Abercrombie & Fitch Co. (ANF) Reports Stellar Full Year Results with Significant Margin ...

Net Sales Growth: ANF reported a 21% increase in Q4 net sales and a 16% increase for the full year.

Operating Margin: Full year operating margin reached 11.3%, marking the highest in fifteen years.

Net Income Per Share: ANF saw a substantial rise in net income per diluted share to $6.22 for the full year, compared to $0.05 in the previous year.

Comparable Sales: Comparable sales were up 13% for the full year, indicating strong brand performance.

Gross Profit Rate: The gross profit rate improved by 600 basis points for the full year, driven by higher average unit retail and lower costs.

Liquidity: ANF ended the year with approximately $1.2 billion in liquidity, an increase from $0.9 billion last year.

Capital Expenditures: For fiscal 2024, ANF expects capital expenditures of approximately $170 million.

Abercrombie & Fitch Co (NYSE:ANF) released its 8-K filing on March 6, 2024, revealing robust fourth quarter and full year financial results for the period ending February 3, 2024. The specialty retailer, known for its casual clothing and accessories for men, women, and children, operates under the Abercrombie & Fitch, Abercrombie kids, and Hollister brands, with a significant presence in North America, Europe, and Asia.

Financial Performance and Strategic Execution

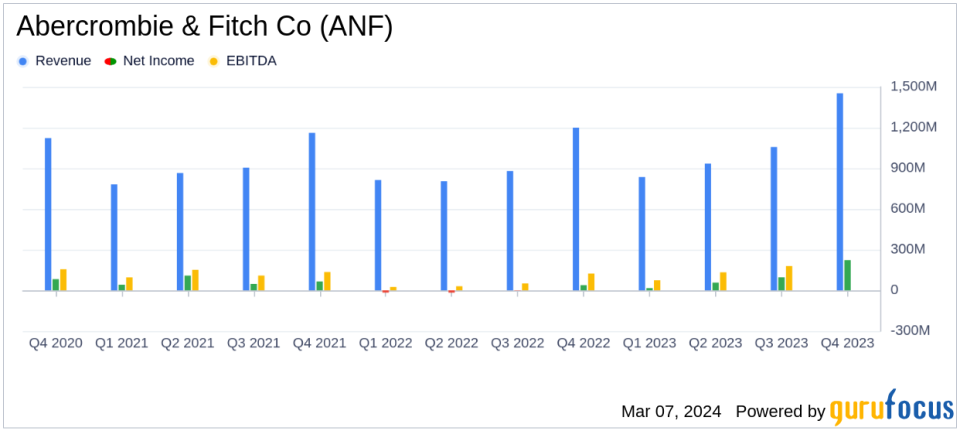

ANF's performance in fiscal 2023 was marked by a 21% increase in fourth quarter net sales, totaling $1.5 billion, and a 16% increase in full year net sales, reaching $4.28 billion. This growth was attributed to a 13% rise in comparable sales and was consistent across regions and brands, with the Abercrombie brands experiencing a 23% increase in comparable sales. The company's operating margin for the full year was 11.3%, an 880 basis point improvement over the previous year and above the target set in the Always Forward Plan for 2025.

ANF's Chief Executive Officer, Fran Horowitz, highlighted the company's successful execution of its strategic initiatives, which led to the impressive financial results. The Always Forward Plan's focus on delivering the right product, voice, and experience to customers globally has been a key driver of the company's success.

"Following several years of transformation across our brands, people and operating model, fiscal 2023 was a defining year for our company," said Fran Horowitz.

Income Statement and Balance Sheet Highlights

The fourth quarter gross profit rate stood at 62.9%, a 720 basis point increase from the previous year, driven by higher average unit retail and lower freight and raw material costs. Operating income for the quarter was $223 million, a significant rise from $87 million in the prior year. Full year net income per diluted share was $6.22, compared to just $0.05 in the previous year, reflecting the company's strong profitability.

As of February 3, 2024, ANF's financial position was solid with $901 million in cash and equivalents, a decrease in inventories by approximately 7% over the previous year, and long-term gross borrowings of $223 million. The company's liquidity stood at approximately $1.2 billion, an increase from the previous year's $0.9 billion.

Looking Ahead

For fiscal 2024, ANF anticipates net sales growth in the range of 4% to 6% from the previous year, with operating margin expected to be around 12%. The company plans to continue investing in its people, stores, and key technology platforms while focusing on expanding its global customer base with the aim of achieving $5 billion in global sales.

Value investors may find ANF's strong financial position, consistent sales growth, and strategic focus on operational efficiency and market expansion to be compelling reasons to consider the company's stock. With a clear plan for sustained, profitable growth, ANF is positioning itself as a resilient player in the Retail - Cyclical industry.

For more detailed insights and financial analysis, investors are encouraged to review the full earnings report and consider the potential of Abercrombie & Fitch Co (NYSE:ANF) as part of their investment portfolio.

Explore the complete 8-K earnings release (here) from Abercrombie & Fitch Co for further details.

This article first appeared on GuruFocus.