ABM Industries Inc (ABM) Reports First Quarter Fiscal 2024 Earnings, Raises Full-Year Guidance

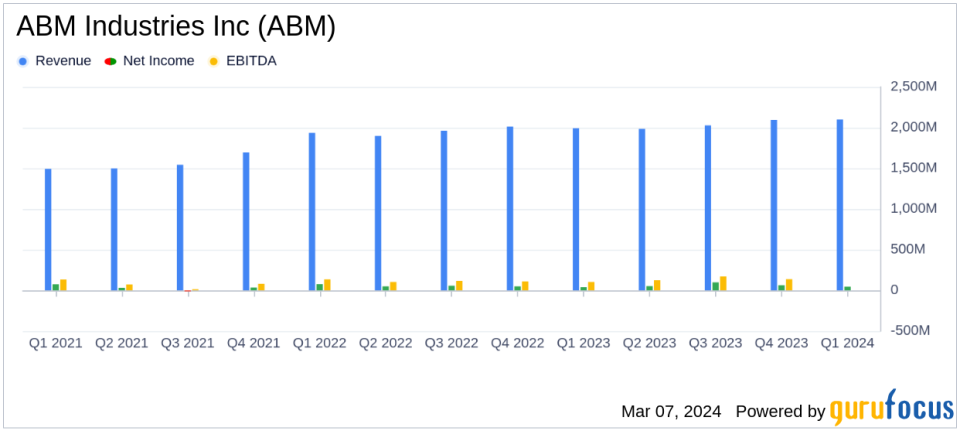

Revenue Growth: ABM Industries Inc (NYSE:ABM) reported a 3.9% increase in revenue, reaching $2.1 billion.

Net Income and EPS Rise: Net income rose by 16% to $44.7 million, with GAAP EPS up 21% at $0.70.

Adjusted EBITDA: Adjusted EBITDA saw a decrease of 5% to $116.7 million.

Adjusted EPS Improvement: Adjusted EPS increased by 9% to $0.86.

Outlook Raised: The company raises its full-year adjusted EPS outlook to $3.30 to $3.45, up from $3.20 to $3.40.

On March 7, 2024, ABM Industries Inc (NYSE:ABM), a leading provider of integrated facility solutions, announced its financial results for the first quarter of fiscal 2024. The company released its 8-K filing, showcasing a strong start to the year with organic revenue growth and a positive adjustment to its full-year earnings outlook.

ABM Industries Inc operates through five segments: Business and Industry, Manufacturing and Distribution, Education, Aviation, and Technical solutions. The company primarily serves the U.S. market, with the Business and Industry segment being the largest revenue contributor, offering janitorial, facilities engineering, and parking services, among others.

The company's revenue growth was driven by a 3.9% increase to $2.1 billion, attributed to organic growth across its segments. Notably, the Aviation and Technical Solutions segments experienced double-digit revenue growth. Despite a flat performance in the Business & Industry segment due to soft demand in the commercial real estate market, ABM benefited from its focus on high-performing Class A properties and the sports and entertainment markets.

ABM's net income for the quarter was $44.7 million, or $0.70 per diluted share, a significant increase from the previous year. Adjusted net income also grew to $54.8 million, or $0.86 per diluted share. The company highlighted discrete tax benefits and higher segment earnings as key contributors to this growth, despite increased corporate investments and interest expenses.

Adjusted EBITDA, however, experienced a 5% decline to $116.7 million, with a margin of 5.9% compared to 6.4% in the previous year. This was largely due to higher corporate investments and project mix in Technical Solutions, offset by cost controls and price increases.

ABM's liquidity and capital structure remained solid, ending the quarter with total indebtedness of $1,410.8 million and available liquidity of $507.8 million. The company also declared a quarterly cash dividend of $0.225 per common share.

In light of the first quarter's performance and discrete tax benefits, ABM raised its outlook for the fiscal year 2024 adjusted EPS to a range of $3.30 to $3.45. The company's management expressed confidence in ABM's strategic investments and market opportunities, particularly in new markets such as microgrids.

ABM's President & CEO, Scott Salmirs, commented on the results:

"ABM is off to an excellent start in 2024, generating revenue growth of 3.9%. We are particularly pleased with the double-digit revenue growth we posted in our Aviation and Technical Solutions segments, while Manufacturing & Distribution and Education were solid as well."

ABM's financial tables reflected the positive trends in revenue and net income, with a detailed breakdown of performance by segment. The company's balance sheet remained robust, with a healthy cash position and total assets of $4,955.4 million.

In conclusion, ABM Industries Inc's first quarter fiscal 2024 results demonstrate a strong start to the year, with revenue growth and an optimistic outlook for the remainder of the year. The company's strategic focus on high-growth segments and effective cost management positions it well for continued success in the dynamic facility solutions industry.

For more detailed information about ABM's financial performance and future outlook, investors and interested parties are encouraged to review the full earnings report and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from ABM Industries Inc for further details.

This article first appeared on GuruFocus.