ACCO Brands Corp (ACCO) Exceeds Full Year 2023 Outlook with Strong Margin Expansion and Debt ...

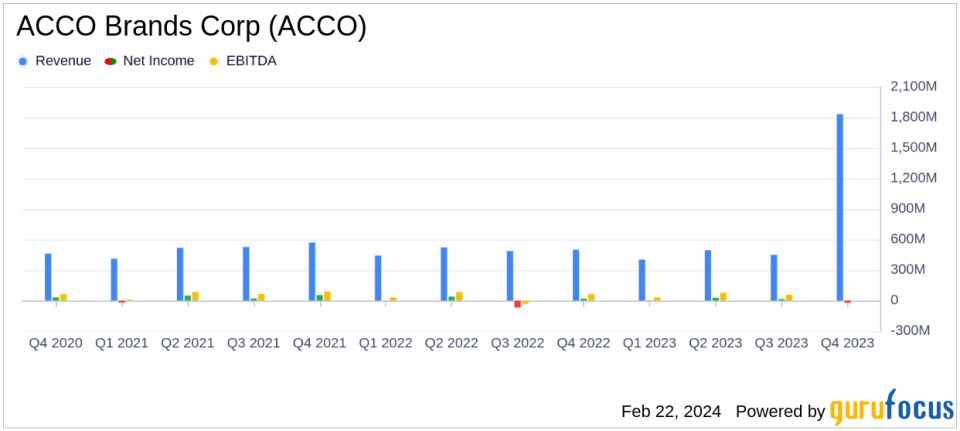

Reported Net Sales: $1.833 billion for the full year, with a decline of 5.9% from 2022.

Gross Margin: Expanded by 420 basis points over the full year.

Adjusted Operating Income: Grew by 17% to $205 million for the full year.

Adjusted EPS: $1.09, surpassing the company's outlook.

Net Operating Cash Flow: Improved by $51 million, generating adjusted free cash flow of $118 million.

Debt Reduction: Reduced total debt by $88 million, ending the year with a consolidated net leverage ratio of 3.4x.

On February 22, 2024, ACCO Brands Corp (NYSE:ACCO) released its 8-K filing, detailing the financial results for the fourth quarter and the full fiscal year ended December 31, 2023. The company, known for its diverse portfolio of consumer and business products, operates through segments including ACCO Brands North America, ACCO Brands EMEA, and ACCO Brands International, offering products under various brands such as AT-A-GLANCE, Five Star, and Kensington.

Performance and Challenges

ACCO Brands faced a challenging demand environment in 2023, with reported net sales declining by 5.9% to $1.83 billion from $1.95 billion in 2022. The company's performance was impacted by a weaker macroeconomic environment, especially in North America and EMEA, and lower than anticipated return to office trends. Despite these challenges, ACCO Brands managed to expand its gross margin by 420 basis points and grow its adjusted operating income by 17% to $205 million.

Financial Achievements

The company's financial achievements are significant in the Industrial Products industry, where efficient capital management and margin improvements are critical. ACCO Brands' ability to reduce total debt by $88 million and improve its net operating cash flow by $51 million, resulting in an adjusted free cash flow of $118 million, demonstrates strong financial discipline and operational efficiency.

Income Statement and Balance Sheet Highlights

For the fourth quarter, ACCO Brands reported a net loss of $59.4 million, or $(0.62) per share, compared to a net income of $18.8 million, or $0.20 per share, in the prior year. This loss was primarily due to a non-cash goodwill impairment charge of $89.5 million. Adjusted net income for the quarter was $37.5 million, or $0.39 per share, compared to $30.5 million, or $0.32 per share, in 2022.

The balance sheet reflects a reduction in total debt and a consolidated net leverage ratio of 3.4x. Cash and cash equivalents stood at $66.4 million as of December 31, 2023, compared to $62.2 million at the end of 2022.

Commentary from Management

"I am pleased to report that our fourth quarter financial performance, including our reported net sales and adjusted EPS and free cash flow, was better than expected. During the year, we successfully executed against our 2023 priorities and implemented our previously announced restructuring plans, which enabled us to significantly expand our gross margin, deliver strong free cash flow, and reduce our consolidated net leverage ratio to 3.4x at the end of 2023. We believe our achievement of these results against a challenging demand environment is a testament to the solid execution of our team and our geographically diverse portfolio of leading brands. The restoration of our gross margins and improved cash flows enables us to make investments that position the Company for long-term growth," stated ACCO Brands' President and Chief Executive Officer, Tom Tedford.

2024 Outlook

Looking ahead to 2024, ACCO Brands anticipates reported sales to decrease in the range of 2.0% to 5.0%, reflecting the uncertain demand environment for its categories. Adjusted EPS is expected to be within a range of $1.07 to $1.11, and the company projects free cash flow to grow to at least $120 million, aiming to end the year with a consolidated leverage ratio of approximately 3.0x to 3.2x.

For value investors and potential GuruFocus.com members, ACCO Brands Corp's ability to exceed its full-year outlook despite a challenging macroeconomic environment highlights the company's resilience and strategic execution. The focus on margin improvement, debt reduction, and cash flow generation positions ACCO Brands for sustainable growth and may present an attractive investment opportunity within the Industrial Products sector.

Explore the complete 8-K earnings release (here) from ACCO Brands Corp for further details.

This article first appeared on GuruFocus.