Accenture PLC (ACN) Reports Stable Revenues and Increased Margins in Q2 Fiscal 2024

New Bookings: $21.6 billion, with generative AI bookings surpassing $600 million for the quarter.

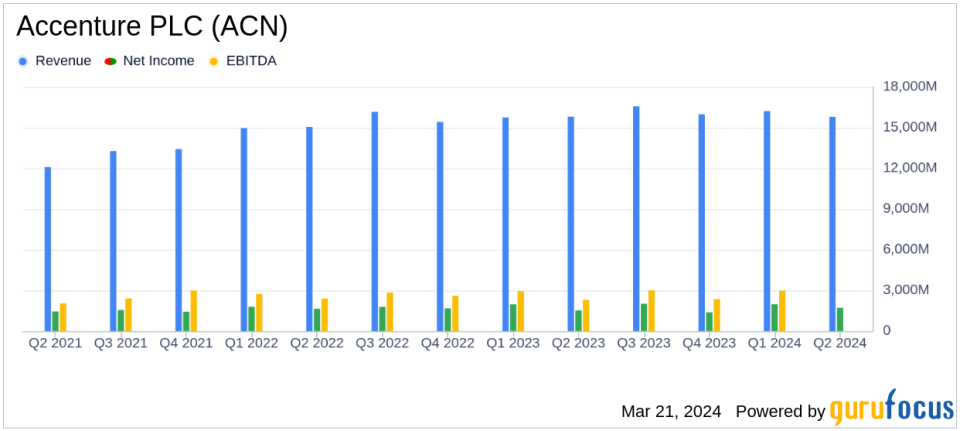

Revenue: Reported at $15.8 billion, remaining flat in both U.S. dollars and local currency compared to the same quarter last year.

Operating Margin: GAAP operating margin improved to 13.0%, a 70 basis point increase year-over-year.

Earnings Per Share (EPS): GAAP EPS rose by 10% to $2.63, while adjusted EPS increased by 3% to $2.77.

Free Cash Flow: Amounted to $2.0 billion for the quarter.

Dividend: Quarterly cash dividend increased by 15% to $1.29 per share.

Outlook: Full-year revenue growth now projected to be between 1% to 3% in local currency.

On March 21, 2024, Accenture PLC (NYSE:ACN) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024, which ended on February 29, 2024. Accenture, a global IT-services firm, offers a broad range of services including consulting, strategy, technology, and operational services across various sectors such as communications, media and technology, financial services, and health and public services. With nearly 500,000 employees in over 200 cities across 51 countries, Accenture is a leader in digital transformation and other IT services.

Financial Performance and Challenges

Accenture's performance in the second quarter shows resilience in the face of a challenging macroeconomic environment. The company's revenue remained flat at $15.8 billion, which was slightly above the midpoint of the company's guided range. This stability in revenue is significant as it demonstrates Accenture's ability to maintain its business volume amidst economic uncertainties. However, the lack of revenue growth could signal a plateau in client demand or market saturation, which may pose challenges for future expansion.

The company's GAAP operating margin improved to 13.0%, reflecting a 70 basis point increase over the same quarter of the previous fiscal year. This improvement in operating margin is indicative of Accenture's effective cost management and operational efficiency, which are crucial for maintaining profitability, especially when revenue growth is stagnant.

Financial Achievements and Industry Significance

Accenture's financial achievements this quarter, particularly the increase in GAAP EPS by 10% to $2.63 and adjusted EPS by 3% to $2.77, are important indicators of the company's profitability and its ability to generate value for shareholders. In the software and IT services industry, where innovation and rapid change are the norms, Accenture's ability to increase earnings per share suggests a strong competitive position and the potential for sustained shareholder returns.

Key Financial Metrics

Accenture's financial strength is further evidenced by its free cash flow of $2.0 billion and a robust new bookings total of $21.6 billion, which includes over $600 million in generative AI bookings for the quarter. The company's focus on high-growth areas such as generative AI is a strategic move that aligns with industry trends and positions Accenture for future growth. Additionally, the company's disciplined capital deployment, with $2.9 billion invested in strategic acquisitions in the first half of the fiscal year, underscores its commitment to expanding its service offerings and market reach.

Julie Sweet, chair and CEO of Accenture, commented on the results: "In an uncertain macro environment, we remain the trusted partner to our clients for reinvention with a record 39 clients with quarterly bookings of over $100 million. We also extended our early lead in generative AI with $1.1 billion in new bookings in the first half of the year. And we are investing to serve the needs of our clients and expand our growth opportunities with $2.9 billion of capital deployed in the first half in strategic acquisitions. Thank you to our more than 740,000 people around the world for your dedication to delivering value for our clients."

Analysis of Company's Performance

Accenture's performance this quarter reflects a company that is effectively navigating a complex economic landscape. The firm's ability to maintain stable revenues, improve operating margins, and deliver increased EPS highlights its operational excellence and strategic focus. The significant investments in generative AI and strategic acquisitions demonstrate a forward-looking approach that is likely to benefit the company in the long term. However, the flat revenue growth suggests that Accenture will need to continue innovating and adapting to market demands to drive future growth.

As Accenture updates its business outlook for fiscal 2024, with expectations of full-year revenue growth between 1% to 3% in local currency, investors and stakeholders will be watching closely to see how the company's strategic initiatives unfold in the coming quarters.

For a more detailed analysis of Accenture's financial results and future outlook, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Accenture PLC for further details.

This article first appeared on GuruFocus.