AbbVie's (ABBV) Epcoritamab Gets Approval in Europe for DLBCL

AbbVie ABBV and partner Genmab GMAB announced that the European Commission has granted conditional marketing authorization to epcoritamab for treating relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL). DLBCL is a common, aggressive and fast-growing form of non-Hodgkin's lymphoma (NHL).

Epcoritamab will be marketed as Tepkinly in the European Union for the treatment of adult patients with R/R DLBCL after two or more lines of systemic therapy. The approval was expected as, in July, the European Medicines Agency's Committee for Medicinal Products for Human Use had given a positive opinion recommending conditional marketing authorization to epcoritamab.

The approval was based on the response rate and durability of response data from the expansion cohort of phase I/II study, EPCORE NHL-1. In the study, epcoritamab demonstrated an overall response rate of 62% and a complete response rate of 39%. The median duration of response was 15.5 months in patients with R/R large B-cell lymphoma, including its subtype DLBCL.

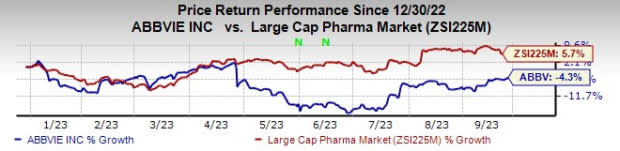

Year to date, AbbVie’s shares have lost 4.3% against the industry’s 5.7% rise.

Image Source: Zacks Investment Research

Tepkinly is AbbVie's second hematological cancer drug to be approved in the European Union. It is also the third blood cancer medicine in AbbVie’s portfolio, the other two being Imbruvica and Venclexta.

Epcoritamab was approved (accelerated approval) as Epkinly for certain patients with relapsed/refractory DLBCL in the United States in May.

Phase III studies are ongoing on epcoritamab in earlier lines of DLBCL and for follicular lymphoma.

AbbVie and Genmab are jointly developing and commercializing Epkinly/Tepkinly as part of the companies' oncology collaboration entered into in 2020. The companies share commercial responsibilities in the United States and Japan.

Zacks Rank & Key Picks

AbbVie currently has a Zacks Rank #3 (Hold).

Some top-ranked drug/biotech companies worth considering are Aurinia Pharmaceuticals AUPH and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the loss per share estimate for Aurinia Pharmaceuticals for 2023 has narrowed from 71 cents per share to 58 cents per share, while that for 2024 has narrowed from 43 cents to 28 cents. Year to date, shares of Aurinia Pharmaceuticals have gained 87.7%.

Earnings of Aurinia Pharmaceuticals beat estimates in all the last four quarters, delivering an earnings surprise of 45.61% on average.

In the past 60 days, the Zacks Consensus Estimate for Corcept’s earnings has increased from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 59.1% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

Genmab A/S Sponsored ADR (GMAB) : Free Stock Analysis Report