Abercrombie (ANF) Gains on Brand Momentum & Growth Plans

Abercrombie & Fitch Co. ANF has been witnessing robust momentum, owing to the strength across both brands. The company’s namesake brand reflected strong momentum in the last reported quarter, while the Hollister brand posted sequential gains on its efforts to improve its brand positioning. Also, strategic investments across stores bode well.

In second-quarter fiscal 2023, sales in the United States rose 19% year over year. On the international front, sales grew 4% in the EMEA and advanced 18% in the APAC. Brand-wise, net sales improved 8% year over year at Hollister and 26% at Abercrombie.

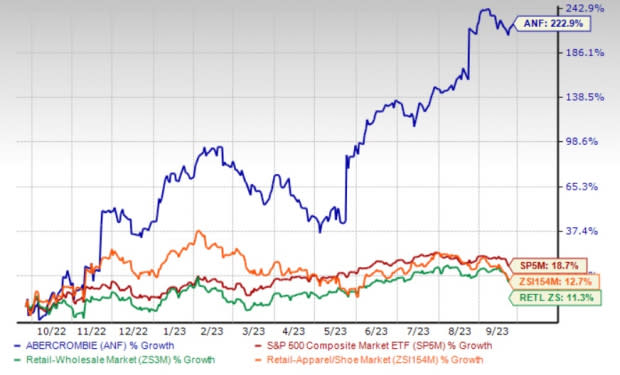

The company’s focus on improving its brand performance has been well-reflected in its share price, with the stock outperforming the industry and the market. Shares of this Zacks Rank #1 (Strong Buy) company have rallied 222.9% in the past year compared with the industry’s growth of 12.7%. The stock has also fared better than the sector’s rise of 11.3% and the S&P 500’s growth of 18.7% in the same period.

Further optimism on the stock is reflected by its forward estimates, which suggest notable growth. The Zacks Consensus Estimate for ANF’s fiscal 2023 sales and earnings suggests growth of 10.4% and a significant 1,644%, respectively, from the year-ago period’s reported numbers.

Image Source: Zacks Investment Research

Upbeat View

Driven by the robust performance, the company raised its guidance for fiscal 2023. Management envisions year-over-year net sales growth of 10% for fiscal 2023. It expects the Abercrombie brand to continue outperforming the Hollister brand in fiscal 2023. Fiscal 2023 includes a 53rd week, which is estimated to benefit sales by $45 million.

Abercrombie expects an operating margin of 8-9%, including year-over-year gains of 250 bps, driven by reduced freight and raw material costs, and a modest operating expense leverage. The company expects sales growth in fiscal 2023 to more than offset higher expenses resulting from inflation and increased investment for the 2025 Always Forward Plan initiatives.

The operating margin is envisioned to be 8-10%, whereas it reported an adjusted operating margin of 2.4% in the prior-year quarter. The rise is expected to be driven by a higher gross margin on lower freight costs and higher AURs, as well as slight operating expense leverage on higher sales.

Long-Term Plans

Abercrombie is on track with its 2025 Always Forward plan, which focuses on brand growth, leveraging its omnichannel capabilities, and expanding digital penetration and financial discipline. As part of this plan, the company earlier provided a financial outlook for fiscal 2025 and a long-term view.

ANF anticipates annual revenues of $4.1-$4.3 billion and an annual operating margin rate of 8% or more by the end of fiscal 2025. For the long term, management expects annual revenues of $5 billion and an annual operating margin rate of 10% or more.

The company also predicts the Abercrombie & Fitch and abercrombie kids brands to see a 6-8% sales CAGR each over the next three years, with the Hollister and Gilly Hicks brands witnessing a flat-to-2% and 15% sales CAGR, respectively. Notably, Abercrombie & Fitch adults are forecast to be the major driver.

The company intends to accelerate its digital revolution via Knowing Their Customer Better and Wowing Them Everywhere initiatives. Increased investment in customer analytics to meet and outpace customer demand bodes well. The company plans to generate at least $600 million of free cash flow in the next three years to deliver healthy shareholder returns, and drive omnichannel growth across digital and physical stores.

Abercrombie is also working toward rationalizing its store base by reducing its dependence on underperforming tourist-driven locations. As part of its store optimization plans, ANF plans to reposition larger-format flagship locations to smaller omni-channel-enabled stores.

The company opened its 5th Avenue, NY store, which offers women’s and men’s collections and dedicated shop-in-shop spaces for its kids’ brand, abercrombie kids, as well as its adult activewear franchise, YPB (Your Personal Best). The company ended the second quarter with 759 stores. Abercrombie expects 35 new stores, 20 combined remodels and rate sizes, and 30 closures for fiscal 2023.

Other Key Picks

Here we have highlighted three other top-ranked stocks, namely American Eagle Outfitters AEO, Urban Outfitters URBN and Boot Barn BOOT.

American Eagle, which operates as a specialty retailer of casual apparel, accessories and footwear for men and women, currently flaunts a Zacks Rank #1. AEO has a trailing four-quarter earnings surprise of 43.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle’s current financial-year sales and earnings indicates growth of 1.3% and 33%, respectively, from the year-ago reported numbers.

Urban Outfitters, a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home décor and gifts products, currently sports a Zacks Rank #1. URBN has a trailing four-quarter earnings surprise of 19.2%, on average.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and earnings implies growth of 9% and 84.6%, respectively, from the year-ago reported numbers.

Boot Barn, a lifestyle retail chain, currently sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 13.5%, on average.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 7.8% from the year-ago reported number. The consensus mark for EPS is pegged at $5.27, suggesting a decline of 6.2% from the year-ago quarter’s EPS of $5.62.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report