AbbVie (ABBV) Buys Parkinson's Disease Treatment Maker

AbbVie ABBV announced that it is exercising its exclusive right and acquiring private biotech company Mitokinin, which is making a novel treatment for Parkinson's Disease (“PD”).

Mitokinin’s lead pipeline compound is a selective PINK1 activator that addresses mitochondrial dysfunction, which plays an instrumental role in the pathogenesis and progression of PD. Mutations in the PINK1 gene can cause a loss of the PINK1 function, which can result in familial forms of PD. Targeting the PINK1 gene can provide a novel approach for treating PD. Pre-clinical data has shown that the compound can selectively enhance the active form of the PINK1 gene, which amends mitochondrial damage and re-instates mitochondrial function

The candidate, if successfully developed, could be a potential new treatment option for PD. Therapies available to treat PD presently reduce the symptoms of the disease but none prevent the progression of the disease.

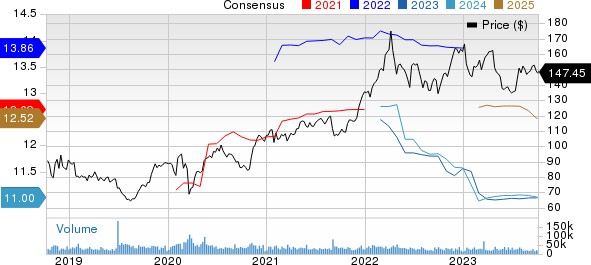

Year to date, AbbVie’s shares have lost 8.8% against the industry’s 2.9% rise.

Image Source: Zacks Investment Research

For the deal, AbbVie is making a payment of $110 million to Mitokinin shareholders who will also remain eligible for potential development/commercial milestone payments of up to $545 million

The acquisition, if successfully closed, will strengthen AbbVie’s neuroscience pipeline.

AbbVie’s neuroscience portfolio includes mature drugs like Vraylar and Botox as well as newer drugs like Ubrelvy and Qulipta. While Vraylar is approved for schizophrenia and manic or mixed episodes associated with bipolar I disorder, Botox is approved for several neuroscience indications including chronic migraine, and spastic disorders among others. AbbVie’s neuroscience drugs generated sales of $3.1 billion in the first half of 2023, up 13.8% year over year.

AbbVie also has another PD candidate in its neuroscience pipeline called ABBV-951 for treating motor fluctuations in patients with advanced PD. In March this year, the FDA issued a complete response letter (CRL) to AbbVie’s new drug application (“NDA”) seeking approval for ABBV-951.

ABBV-951 is a solution of carbidopa and levodopa prodrugs, which are the standard of care for PD patients. ABBV-951 has been designed to offer continuous subcutaneous delivery of CD/LD prodrugs through a pump device and offer a better patient experience. In the CRL, the FDA has asked for some extra information about the pump device used to administer the medicine. The FDA has not requested any additional efficacy/safety studies.

Zacks Rank & Key Picks

AbbVie currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AbbVie Inc. Price and Consensus

AbbVie Inc. price-consensus-chart | AbbVie Inc. Quote

Some top-ranked drug/biotech companies worth considering are Alpine Immune Sciences ALPN, Aurinia Pharmaceuticals AUPH and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the consensus estimate for Alpine Immune Sciences’ 2023 loss has narrowed from $1.43 per share to $1.18 per share, while the same for 2024 has narrowed from $1.73 per share to $1.47 per share. Year to date, shares of Alpine Immune Sciences have rallied 65.5%.

ALPN’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative earnings surprise of 79.65%.

In the past 60 days, the loss per share estimate for Aurinia Pharmaceuticals for 2023 has narrowed from 64 cents per share to 58 cents per share, while that for 2024 has narrowed from 37 cents to 27 cents. Year to date, shares of Aurinia Pharmaceuticals have gained 68.5%.

Earnings of Aurinia Pharmaceuticals beat estimates in all the last four quarters, delivering an earnings surprise of 45.61% on average.

In the past 60 days, the Zacks Consensus Estimate for Corcept’s earnings has increased from 75 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 81 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 30.4% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average earnings surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

Alpine Immune Sciences, Inc. (ALPN) : Free Stock Analysis Report