Acacia Research Corp (ACTG) Reports Significant Revenue Growth and Strategic Acquisitions in Q4 2023

Revenue Surge: Q4 consolidated revenue jumped to $92.3 million from $13.1 million in the same quarter last year.

Intellectual Property Success: Intellectual property operations generated $82.8 million in Q4, a substantial increase from $2.5 million in Q4 2022.

Net Income Leap: GAAP net income soared to $74.8 million, or $0.75 per diluted share, reversing a net loss from the previous year.

Strategic Acquisitions: Acacia acquired a majority stake in Benchmark Energy II LLC and sold Arix Bioscience Plc shares for $57.1 million.

Book Value Growth: Book value per share increased to $5.90 at the end of Q4 2023, up from $5.04 in the previous quarter.

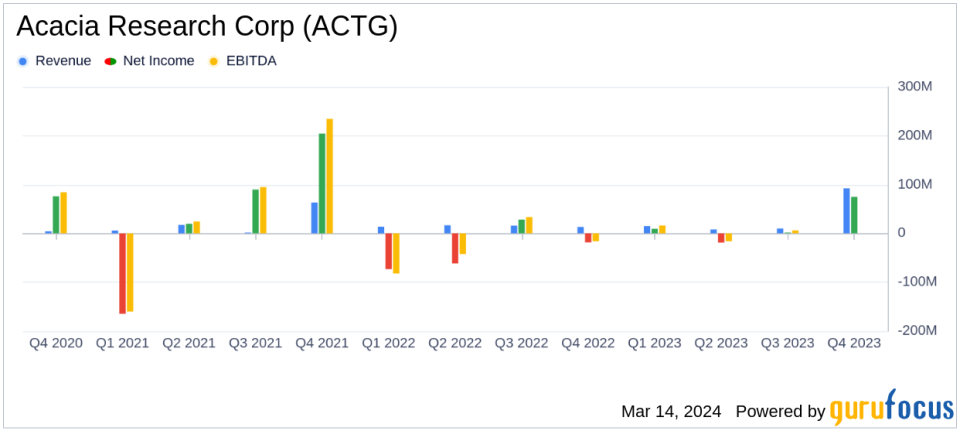

On March 14, 2024, Acacia Research Corp (NASDAQ:ACTG) released its 8-K filing, detailing a remarkable fourth quarter and full-year financial performance for the period ending December 31, 2023. The company, known for its acquisition, development, and licensing of patented technologies, has reported significant growth in revenue and net income, largely driven by its intellectual property operations and strategic asset sales.

Financial Performance and Strategic Moves

Acacia's Q4 revenue of $92.3 million represents a sevenfold increase over the $13.1 million reported in the same quarter of the previous year. This surge was primarily due to the company's intellectual property operations, which generated $82.8 million in revenue, compared to just $2.5 million in Q4 2022. The company's industrial operations contributed $8.6 million, while its newly acquired energy operations added $0.8 million to the total revenue.

The company's strategic maneuvers, including the sale of Arix Bioscience Plc shares for $57.1 million and the acquisition of a majority stake in Benchmark Energy II LLC, have bolstered its financial position. These moves are part of Acacia's broader strategy to diversify its asset base and create additional value for shareholders.

Income Statement and Balance Sheet Highlights

Acacia's operating income for the quarter stood at $55.9 million, a significant turnaround from the operating loss of $14.5 million in the same quarter last year. The company's GAAP net income reached $74.8 million, or $0.75 per diluted share, reversing the net loss of $18.4 million, or $0.50 per diluted share, from Q4 2022. The net income included $12.6 million in unrealized gains related to the increase in share price of certain holdings.

On the balance sheet, cash, cash equivalents, and equity investments measured at fair value totaled $403.2 million at the end of 2023, up from $349.4 million at the end of 2022. The company's book value also reflected positive momentum, with an increase to $589.6 million, resulting in a book value per share of $5.90.

Outlook and Management Commentary

CEO Martin ("MJ") D. McNulty, Jr. expressed satisfaction with the company's progress, highlighting the growth in book value per share and the potential for future cash flows. McNulty emphasized the company's scale and capital base as significant advantages in pursuing additional acquisitions, particularly in the oil and gas space, to drive shareholder value.

"Through the last quarter of 2023 and into the beginning of 2024 we continued to meaningfully advance our business strategy in an effort to drive earnings and book value per share growth in disciplined and unique ways," said McNulty.

Acacia's strategic acquisitions and its intellectual property licensing and settlement agreements have positioned the company for continued growth. With a focus on capital allocation and business strategy, Acacia Research Corp (NASDAQ:ACTG) enters 2024 with a strong financial foundation and a clear vision for driving book value per share.

Investors and stakeholders can access more details about the company's performance and strategic plans during the investor conference call or by visiting the investor relations section of Acacia's website.

For a comprehensive understanding of Acacia Research Corp's financials and strategic direction, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Acacia Research Corp for further details.

This article first appeared on GuruFocus.