Acadia Healthcare (ACHC) Inks JV to Better Serve Texas Residents

Acadia Healthcare Company, Inc. ACHC recently inked a joint venture (JV) with the Texas-based leading integrated healthcare system, Ascension Seton, in a bid to provide enhanced behavioral healthcare services across Austin and neighboring communities. Ascension Seton is a part of Ascension’s extensive national health network comprising 139 hospitals and 40-plus senior living facilities in 19 states and the District of Columbia.

As part of the JV, Acadia Healthcare will expand the inpatient behavioral bed count in its acute behavioral hospital, Cross Creek Hospital, thereby increasing the availability of such beds across Austin. Initially equipped with 90 beds, ACHC will add another 106 beds, thus taking the total licensed bed count of the hospital to 196. Bed additions are often a means for the behavioral healthcare services provider to earn higher revenues from its facilities.

The enlarged facility will be known as “Cross Creek Hospital together with Ascension Seton” and is likely to become operational in late 2024. It will also play the role of training students, residents and fellows of The University of Texas at Austin’s Dell Medical School.

The ulterior motive of Acadia Healthcare in forming this JV remains to seek assistance from Ascension Seton hospitals and follow a collaborative approach to bring about improved health outcomes throughout the Austin community. Before this, ACHC had also formed a JV with Ascension to build the Tennessee-based Ascension Saint Thomas Behavioral Health Hospital, which started operating in 2021.

Therefore, Acadia Healthcare seems prudent to have taken the help of Ascension, which has been catering to the needs of Texas residents for more than 12 decades. Ascension will enable ACHC to gain an in-depth understanding of the behavioral health needs of the Austin region and hence, serve patients better.

Through providing increased access to behavioral healthcare to Texas residents, the statewide presence of ACHC is expected to be further solidified. Being a faith-based healthcare organization, Ascension places special focus on treating the poor and most vulnerable populations, thereby making the recent JV of ACHC all the more noteworthy.

The latest announcement marks the 21st JV partnership of Acadia Healthcare. JVs usually combine the expertise, capabilities and resources of both partners and hence, attributable to such growth-related initiatives, ACHC has been successful in building an enhanced behavioral healthcare services suite and diversifying its treatment network.

Management remains optimistic about pursuing similar partnerships with leading U.S. health systems in the future to address mental health issues and substance use disorders prevailing throughout the country. In 2024, the hospitals, which are likely to be constructed as a result of Acadia Healthcare’s JV partnerships with Henry Ford Health and Intermountain Health, are likely to become operational.

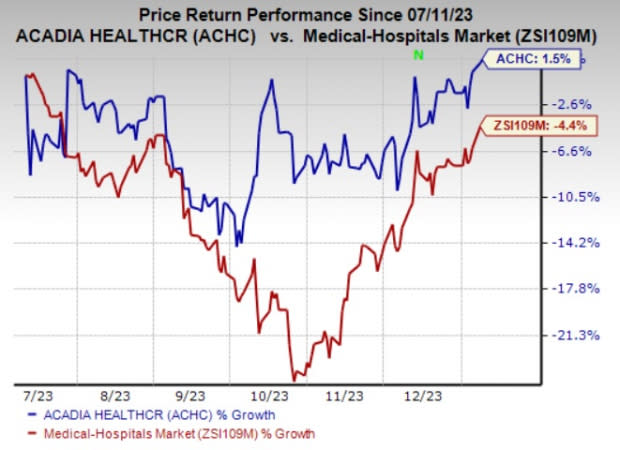

Shares of Acadia Healthcare have inched up 1.5% in the past six months against the industry’s 4.4% decline. ACHC currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the Medical space are Regeneron Pharmaceuticals, Inc. REGN, Amphastar Pharmaceuticals, Inc. AMPH and DaVita Inc. DVA, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Regeneron Pharmaceuticals surpassed estimates in each of the last four quarters, the average surprise being 12.34%. The Zacks Consensus Estimate for REGN’s 2024 earnings indicates 2.4% growth while the consensus estimate for revenues suggests a 5.2% rise from their corresponding 2023 estimate. The consensus mark for REGN’s 2024 earnings has moved 4.1% north in the past 30 days.

Amphastar Pharmaceuticals’ earnings beat estimates in each of the trailing four quarters, the average surprise being 52.06%. The Zacks Consensus Estimate for AMPH’s 2024 earnings indicates 17.7% growth from the 2023 estimate. The consensus estimate for revenues implies 25.4% growth from the 2023 estimate. The consensus mark for AMPH’s 2024 earnings has moved 5.9% north in the past 60 days.

The bottom line of DaVita outpaced estimates in each of the trailing four quarters, the average surprise being 36.55%. The Zacks Consensus Estimate for DVA’s 2024 earnings indicates 4.9% growth while the same for revenues suggests a 2.7% rise from their corresponding 2023 estimate. The consensus mark for DVA’s 2024 earnings has moved 0.4% north in the past 30 days.

Shares of Regeneron Pharmaceuticals, Amphastar Pharmaceuticals and DaVita have gained 25.9%, 3.2% and 5.2%, respectively, in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH) : Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report