‘All Aboard’: Jefferies Says Solar Stocks Offer a Positive Risk-Reward — Here Are 2 Names to Take Advantage

The pace of inflation is slowing down, and investors are starting to price in higher odds of interest rate cuts next year – but the ripples of the high inflation/high rates regime still linger. Consumer costs are up, and credit is harder to come by; financing for large projects is both harder to get and more expensive to pay for. Plenty of sectors are feeling the pressure.

And this brings us to the residential solar market. Solar stocks depend on both homeowners and the availability of financing for their livelihoods; the pressure on residential solar providers has been real in recent months. Solar stocks were volatile this past year, and year-to-date losses were not uncommon in the sector. But the thought of rate cuts next year, more probable after the Fed’s last meeting, is breathing new life into solar shares.

Sector expert Dushyant Ailani, writing from Jefferies, lays out the recent swoon and near-term potential: “Solar manufacturers have underperformed the S&P500 by ~60% YTD, driven by higher (for longer?) interest rate environment, interconnection delays pushing out projects, regulatory change (NEM 3.0) in California, and excess inventory in the system. We are starting to see some data points that could potentially lead to a turnaround for the sector namely: (1) potential Fed Funds rate cut expected by JEF economists in 2024, (2) data for residential solar permits showing signs of bottoming, and (3) FERC’s new interconnection rules potentially easing some of the backlog we have seen build up over the last few years. We view these data points as tailwinds in attracting investors back into the sector.”

Ailani doesn’t leave us with a macro view of the sector. The analyst delves into the micro level, selecting two solar stocks that are shouting ‘All aboard!’ to investors, as the market warms again. We ran them through the TipRanks database to see what makes them stand out.

Don’t miss

Bank of America Pounds the Table on These 3 Buy-Rated Stocks

These 3 Biotech Stocks Have Strong Upside Potential, Says Deutsche Bank

‘Time to Hit Buy,’ Says Wells Fargo About These 2 Energy Stocks

Sunrun, Inc. (RUN)

We’ll start our look at solar stocks with Sunrun, the leading company in the US residential solar power industry, with the largest market share – an absolute majority – among its peers. The company provides a full range of services in its niche, including designing and installing custom-made solar power installations for single-family homes. Made-to-order is an important selling point, as many single-family homes are highly modified from their original construction, so that it’s uncommon to find two that are identical. Sunrun has the expertise to cope with this and to create solar power systems that fit the customer’s residence.

The residential solar industry has come a long way from the days of Jimmy Carter when the 39th President had rooftop solar panels installed on the White House. Sunrun’s projects are high-end package deals and include modern photovoltaic panels, grid connections, ‘smart home’ power control systems, and power storage batteries, all designed to meet the homeowner’s electrical load needs.

Sunrun has a financial division as well and can offer a variety of payment plan options for its customers. Buyers can choose to pay ‘cash on the barrel,’ in advance and in full, or can use the company’s financing options to set up payment plans. These can be based on long-term amortization or even on an equipment ‘lease,’ with monthly payments. The prospect of lower interest rates starting as early as next year should ease the pressure on prospective customers by making such financing plans more affordable.

In the meantime, we can look back at Sunrun’s last financial release – from 3Q23, announced at the beginning of November – for a snapshot of where the company stands right now. Sunrun showed some solid metrics in that report, including 33,806 net customer additions of whom 29,303 were added as subscription customers. The company had, as of September 30, a total of 903,270 customers, including 754,087 subscribers. Year-over-year, the company’s customer base has expanded by 19%.

At the top line, Sunrun showed $593.2 million in total revenue. This was down 11% year-over-year and missed the forecast by almost $12 million. At the bottom line, however, the non-GAAP EPS figure of 40 cents per diluted share, based on $88.5 million in net income, was an impressive 56 cents per share ahead of the forecast.

For Ailani, the key point is Sunrun’s leading market share in the residential solar industry. The Jefferies analyst writes, “As the leading clean energy provider under a subscription service, and with over a 60% residential market share of new subscriptions, Sunrun is well poised to take advantage of the growth in resi solar after a disappointing 2023. We see upside to Sunrun’s NSV driven by cost deflation, ITC adders and product mix shift to solar + storage vs solar only. The company’s storage attach rates improved to ~33% in 3Q from ~15% in 1Q23, and we expect the rates to trend to ~40% in 2024 and closer to ~50% in 2025. In a high interest rates environment, we expect RUN’s total customer base to increase by 15% / 13% in ‘24 / ‘25, with ~90% being Subscribers.”

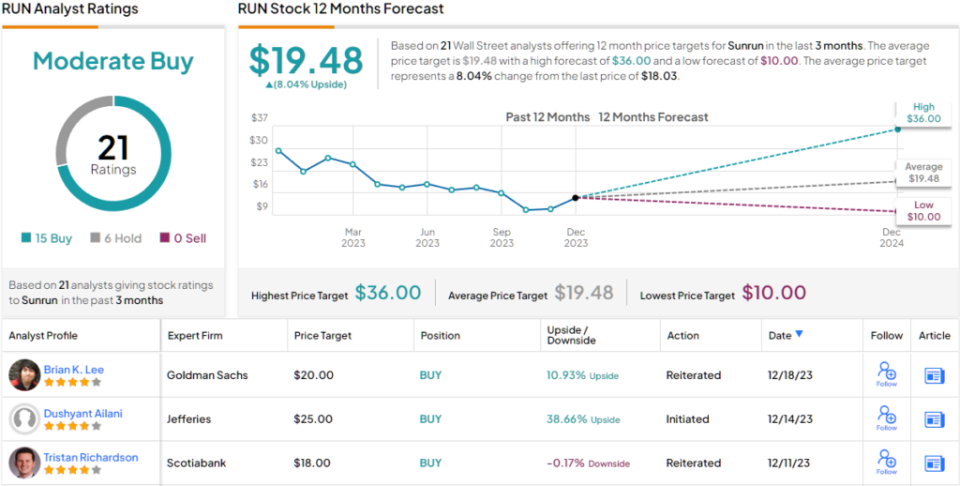

These comments support the analyst’s Buy rating on Sunrun shares, and his $25 price target implies a bullish one-year upside potential of ~39%. (To watch Ailani’s track record, click here)

Overall, Sunrun has picked up plenty of attention from the Street’s analysts – 21 recent analyst reviews, including 15 Buys and 6 Holds, give the stock its Moderate Buy consensus rating. (See Sunrun stock forecast)

First Solar (FSLR)

The second stock we’ll look at, First Solar, has been in the US solar power market since 1999 and is currently a leader among US-domiciled photovoltaic panel producers. The company has an international manufacturing footprint, with development and assembly facilities in India, Vietnam, and Malaysia, as well as several facilities in the US, in the state of Ohio. First Solar is the largest manufacturer of solar panels in the Western Hemisphere.

The company is pursuing an aggressive expansion plan, buoyed by the social and political forces promoting various clean energy initiatives, including solar power. First Solar reports that it is on track to have 25 gigawatts of solar power generation built and online by 2026 and has accumulated a total R&D spend of $1.5 billion in pursuit of that goal. The company’s heavy investment in R&D is part of its commitment to environmental protection and quality. This commitment has led directly to its use of advanced thin-film photovoltaic modules, which have set an industry standard in the combination of durability and reliability while minimizing environmental impact.

First Solar has organized its manufacturing processes to avoid dependence on Chinese crystalline silicon. The company uses a proprietary process that allows the transformation of glass sheets into functional solar panels in approximately 4 hours. First Solar’s cadmium-telluride (CadTel) technology utilizes the byproducts of copper and zinc mining to create a photovoltaic panel at a lower cost and with superior performance compared to traditional designs.

In line with the company’s commitment to maintaining environmental quality, First Solar has a goal of converting 100% of its global manufacturing operations to renewable energy sources by 2028. In the longer term, the company aims for a Net Zero carbon footprint by 2050. Already, the company uses less water, energy, and semiconductor material than companies producing crystalline silicon panels.

When we turn to First Solar’s financial performance, we find that the company reported $801 million in net sales for 3Q23, the last reported quarter. This result was down 27% year-over-year, which is typical of the industry this year, given the difficult credit environment. It also missed expectations by $91.25 million. However, the bottom line figure beat the forecasts, coming in at $2.50 per diluted share, which is 46 cents per share better than had been anticipated.

What has really caught investors’ attention here, however, is the company’s forward guidance. First Solar issued full-year 2023 revenue guidance in the range of $3.4 billion to $3.6 billion, which was in-line with the consensus $3.5 billion figure. But when it comes to earnings, the company bumped up the lower end of its full-year EPS guidance, from $7 to $8 per share to $7.20 to $8 per share. The consensus on EPS was $7.59. The sound guidance reflects the company’s solid work backlog, which was reported to total 81.8 gigawatts at the end of Q3.

Setting out the Jefferies view, analyst Ailani takes heart from First Solar’s strong existing position and sound prospects for continued work. He writes, “First Solar’s exposure to utility scale and strong backlog insulates it well against near term volatility inherent in the sector. The company is well-positioned to benefit from its strong ~82GW backlog and potential upside to ASP. Furthermore, we expect gross margin expansion from 18% in ‘23 to 25% in ‘25, which is in the low end of company guidance. First Solar is also leading peers in expanding capacity in the US to take adv of the IRA credits which can add to gross margins, to ~53% by ‘25.”

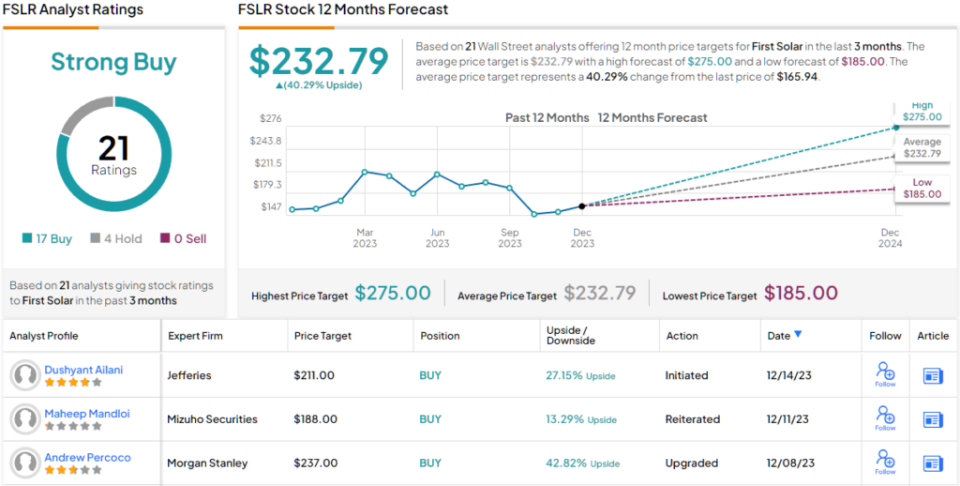

To quantify his stance, the analyst rates FSLR shares as a Buy, and puts a $211 price target here to suggests a 27% upside in the next 12 months. (To watch Ailani’s track record, click here)

Like Sunrun above, First Solar has attracted plenty of notice from the Street, in the form of 21 recent analyst reviews that include 17 Buys and 4 Holds for a Strong Buy consensus rating. (See FSLR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.