Accel Entertainment (NYSE:ACEL) Surprises With Q4 Sales

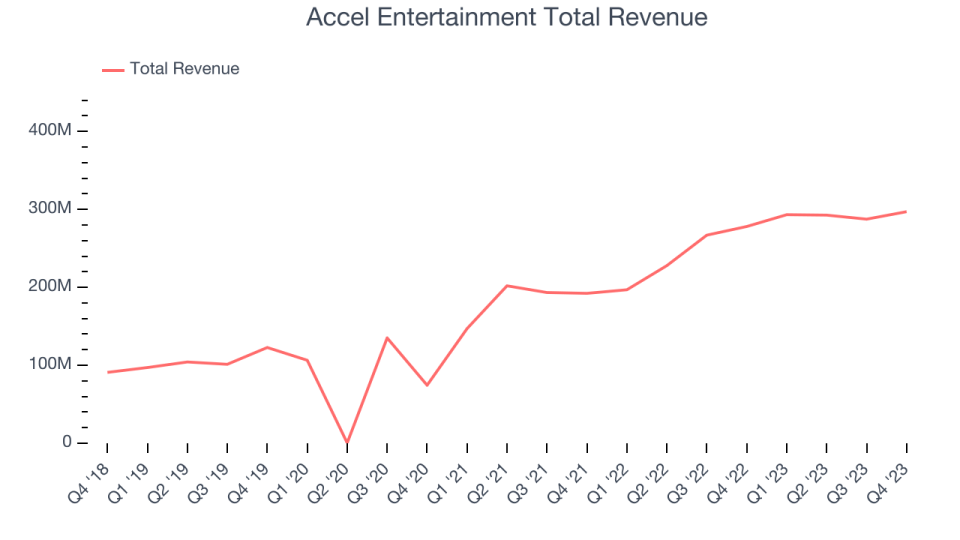

Slot machine and terminal operator Accel Entertainment (NYSE:ACEL) announced better-than-expected results in Q4 FY2023, with revenue up 6.8% year on year to $297.1 million.

Is now the time to buy Accel Entertainment? Find out by accessing our full research report, it's free.

Accel Entertainment (ACEL) Q4 FY2023 Highlights:

Revenue: $297.1 million vs analyst estimates of $285 million (4.2% beat)

Gross Margin (GAAP): 31%, up from 29.8% in the same quarter last year

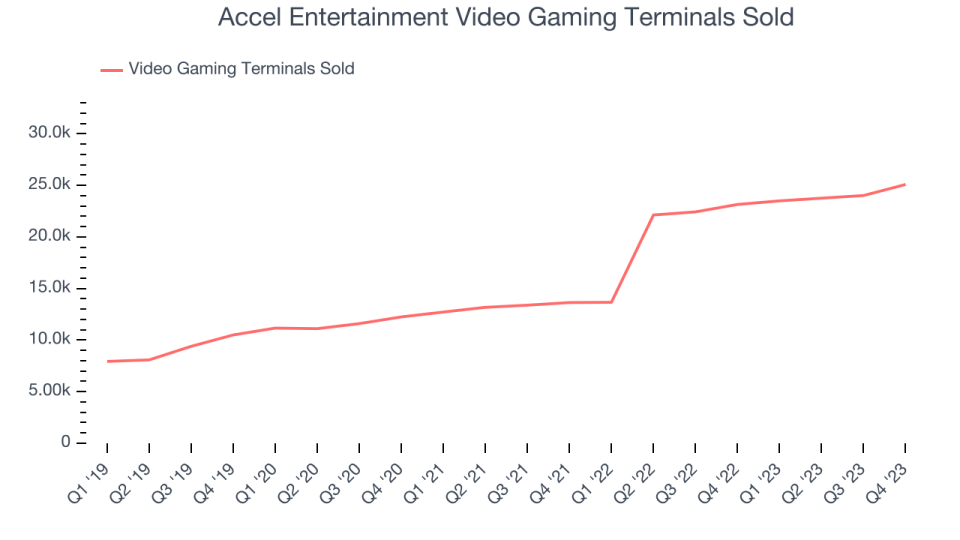

Video Gaming Terminals Sold: 25,083

Market Capitalization: $890.4 million

Accel CEO Andy Rubenstein commented, “I am excited to report that Accel had another record-setting year in 2023. Our continued success demonstrates the long-term viability of focusing on the local gaming market. We continue to explore opportunities throughout the country to expand our reach as an industry leader and remain committed to providing value and positive returns to our investors.”

Established in Illinois, Accel Entertainment (NYSE:ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Casinos and Gaming

Casino and gaming companies that offer slot machines, Texas Hold ‘Em, Blackjack and the like can enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits-have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casino and gaming companies may face stroke-of-the-pen risk that suddenly limits what they do or where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing casino and gaming companies to adapt to keep up with changing consumer preferences such as being able to wager anywhere on demand.

Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Accel Entertainment's annualized revenue growth rate of 27.6% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Accel Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 26.2% over the last two years is below its five-year trend.

We can dig even further into the company's revenue dynamics by analyzing its number of video gaming terminals sold, which reached 25,083 in the latest quarter. Over the last two years, Accel Entertainment's video gaming terminals sold averaged 38.4% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, Accel Entertainment reported solid year-on-year revenue growth of 6.8%, and its $297.1 million of revenue outperformed Wall Street's estimates by 4.2%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Accel Entertainment was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 9.5%.

This quarter, Accel Entertainment generated an operating profit margin of 8.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Key Takeaways from Accel Entertainment's Q4 Results

We were impressed by how significantly Accel Entertainment blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. No financial guidance was given in the earnings release, so it is hard to tell what the company's outlook for near-term financial performance is. Overall, we think this was a really good quarter that should please shareholders. The stock is flat after reporting and currently trades at $10.65 per share.

Accel Entertainment may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.