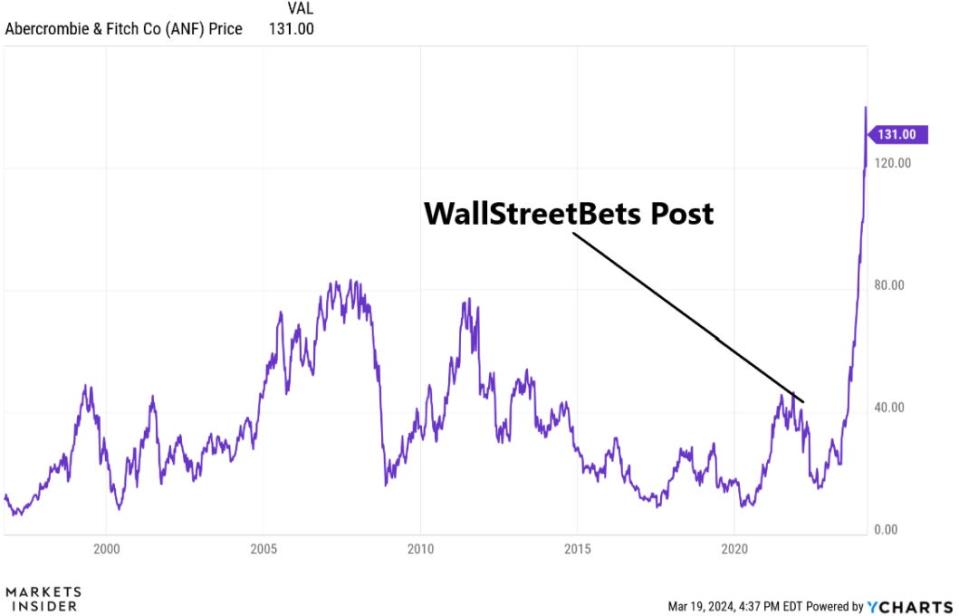

'Abercrombie & Fitch is cool again': A WallStreetBets post from 2 years ago nailed the clothing retailer's 305% meme-stock spike

A WallStreetBets post on Reddit nailed the 305% rally in Abercrombie and Fitch stock.

Shares of the clothing retailer have been on a tear recently as profits and revenues improve.

"Abercrombie & Fi[t]ch is cool again... and the stock is GROSSLY undervalued," reads the WallStreetBets post.

The remarkable rise in Abercrombie & Fitch stock has shocked Wall Street over the past year — but one WallStreetBets user isn't surprised at all.

Reddit user SillyGoose41212 wrote in a WallStreetBets post on January 10, 2022 that Abercrombie & Fitch stock was extremely undervalued.

Since SillyGoose41212 posted their thesis to the WallStreetBets forum, the stock has soared 268% and is trading at near an all-time high of $131 per share.

Abercrombie & Fitch's stock performance even outpaced AI-darling Nvidia in 2023.

The post, which is titled "Abercrombie & Fi[t]ch ($ANF) is cool again... and the stock is GROSSLY undervalued," offered a fundamental thesis as to why the clothing retailer's stock price was a good buy at the time.

The opportunity

At the time of the WallStreetBets post, Abercrombie & Fitch stock traded at just over $32 per share, the same level it traded at in December 1998.

The brand had languished throughout the 2010s, as its heavy exposure to mall-based retail locations and limited exposure to e-commerce didn't sit well with investors or consumers.

But Abercrombie's fortunes started to turnaround when its current CEO, Fran Horowitz, took the top job in 2017 and initiated a multi-year turnaround plan.

A few years later, and SillyGoose41212 took notice.

"You might think of Abercrombie & Fi[t]ch as the store you used to shop at when at the mall as a teenager.. you know, the store with the clothes that had Abercrombie & Fi[t]ch written all over everything? (Same thing with their other store Hollister)," the Reddit user wrote.

"But here's the thing: their clothes are actually kinda cool now. They have thankfully adapted to the times and are offering a very inoffensive and trendy selection of clothing."

"It also isn't painful to walk into Abercrombie/Hollister as they are no longer perfume/fragrance infested dungeons... Finally but most importantly: The clothes don't have their stupid logo/name all over them anymore and are actually fashionable," SillyGoose41412 wrote.

Abercrombie's appealing valuation in January 2022 also bolstered the likelihood of success for the trade.

The author observed that even though Abercrombie & Fitch had industry-leading 60% gross margins and was executing aggressive share buybacks, the stock traded at just a 4x multiple of its trailing twelve-month enterprise value to EBITDA multiple, and at a price-to-sales ratio of just 0.5x.

"I think in a market with insane multiples on pre-revenue companies that value is a safe place to be, and although clothing retail is as boring of a sector as it gets, the multiples here cannot be overlooked. $ANF is undervalued. It should trade higher than the current price," SillyGoose41212 concluded in early 2022.

The results

Following the Reddit post in January 2022, Abercrombie & Fitch got caught up with the ensuing bear market and declined by as much as 57%. But since the stock found its bottom in September 2022, it has been on an absolute tear, soaring as much as 901% to record highs.

The strong stock performance has been driven by a successful turnaround in Abercrombie's business that has been years in the making.

The company's e-commerce sales channel now makes up about half of its annual revenue, and a methodical refresh of its stores and apparel has helped drive a surge in sales and profits.

Abercrombie & Fitch raised its full-year 2023 guidance in November after it saw third-quarter sales surge 20%, and it provided another upbeat outlook on its sales trajectory in January following a solid holiday quarter.

What Wall Street is saying

At the time of the Reddit post, Abercrombie & Fitch had an average price target of $48. Five Wall Street analysts had rated Abercrombie stock a "Buy", while four analysts considered it either a "Hold" or a "Sell," according to data from Bloomberg.

Wall Street still isn't convinced that the stock is a good buy. Only three Wall Street analysts rate the retailer as a "Buy" while there are six "Hold" ratings. The average price target of $129 represents a potential downside of about 2% from current levels.

Since March 2023, JPMorgan retail analyst Matthew Boss has raised his price target on Abercrombie & Fitch seven times, from a low of $34 to today's target of $125, thanks in part to its "90's-esque brand momentum."

Boss rates the stock at "Neutral," but noted in a recent note that the stock is on "Positive Catalyst Watch."

"Our work points to continued brand momentum into November/December across both brands, with Abercrombie NPS per our HundredX insights data up more than 90% relative to the trailing 24 months and Hollister NPS +11% over the same time period," Boss wrote in a note last month.

"We remain Neutral on ANF given fashion-driven demand/margin volatility multi-year across the Abercrombie/Hollister brands," Boss said.

A throwback to the 2021 meme-stock craze

The prescient stock pitch by SillyGoose41212 is a throwback to the meme-stock craze that took over the stock market in 2020 and 2021, which was spearheaded by the 15-million-strong WallStreetBets group.

Retail investors piled into shares of beaten-down companies that went viral regardless of the underlying company fundamentals, in a bid to both make money and make Wall Street lose money.

Shares of GameStop and AMC Entertainment soared to astronomical levels, leading to billions of dollars of losses for some hedge fund managers who were caught on the other side of the trade.

And while Abercrombie & Fitch might stoke a sense of 1990's nostalgia for some investors, it's also very different from the meme-stock craze of yesteryear.

Despite the stock's 901% rally since September 2022, it still trades at a reasonable valuation with a 16x forward price-to-earnings multiple, which is less than the S&P 500's current multiple of 20x.

It has a growing and profitable business, and the fundamental rationale behind SillyGoose41212's stock pitch is much more sound than the YOLO mentality that is often present among WallStreetBets traders.

Yet just like the meme-stock craze, the successful stock pitch on Abercrombie & Fitch serves as a reminder that retail investors can still beat Wall Street at their own game.

This story was originally published in February 2024.

Read the original article on Business Insider