Accenture (ACN) Announces Velocity Co-developed With AWS

Accenture plc ACN yesterday announced that it has launched Velocity, a platform that significantly accelerates business transformation processes of clients by simplifying the process of building and operating enterprise-scale applications and estates in the cloud.

Jointly funded and co-developed with Amazon’s AMZN Amazon Web Services (“AWS”), Velocity enables clients to quickly accept Accenture and AWS innovations based on learnings from several projects, as it eliminates the need to recreate time-consuming, labor-intensive work and incur recurring costs at the beginning of a project.

Karthik Narain, global lead of Accenture Cloud First said, "Velocity will bring AWS-powered industry, cross-industry, and technology solutions to market faster, with more repeatability and at a lower cost. It’s the essence of innovation powered by the shared experiences of Accenture and AWS."

The move seems to be part of Accenture’s strategy of enhancing its cloud capabilities through partnerships. Considering the growing need for cloud-based applications and software, we expect Accenture’s investments in this space to propel long-term growth.

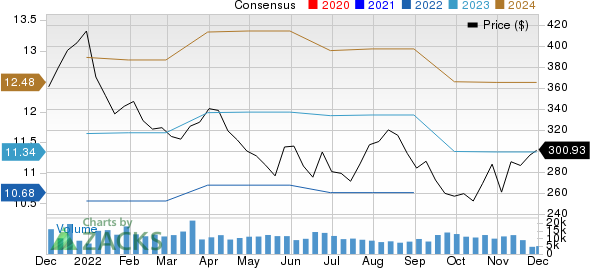

Accenture’s shares have lost 16.5% in the past year compared with the 15% fall of the industry it belongs to and the 13.9% decline of the Zacks S&P 500 composite.

Accenture PLC Price and Consensus

Accenture PLC price-consensus-chart | Accenture PLC Quote

Zacks Rank and Stocks to Consider

Accenture currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Allen Hamilton Holding Corporation BAH and Cross Country Healthcare, Inc. CCRN.

Booz Allencarries a Zacks Rank #2 (Buy) at present. BAH has a long-term earnings growth expectation of 8.9%.

Booz Allen delivered a trailing four-quarter earnings surprise of 8.8% on average.

Cross Country Healthcare is currently a Zacks #2 Ranked stock. CCRN has a long-term earnings growth expectation of 6%.

CCRN delivered a trailing four-quarter earnings surprise of 10.1% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report