AbbVie (ABBV) Beats Q4 Earnings Estimates, Misses on Sales

AbbVie Inc. ABBV reported adjusted earnings of $3.60 per share for the fourth quarter of 2022, beating both the Zacks Consensus Estimate and our estimate, which stood at $3.54. The reported earnings also exceeded the guidance of $3.51-$3.55. Earnings rose 16.9% year over year.

ABBV’s revenues of $15.12 billion missed the Zacks Consensus Estimate and our estimate of $15.35 billion and $15.32 billion, respectively. Sales rose 1.6% year over year on a reported basis and 3.8% on an operational basis. Sales were driven by immunology and neuroscience products, with key drugs like Rinvoq, Skyrizi and Vraylar contributing to the top line. This was partially offset by lower sales of Juvederm and Imbruvica.

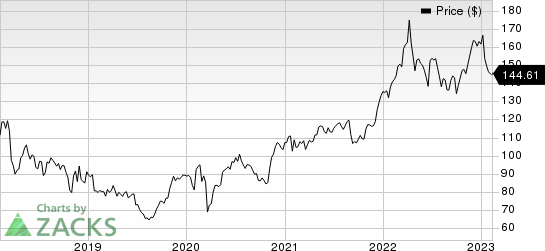

Shares of AbbVie were up 1% in pre-market trading on Feb 9 following the announcement. AbbVie’s shares have gained 1.3% in the trailing 12 months period compared with the industry’s 9.2% rise.

Image Source: Zacks Investment Research

All growth rates mentioned below are on a year-on-year basis and at constant exchange rates (CER).

Quarter in Detail

In immunology, AbbVie’s flagship drug Humira recorded a year-over-year sales rise of 6.0% to $5.58 billion on an operational basis. Sales in the United States climbed 9.9% to $5.01 billion, which more than offset the 16.9% decline in ex-U.S. market sales of $573 million. The drug’s sales met the Zacks Consensus Estimate pegged at $5.58 billion.

Humira’s international sales were affected by the launch of several direct biosimilar drugs in Europe by other pharma companies, including Amgen AMGN, Sandoz and Biogen BIIB. Companies like Amgen, Sandoz and Biogen were the first to start commercializing a Humira-biosimilar in Europe in 2018. Amgen, Biogen, Boehringer Ingelheim, Pfizer, Sandoz and many other companies have already received FDA approvals for their own Humira biosimilars, many of which are expected to be launched at various times this year per agreements with AbbVie. Last week, Amgen announced the launch of Amjevita in the United States, becoming the first company to launch a Humira biosimilar in the country.

Net revenues recorded from Skyrizi in the fourth quarter were $1.58 billion, up 78.9% on an operational basis year over year. This significant rise in sales is due to label expansions to the drug to include new patient populations in the last few quarters. Skyrizi sales also beat the Zacks Consensus Estimate and our model estimates of $1.55 billion and $1.47 billion, respectively.

During the quarter, Rinvoq registered sales of $770 million, up 55.4% year over year on an operational basis. Ex-U.S. sales of the drug rose 74.5% year over year during the quarter. However, the drug’s sales missed both the Zacks Consensus Estimate and our model estimates of $868 million and $859 million, respectively.

Sales from the neuroscience portfolio increased 5.1% on an operational basis to $1.71 billion, driven by higher sales of Botox Therapeutic and Vraylar. The company also generated additional sales from the migraine drug Qulipta. Neuroscience sales figures missed the Zacks Consensus Estimate and our estimate of $1.90 billion and $1.93 billion, respectively.

While Botox Therapeutic sales rose 10.7% to $728 million, sales of Vraylar increased 15.5% to $565 million. Sales of AbbVie’s oral migraine drug Ubrelvy were $197 million, up 7.7% year over year.

The recently launched Qulipta generated $52 million in product revenues compared to $62 million in third-quarter 2022.

AbbVie’s oncology/hematology (including Imbruvica and Venclexta) sales declined 11.2% on an operational basis to $1.63 billion in the quarter, as growth of Venclexta sales, was more than offset by lower U.S. sales of Imbruvica. While the oncology/hematology sales beat the Zacks Consensus of $1.54 billion, it missed our model estimate of $1.66 billion.

Fourth-quarter net revenues from Imbruvica were $1.12 billion, down 19.5% year over year. AbbVie developed the drug in partnership with Johnson & Johnson JNJ. The company shares international profits earned from Imbruvica with J&J.

U.S. sales of J&J-partnered Imbruvica grossed $841 million, down 24.6% from the year-ago figure. Sales of the J&J-partnered Imbruvica declined amid rising competition from novel oral treatments in the United States. AbbVie’s share of profit from the international sales of the J&J-partnered drug rose 1.6% to $274 million.

ABBV’s leukemia drug Venclexta generated revenues of $516 million in the reported quarter, reflecting 12.2% year-over-year growth.

AbbVie’s aesthetics portfolio sales were down 4.2% on an operational basis to $1.29 billion. The sales figure was lower than management’s expectations as declining sales of Juvederm and other aesthetic drugs offset growth in the sales of Botox Cosmetic. Sales of Botox Cosmetic rose 7.1% on an operational basis to $642 million, while Juvéderm’s sales fell 19% on an operational basis to $322 million.

Juvederm sales were hurt by the impact of COVID in China and the suspension of AbbVie’s aesthetics business operations in Russia, a key market for fillers.

Eye care portfolio sales declined 35.2% on an operational basis to $590 million. Sales of Restasis, a key drug in the portfolio, decreased 69.4% year over year to $110 million.

Adjusted SG&A expenses declined 4.7% to $3.15 billion, while adjusted R&D expenses were $1.74 billion in the fourth quarter, down 3.2% year over year. The adjusted operating margin represented 52.1% of sales.

Full-Year Results

AbbVie reported revenues of $58.05 billion, up 5.1% year over year. The company’s adjusted earnings for 2022 were $13.77 per share, up 16.4% from the year-ago period’s levels.

2023 Guidance

AbbVie issued earnings per share (EPS) guidance for 2023. The company expects adjusted EPS in the range of $10.70-$11.10, suggesting a year-over-year decline of 19.4-22.3%. The earnings guidance fell short of the Zacks Consensus Estimate of $11.50 per share.

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank

AbbVie currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report