank #2 at present, has a long-term estimated earnings growth rate of 15.7% compared with the industry’s 15.5%. Shares of the company have rallied 51.1% compared with the industry’s 1.8% growth over the past year.

ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 4.19%.

Quanterix, carrying a Zacks Rank #2 at present, has an estimated earnings growth rate of 62.8% for the current year compared with the industry’s 15.2%. Shares of QTRX have surged 145.6% against the industry’s 0.8% decline over the past year.

Quanterix’s earnings surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report