Accuray Inc (ARAY) Reports Fiscal Q2 2024 Results: Order Growth and Service Revenue Expansion ...

Order Growth: Gross orders surged by 19% year-over-year, indicating strong demand for Accuray's products.

Service Revenue: Service revenue increased by 8% year-over-year, reflecting the company's expanding service capabilities.

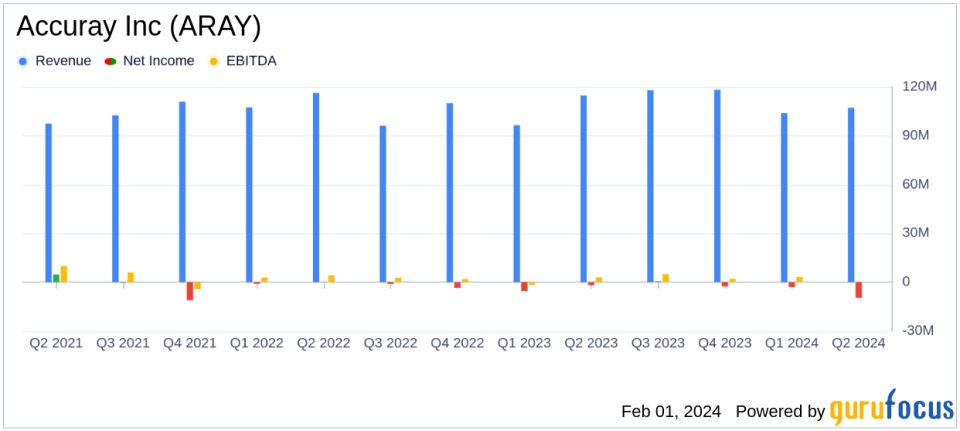

Net Revenue: A 7% year-over-year decrease in net revenue, with a slight sequential increase of 3% from the previous quarter.

Net Loss: GAAP net loss widened to $9.6 million compared to $1.9 million in the same period last fiscal year.

Adjusted EBITDA: Decreased to $2.0 million from $8.5 million in the prior fiscal year's same quarter.

Guidance Confirmation: FY24 guidance reaffirmed, with total revenue expected to grow by 3 to 5 percent year-over-year.

On January 31, 2024, Accuray Inc (NASDAQ:ARAY) released its 8-K filing, detailing the financial outcomes for the second quarter and first half of fiscal year 2024. The company, known for its innovative radiation oncology solutions like the CyberKnife Systems, reported mixed results with notable order growth and service revenue expansion, yet faced challenges with a decline in net revenue and a widened net loss.

Financial Performance Overview

Accuray's fiscal second quarter saw a 19% year-over-year increase in gross orders, reaching $93.9 million, which is a positive indicator of the company's market demand. The book to bill ratio, an important metric for future revenue potential, improved to 1.8 from 1.2 in the prior year. However, net revenue for the quarter fell by 7% year-over-year to $107.2 million, with a constant currency basis net revenue showing an 8% decrease. The company's service revenue, on the other hand, showed resilience with an 8% increase compared to the same period last year.

Despite the growth in orders and service revenue, Accuray's profitability faced headwinds. The GAAP net loss for the quarter expanded to $9.6 million from a net loss of $1.9 million in the same quarter of the previous fiscal year. Adjusted EBITDA also declined to $2.0 million from $8.5 million year-over-year. These figures reflect the challenges the company faces in converting its order book and service growth into bottom-line profitability.

Operational Highlights and Challenges

Accuray's operational highlights included a 44% increase in orders from China, driven by the launch of the Tomo C product, and a strong performance in the EIMEA region with 30% order growth. The company also celebrated the 250th installation milestone in the APAC region and gained Shonin approval for the VitalHold breast cancer treatment package in Japan.

However, the company's financial results indicate that despite these operational successes, there are challenges in maintaining profitability. The increased net loss and decreased adjusted EBITDA suggest that Accuray is facing pressure on its margins and may need to focus on cost management and operational efficiency to improve its financial health.

Looking Forward

Accuray's reaffirmed guidance for fiscal year 2024 suggests confidence in its business strategy and market position. The company expects total revenue to be in the range of $460 million to $470 million, representing a year-over-year growth of 3 to 5 percent. The projected adjusted EBITDA for the fiscal year is anticipated to be between $27 million and $30 million.

Value investors may find Accuray's order growth and service revenue expansion encouraging signs of the company's potential. However, the increased net loss and challenges in profitability highlight the importance of closely monitoring the company's operational efficiency and cost management strategies. As Accuray continues to innovate and expand its market reach, it remains to be seen how these efforts will translate into improved financial performance.

For a more detailed analysis of Accuray Inc (NASDAQ:ARAY)'s financial results and operational strategies, investors are encouraged to review the full 8-K filing and consider the implications for their investment decisions.

Explore the complete 8-K earnings release (here) from Accuray Inc for further details.

This article first appeared on GuruFocus.