Abeona Therapeutics Inc (ABEO) Reports Full Year 2023 Financial Results

Cash Position: Maintained a stable cash reserve with $52.6 million as of December 31, 2023.

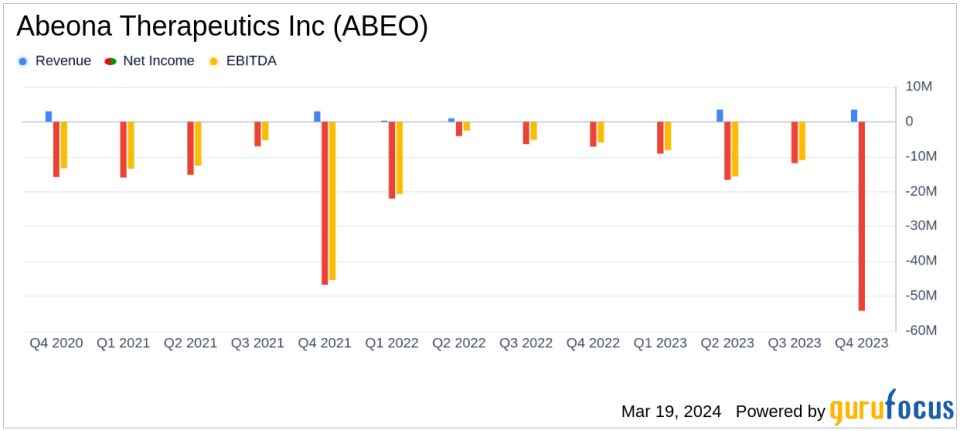

Revenue Growth: Year-over-year increase in license and other revenues, reaching $3.5 million in 2023.

Operating Expenses: Research and development expenses rose to $31.1 million, while general and administrative expenses reached $19.0 million.

Net Loss: Reported a net loss of $54.2 million, or $2.53 loss per common share.

Regulatory Milestones: Completed FDA inspections with positive outcomes, supporting the BLA for pz-cel.

Commercial Preparation: Advanced commercial activities in anticipation of potential U.S. launch for pz-cel.

Abeona Therapeutics Inc (NASDAQ:ABEO) released its 8-K filing on March 18, 2024, detailing the company's financial results for the full year of 2023 and announcing the completion of critical FDA inspections. Abeona Therapeutics, a clinical-stage biopharmaceutical company, is at the forefront of developing gene therapies and plasma-based products for rare genetic diseases, with a focus on its lead clinical programs EB-101, ABO-102, and ABO-101.

The company's financial stability is underscored by its cash reserves, totaling $52.6 million as of December 31, 2023, which is consistent with the previous year's balance. This financial stability is crucial for Abeona as it continues to invest in research and development, particularly as it prepares for the potential commercial launch of its gene therapy product, pz-cel.

Revenue for the year ended December 31, 2023, saw a significant increase to $3.5 million, up from $1.4 million in the previous year, primarily due to clinical milestone payments under a licensing agreement. This revenue growth is a positive indicator of the company's ability to generate income through strategic partnerships and licensing agreements.

However, the company also reported increased operating expenses, with research and development costs rising to $31.1 million, and general and administrative expenses reaching $19.0 million. These increases are attributed to expanded headcount related to BLA activities and preparations for the potential launch of pz-cel. Consequently, Abeona reported a net loss of $54.2 million, or $2.53 loss per common share, which is an increase from the previous year's net loss of $43.5 million, or $5.53 loss per common share.

From a regulatory standpoint, Abeona has achieved significant milestones, including the completion of FDA inspections of its manufacturing facility and clinical trial sites with favorable outcomes. These inspections are a critical step towards the potential approval of pz-cel, with a target PDUFA date of May 25, 2024. The company's proactive engagement with the FDA and its positive inspection results are indicative of its commitment to regulatory compliance and product quality.

In preparation for a potential U.S. commercial launch of pz-cel, Abeona has been actively engaging with EB treatment sites, payers, and has been hiring key commercial roles. The company's market research supports the reimbursement coverage of pz-cel at a price aligned with the value of approved gene therapies, highlighting the potential for significant revenue generation upon commercialization.

Looking ahead, Abeona estimates that its current financial resources, along with the credit facility from Avenue Venture Opportunities Fund, L.P., will fund operations into the first quarter of 2025. This forecast does not account for potential revenue from commercial sales of pz-cel, if approved, or proceeds from the sale of a Priority Review Voucher, if awarded by the FDA.

Abeona Therapeutics will host a conference call and webcast to discuss these financial results and provide updates on corporate progress. Investors and stakeholders are encouraged to participate or access the archived webcast to gain further insights into the company's performance and future prospects.

As Abeona Therapeutics Inc (NASDAQ:ABEO) navigates through these pivotal moments, the company's financial results and regulatory achievements in 2023 serve as a testament to its strategic focus and operational execution. Investors and industry observers will be closely monitoring Abeona's progress as it approaches the PDUFA date and prepares for potential market entry.

Explore the complete 8-K earnings release (here) from Abeona Therapeutics Inc for further details.

This article first appeared on GuruFocus.