Accel Entertainment Inc (ACEL) Reports Record Revenue and Adjusted EBITDA for 2023

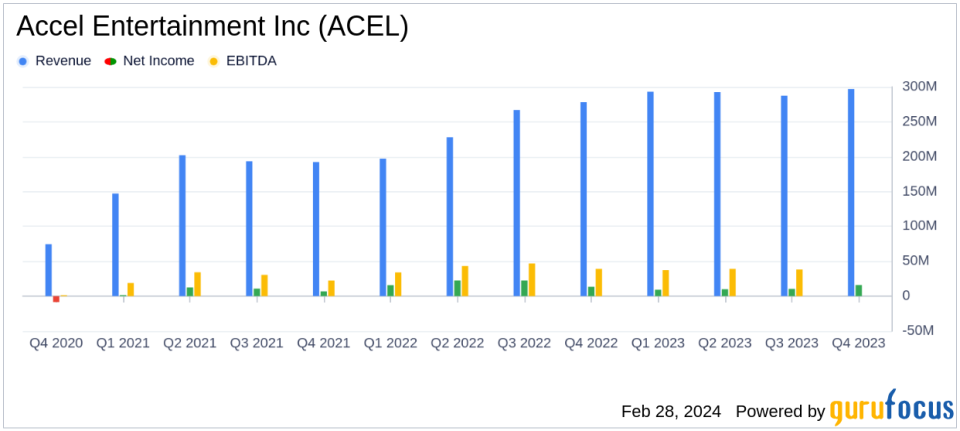

Revenue Growth: Accel Entertainment Inc (NYSE:ACEL) achieved a record revenue of $297 million in Q4 2023 and $1.2 billion for the full year.

Net Income: The company reported a net income of $16 million for Q4 and $46 million for the year-end 2023.

Adjusted EBITDA: Adjusted EBITDA reached $45 million in Q4 and $181 million for the year, marking another record.

Location and Terminal Expansion: Accel expanded to 3,961 locations and 25,083 gaming terminals by the end of 2023, a 6% and 7% increase respectively year-over-year.

Stock Repurchase: The company repurchased $14 million of its Class A-1 common stock in Q4 and $30 million for the full year.

Debt Reduction: Net debt was reduced by 12% compared to 2022, ending the year at $281 million.

On February 28, 2024, Accel Entertainment Inc (NYSE:ACEL), a leading distributed gaming operator in the United States, released its 8-K filing, announcing financial and operating results for the fourth quarter and full year ended December 31, 2023. The company, which specializes in the installation, maintenance, and operation of video gaming terminals, reported a record year for both revenue and Adjusted EBITDA.

Accel's revenue for the fourth quarter was $297 million, bringing the total for the year to $1.2 billion. This represents a significant increase from the previous year's figures. Net income for the fourth quarter stood at $16 million, with the year-end figure reaching $46 million. Adjusted EBITDA, a key metric for evaluating a company's operating performance, was $45 million for Q4 and $181 million for the full year, indicating strong profitability and operational efficiency.

Financial Performance and Expansion

Accel's growth strategy has been reflected in its expansion of locations and gaming terminals. By the end of 2023, the company increased its locations by 6% to 3,961 and gaming terminals by 7% to 25,083. This expansion, excluding the newly entered Nebraska market, still shows a robust growth of 3% in locations and 5% in gaming terminals compared to the previous year. The Illinois market, a core area for Accel, saw same-store sales growth of 1% in Q4 and 3% for the full year.

Moreover, the company demonstrated prudent financial management by reducing its net debt by 12%, ending the year with $281 million. This deleveraging reflects a strong balance sheet and positions the company for future growth opportunities. Additionally, Accel showed its commitment to shareholder returns by repurchasing $14 million of its Class A-1 common stock in the fourth quarter, totaling $30 million for the year.

Management's Commentary

"I am excited to report that Accel had another record-setting year in 2023. Our continued success demonstrates the long-term viability of focusing on the local gaming market. We continue to explore opportunities throughout the country to expand our reach as an industry leader and remain committed to providing value and positive returns to our investors." - Accel CEO Andy Rubenstein

Financial Statements Highlights

The company's income statement reveals a steady increase in operating income, reaching $25.45 million for Q4 and $107.4 million for the year. Income before income tax expense was reported at $19.38 million for Q4 and $65.72 million for the year. The balance sheet shows a solid financial position with total net revenues by state indicating growth across Illinois, Montana, Nevada, and Nebraska.

Accel's cash flow statement and non-GAAP financial measures further underscore the company's financial health. The reconciliation of debt to net debt and the adjusted financial metrics provide a clearer picture of the company's operational efficiency and financial stability.

Conclusion

Accel Entertainment's 2023 performance showcases a company that is not only expanding its operational footprint but also managing its finances with an eye towards sustainable growth and shareholder value. The record revenue and Adjusted EBITDA, coupled with strategic stock repurchases and debt reduction, paint a picture of a company on a robust financial footing, ready to capitalize on future opportunities in the distributed gaming market.

Investors and analysts interested in further details can access the full earnings report and join the investor conference call hosted by Accel on February 28, 2024, to discuss these financial and operating results.

Explore the complete 8-K earnings release (here) from Accel Entertainment Inc for further details.

This article first appeared on GuruFocus.