Academy Sports (ASO) Expands Virginia Footprint With New Store

Academy Sports and Outdoors, Inc. ASO is fortifying its market presence with the grand opening of a 77,000-square-foot store in Fredericksburg, VA. This marks ASO's second location in Virginia and the sixth store launched in 2023. The company plans an ambitious expansion, targeting 120 to 140 new stores by 2027.

This Fredericksburg store will be a haven for sports and outdoor enthusiasts, offering a vast array of merchandise from top national brands like Nike, adidas, YETI and more. Exclusive, private-label brands like Magellan Outdoors and BCG contribute to the store's unique offerings, covering outdoor apparel, equipment and accessories.

The glorious introduction, from Oct 6 to 8, promises customers exclusive deals and giveaways, making it an opportune time for savvy shoppers. The store caters to diverse interests, from camping and tailgating to team sports and outdoor activities.

Investors keen on retail growth and market penetration should watch ASO's strategic moves closely. The company's commitment to providing quality and value in the sports and outdoors sector positions it favorably for sustained success.

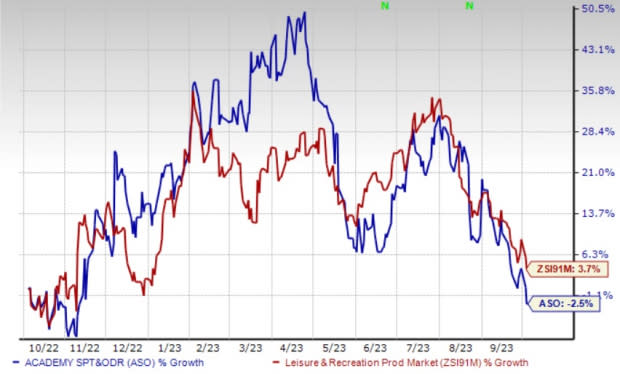

Image Source: Zacks Investment Research

Stock Performance

Shares of ASO have declined 2.5% in the past year against the industry’s 3.7% growth. The company is likely to benefit from its expansion efforts, product innovation and operational efficiency.

Academy Sports’ primary growth strategy focuses on expanding by establishing new stores. The goal is to leverage the recent momentum by consistently enhancing all aspects of business and executing three key growth strategies. These strategies involve developing a robust omnichannel presence, driving growth from existing stores through improved service, productivity, enhanced merchandising and captivating customer engagement.

Zacks Rank and Stocks to Consider

Currently, ASO carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector include:

Live Nation Entertainment, Inc. LYV sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 34.6% on average. Shares of LYV have increased 2.8% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Hilton Worldwide Holdings Inc. HLT currently carries a Zacks Rank #2 (Buy). HLT has a trailing four-quarter earnings surprise of 12.5% on average. The stock has gained 16.6% in the past year.

The Zacks Consensus Estimate for HLT’s 2023 sales and EPS suggests improvements of 14.8% and 23.7%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW currently carries a Zacks Rank #2. OSW has a trailing four-quarter earnings surprise of 42.6% on average. Shares of OSW have risen 30.8% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS implies 44.5% and 117.9% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

Academy Sports and Outdoors, Inc. (ASO) : Free Stock Analysis Report