Aboitiz Equity Ventures Inc's Dividend Analysis

Understanding Aboitiz Equity Ventures Inc's Dividend Dynamics

Aboitiz Equity Ventures Inc (ABOIF) recently announced a dividend of $1.4 per share, payable on 2024-03-26, with the ex-dividend date set for 2024-03-18. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Aboitiz Equity Ventures Inc's dividend performance and evaluate its sustainability.

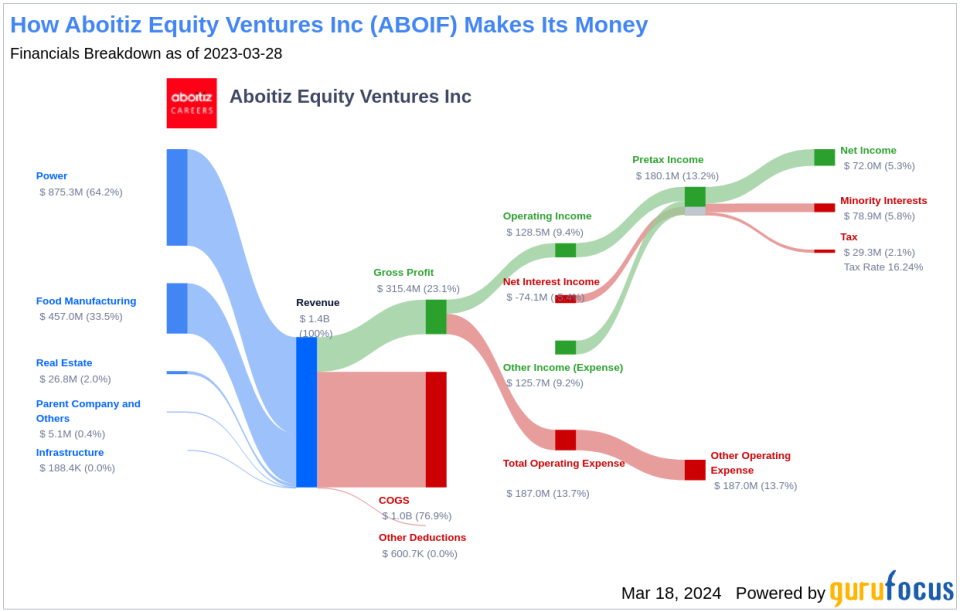

What Does Aboitiz Equity Ventures Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Aboitiz Equity Ventures Inc is a Philippines-based holding company with operations spanning power distribution and generation, financial services, food manufacturing, real estate, and infrastructure. The power segment, which is its primary revenue driver, focuses on power generation and electricity sales. The food manufacturing segment is involved in producing flour, animal feeds, and swine breeding. Aboitiz Equity Ventures Inc operates exclusively within the Philippines, leveraging its diverse portfolio for steady growth.

A Glimpse at Aboitiz Equity Ventures Inc's Dividend History

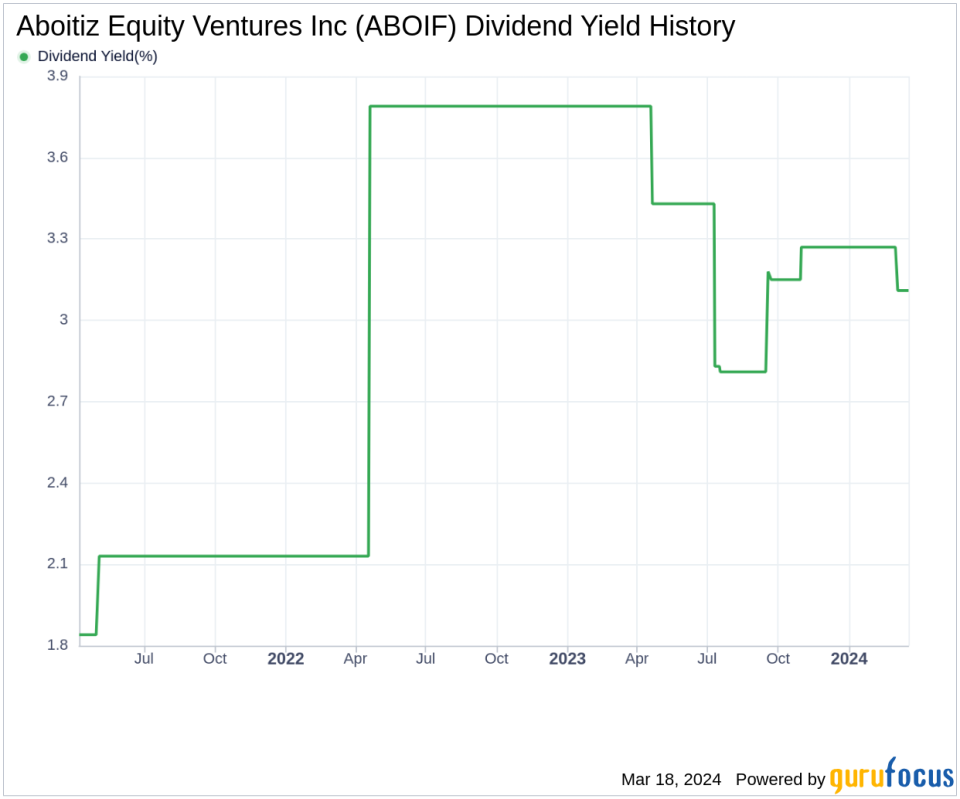

Aboitiz Equity Ventures Inc has established a reputation for consistent dividend payments since 2021, with distributions occurring annually. To better understand the trend, refer to the chart below which illustrates the company's annual Dividends Per Share over time.

Breaking Down Aboitiz Equity Ventures Inc's Dividend Yield and Growth

Aboitiz Equity Ventures Inc's current 12-month trailing dividend yield stands at 3.19%, with a 12-month forward dividend yield of 2.94%, indicating a potential decrease in dividend payments in the coming year. Over the past three years, the annual dividend growth rate was 7.10%, but this figure dips to -0.20% when extended to a five-year period. The decade-long annual growth rate of dividends per share further declines to -1.00%. The 5-year yield on cost for Aboitiz Equity Ventures Inc stock is approximately 3.16% as of today.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio, which stands at 0.37 as of 2023-09-30, is a key indicator of dividend sustainability. It reveals that Aboitiz Equity Ventures Inc retains a considerable portion of its earnings, supporting future growth and providing a buffer for potential downturns. The company's profitability rank is strong at 9 out of 10, suggesting robust profitability relative to its peers. Consistently positive net income over the past decade further cements its financial health.

Growth Metrics: The Future Outlook

Aboitiz Equity Ventures Inc's impressive growth rank of 9 out of 10 signals a promising growth trajectory. The company's revenue per share and 3-year revenue growth rate of 15.10% annually surpasses 72.91% of global competitors. The 3-year EPS growth rate of 6.10% per year and the 5-year EBITDA growth rate of 2.30% further strengthen the company's capacity for sustaining dividends.

Next Steps for Investors

In conclusion, Aboitiz Equity Ventures Inc presents a compelling case for investors interested in stable dividend income. The company's consistent dividend payments, reasonable payout ratio, and solid profitability indicators bode well for its ability to maintain its dividend distributions. Additionally, the favorable growth metrics suggest a resilient business model poised for future success. Investors looking for similar opportunities can explore high-dividend yield stocks using GuruFocus' High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.