AbbVie: An Undervalued Giant

AbbVie Inc. (NYSE:ABBV) has made a decent recovery this year, jumping 11%.

However, no good deed goes unpunished on Wall Street, so it still represents an underdog of the market as, even now, it trades at a valuation even lower than the average price-earnings ratio of the industry.

An undervalued giant of this kind could be a solid investment play as it grows its revenue base.

Navigating AbbVie's journey through patent expiry and biosimilar battles

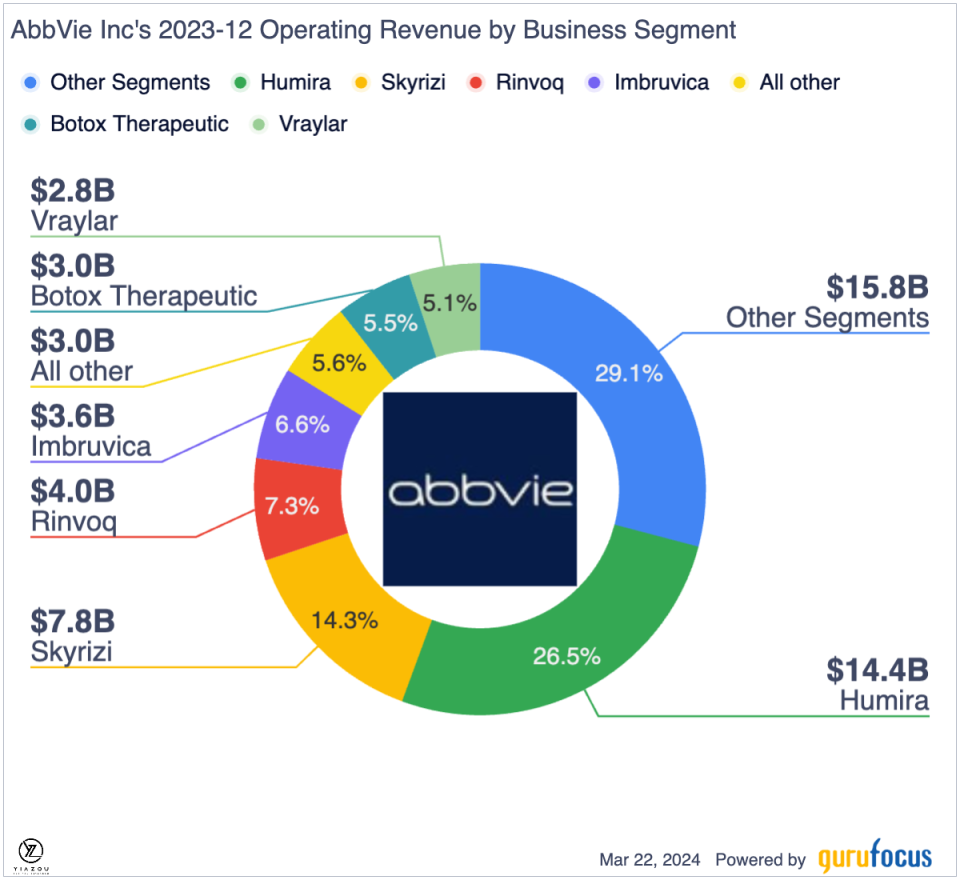

The impressive hikes have come against the company's success in generating substantial cash flow. Backed by a robust pipeline of drugs, the pharmaceutical giant generated free cash flow to the tune of $24.70 billion over the past 12 months. Humira, an injectable treatment for rheumatoid arthritis and other autoimmune conditions, is one of the catalysts behind the company's success. The drug has generated well over $200 billion in 20 years, helping strengthen AbbVie's free cash flow base.

The positive sentiments the company has enjoyed over the past few years were mainly linked to the blockbuster drug. Therefore, the company was always going to come under pressure and scrutiny in the aftermath of Humira losing its 20-year monopoly early last year. Opening the door for using generics for Humira was one factor that rattled the stock for the better part of 2023.

Amgen Inc. (NASDAQ:AMGN) was the first company to counter AbbVie's monopoly by releasing Amjevita, the first close copy of Humira, billed as the best-selling drug of all time. Following the unveiling of seven more Humira copycats known as biosimilars, AbbVie felt the market's wrath amid growing concerns that its ability to generate significant revenue from the drug with biosimilars in play would always come under pressure.

This resulted in the stock coming under pressure and tumbling early last year. AbbVie lost nearly 18% in market value in the first half of 2023 as investors reacted to the end of Humira's monopoly. While the stock did bounce back in the second half of the year, it still came under pressure in the final months, finishing the year down 4%.

Lastly, AbbVie delivered a year of solid performance that underscored the impact of a long-term growth strategy on providing value to patients' communities and stakeholders. It was a highly productive year as the company continued to execute across its diverse portfolio away from Humira.

Even though the company delivered a year-over-year decline in revenue for the fourth quarter and entire year, the ability to forge ahead of its Humira growth portfolio strengthened its sentiments in the market.

AbbVie's resilience: Surging beyond Humira with sky-high Skyrizi and Rinvoq revenue

Revenue in the fourth quarter of 2023 was $14.3 billion, representing a 5.40% year-over-year decline but much better than the $14.05 billion that analysts expected.

The decline can be attributed to a 12.30% decline in the immunology portfolio, hurt by the expiry of Humira patent protection, which resulted in biosimilar competition. Consequently, Humira revenue fell 40.80% in the quarter to $3.30 billion.

Amid the decline, the outperformance driven by the non-Humira growth platform has once again affirmed AbbVie's long-term outlook despite the loss of the patent protection of a critical product.

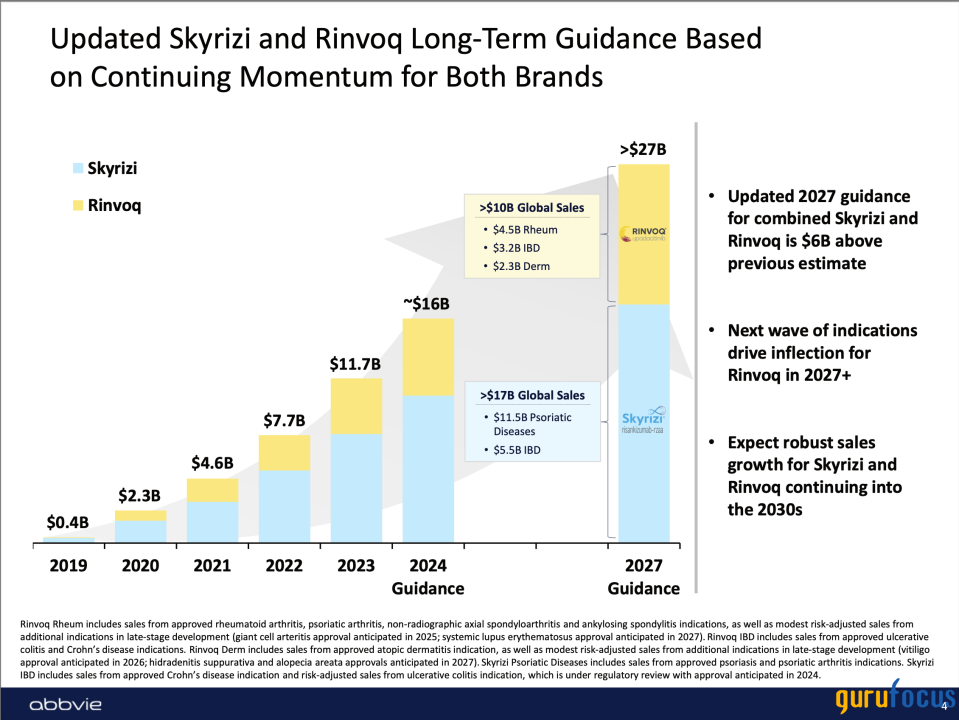

Skyrizi, the company's flagship treatment for moderate to severe psoriasis, recorded a 51.90% increase in revenue at $2.39 billion, offsetting some Humira losses.

On the other hand, Rinvoq, used to treat rheumatoid arthritis, delivered a 62.90% increase in sales to $1.26 billion, while revenue in the neuroscience portfolio increased by 22.60% to $2.09 billion. Similarly, the aesthetics portfolio also delivered a 6.40% revenue increase to $1.37 billion.

Additionally, Skyrizi and Rinvoq are increasingly becoming essential to AbbVie's portfolio as the company faces stiff generic competition on Humira. Impressed by the strong momentum, the company has already increased its guidance of the two drugs by $6 billion, affirming accelerated growth in 2024.

Finally, while full-year revenue dropped 6.40% to $54.32 billion, the growth recorded in the non-Humira portfolios affirmed AbbVie's long-term prospects.

Source: AbbVie

Acquiring Cerevel to forge new frontiers in psychiatric and neurological health

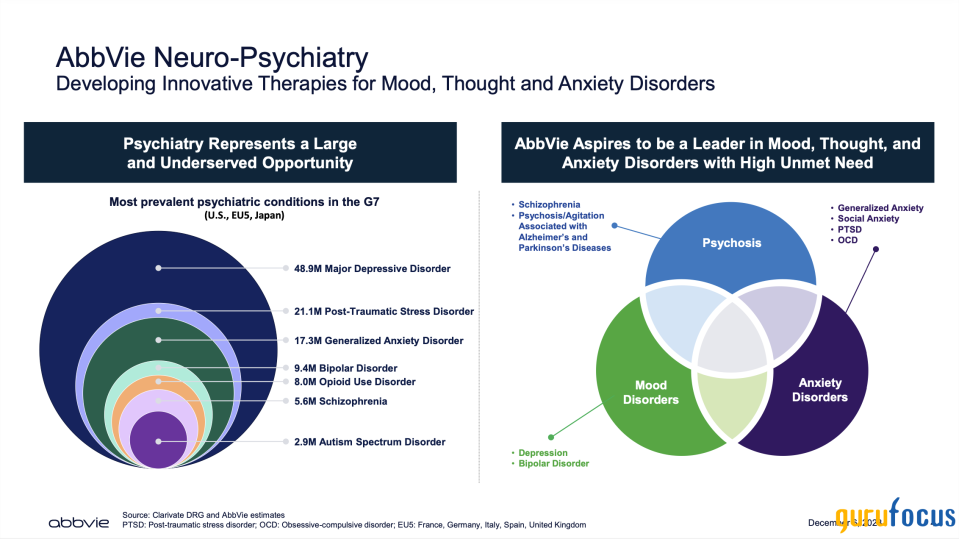

AbbVie has gone out of its way to put anything related to the loss of Humira patent protection in the rearview mirror by making a big effort to shore up its pipeline. In December, the company announced an $8.70 billion deal to buy Cerevel Therapeutics, an acquisition it hopes to complete by mid-year 2024.

While the deal's terms were not disclosed, it is conditional on the growth of the drug pipeline, which has now become a priority for the company, considering that the top-selling treatments, led by Humira, are starting to face skyrocketing competition from cheaper copycats. Cerevel is to fortify the portfolio for treating psychiatric and neurological disorders.

With that, the company is in line to get Emraclidine, which is under development for schizophrenia and psychosis in Alzheimer's. The company would then have its program in phase one and could complete it successfully in a field with projections suggesting $15.50 billion by 2031.

Thus, the acquisition of Cerevel opens up the door to the massive psychiatric opportunity.

Source: AbbVie

In addition to Emraclidine, Cerevel is also working on Tavapadon, a prospective treatment option for Parkinson's disease, and Darigabat, which is being tested for the treatment of panic disorder and epilepsy.

While the Parkinson's disease market was projected to be worth $5.10 billion in 2021, it is poised to grow to $10.4 billion by 2031, presenting a unique opportunity for growth.

Additionally, AbbVie has agreed to buy ImmunoGen for $10.10 billion to strengthen its portfolio of cancer drugs. ImmunoGen boasts a portfolio of antibody-drug conjugates, or ADCs, designed to kill cancer cells directly.

ImmunoGen is poised to accelerate AbbVie's entry into the solid tumor space by providing access to differentiated on-market drugs for ovarian cancer. Likewise, it should give access to multibillion-dollar therapies expected to drive long-term revenue growth and counter the threat of generic competition on Humira.

Following the Cerevel and ImmunoGen acquisitions and the expected revenue growth on Skyrizi and Rinvoq, AbbVie has issued solid long-term guidance that affirms continued growth. The pharmaceutical company lifted its outlook for its blockbusters, which it expects to reach $27 billion in combined annual sales by 2027, which should blow Humira's peak sales of $21 billion as of 2022.

Finally, according to physics, science and tech expert Jed Macosko, AbbVie is proactively diversifying its portfolio beyond Humira by heavily investing in research and development for new treatments in areas like rheumatoid arthritis and cancer, acquiring smaller companies to broaden its developmental pipeline and expanding its global footprint to tap into new markets. Hence, these strategies aim to reduce its dependency on Humira and strengthen its position for future growth.

Battle against biosimilars

AbbVie's biggest threat is the ever-growing generic competition targeting its flagship drugs. The introduction of biosimilars can only continue to make it difficult for the company to generate significant revenue, as was the case in the past.

While the acquisitions of Cerevel and ImmunoGen are expected to counter the threat of competition, delays in the launch of new drugs could pose significant risks. The two have an array of drugs in the pipeline that AbbVie is banking on to strengthen its portfolio. Delays or setbacks in the trial phase can only continue to pile pressure on the pharmaceutical giant.

Bottom line

While AbbVie has lagged behind its peers over the past few years, there is no doubt it is a high-quality and fundamentally strong health care play.

The company might have suffered a massive setback with the loss of Humira patent protection early last year. However, it has already moved on with its non-Humira product portfolio, which is continuously outperforming.

The acquisition of Cerevel and ImmunoGen has once again affirmed the company's long-term prospects and growth metrics as it gains access to vital treatments for cancer and psychiatric disorders.

Therefore, the stock remains a solid investment play as it grows its revenue base while returning value through dividends.

This article first appeared on GuruFocus.