Acadia (ACAD) Q3 Earnings and Sales Beat Estimates, Stock Up

Acadia Pharmaceuticals Inc. ACAD reported third-quarter 2023 loss of 40 cents per share, narrower than the Zacks Consensus Estimate of a loss of 43 cents. In the year-ago quarter, the company had incurred a loss of 17 cents per share.

The company recorded total revenues of $211.7 million in the reported quarter, surpassing the Zacks Consensus Estimate of $194 million. Acadia’s net product revenues comprise revenues generated from the sale of its two marketed products, Nuplazid (pimavanserin) and the newly-approved Daybue (trofinetide).

Nuplazid is an FDA-approved treatment for hallucinations and delusions associated with Parkinson’s disease psychosis. On the other hand, Acadia’s second product, Daybue, was approved by the FDA in March 2023 for the treatment of Rett syndrome in adult and pediatric patients aged two years and older.

Daybue was made available in the U.S. market in April 2023.

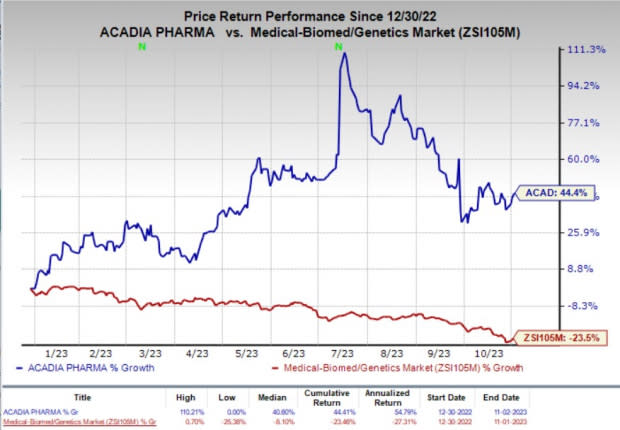

The company’s stock climbed 3.7% in the after-market hours following the better-than-expected third-quarter results. Year to date, shares of Acadia have shot up 44.4% against the industry’s 23.5% fall.

Image Source: Zacks Investment Research

Quarter in Detail

In the reported quarter, revenues from Nuplazid sales increased 10.8% year over year to $144.8 million. Nuplazid sales increased 2% sequentially in the third quarter. Per the company, the uptick in Nuplazid sales was primarily driven by a $7 million in-channel inventory reduction in the prior year that did not recur this year. The reported third-quarter figure beat our model estimate of $133.3 million.

In the first full quarter of commercialization following the April 2023 launch, Daybue recorded net product sales of $66.9 million.

Research and development (R&D) expenses in the quarter were $157 million, up 93% year over year. This uptick in R&D cost was driven by one-time expenses incurred due to the agreement with Neuren during the quarter.

In July 2023, Acadia announced expanding its current licensing agreement for trofinetidewith Neuren Pharmaceuticals. Under the agreement, ACAD acquired rights to market trofinetide outside North America along with exclusive global rights to Neuren’s development candidate, NNZ-2591, in Rett syndrome and Fragile X syndrome.

Selling, general and administrative (SG&A) expenses were $97.9 million, up 25.4% year over year. The increase in such expenses can be attributed to a rise in commercial costs associated with the Daybue launch, partially offset by efficiencies in Acadia’s commercial support of Nuplazid.

Acadia had cash, cash equivalents and investments worth $345.9 million as of Sep 30, 2023 compared with $375.4 million as of Jun 30, 2023. The decrease in cash balance was on account of a $100 million upfront payment made to Nueren in July for worldwide rights to Daybue.

2023 Sales Guidance Updated

Acadia expects fourth-quarter 2023 Daybue sales in the range of $80-$87.5 million.

ACAD also raised the lower end of its full-year 2023 Nuplazid net sales guidance. The company now expects Nuplazid revenues in the $537.5-$545 million range compared with the previously guided range of $530-$545 million.

Moreover, the company expects its full-year R&D expenses in the band of $340-$350 million compared with the previous guidance of $335-$355 million.

For SG&A expenses guidance, the company again raised the lower end of the guided range. Acadia now expects full-year SG&A expenses in the range of $390-$400 million compared with the previous guidance of $380-$400 million. The anticipated rise in SG&A expenses is on account of higher operating costs due to retaining employees and commercialization costs associated with Daybue launch.

Pipeline Updates

The company is currently evaluating pimavanserin in the phase III ADVANCE-2 study for treating negative symptoms of schizophrenia. The company has completed enrollment in the study and expects to announce top-line results from the same in the first quarter of 2024.

Acadia is also developing another pipeline candidate, ACP-204, as a potential treatment for Alzheimer’s disease psychosis (ADP). In the third-quarter earnings release, the company announced that it plans to initiate a phase II study on ACP-204 in the ADP indication in the fourth quarter of 2023.

Additionally, the company is also planning to initiate a phase III study on ACP-101for the treatment of hyperphagia in Prader-Willi syndrome in the fourth quarter of 2023.

ACADIA Pharmaceuticals Inc. Price and Consensus

ACADIA Pharmaceuticals Inc. price-consensus-chart | ACADIA Pharmaceuticals Inc. Quote

Zacks Rank and Other Stocks to Consider

Acadia currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth mentioning are Dynavax Technologies DVAX, Apellis Pharmaceuticals APLS and Adicet Bio, Inc. ACET. While DVAX sports a Zacks Rank #1 (Strong Buy), APLS and ACET carry a Zacks Rank #2 each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 23 cents to 22 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 8 cents. Year to date, shares of DVAX have gained 32.2%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

In the past 30 days, the Zacks Consensus Estimate for Apellis’ 2023 loss per share has narrowed from $4.89 to $4.32. During the same time frame, the estimate for Apellis’ 2024 loss per share has narrowed from $2.77 to $2.15. Year to date, shares of APLS have lost 4.6%.

APLS beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative earnings surprise of 3.91%.

In the past 30 days, the estimate for Adicet Bio’s 2023 loss per share has remained constant at $2.93. During the same period, the estimate for Adicet’s 2024 loss per share has remained constant at $2.40. Year to date, shares of ACET have fallen 83.4%.

ACET’s earnings beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 7.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report