Accuray's (ARAY) New Offering to Boost Radiation Treatment Plans

Accuray Incorporated ARAY recently unveiled an online adaptive therapy option, Cenos, for its Radixact System. The solution was unveiled, in partnership with Limbus AI, at the ongoing 2023 ASTRO (American Society for Radiation Oncology) Annual Meeting.

However, the FDA’s 510(k) clearance is currently pending. Also, the solution is not presently available for sale in the United States and is not CE-marked. Hence, the availability is subject to regulatory clearance or approval in some markets.

The latest offering is expected to significantly strengthen Accuray’s TomoTherapy platform on a global scale.

Significance of the Latest Addition

Per Accuray, the size, shape or location of tumors may change and their proximity to organs and other healthy tissue may shift as patients gain or lose weight over the course of radiation treatments. Accuray’s customers are currently able to leverage real-time adaptive therapy via the company's proprietary Synchrony technology and offline adaptive with PreciseART radiotherapy to account for some of the anatomical changes that occur during radiation delivery. With the addition of Cenos, Accuray customers will likely be able to perform online adaptations of their treatment plan to account for changes that may occur between treatment sessions.

Also, automating the contouring (defining the border of the tumor and organs at risk) portion of the treatment planning process using tools such as the one developed by Limbus AI is expected to make it practical for radiotherapy clinics of all sizes to adopt online adaptive therapy, per requirement.

Accuray’s management believes that Cenos will likely be able to provide its customers with a comprehensive and efficient approach to adaptive radiotherapy that includes a solution for making online adaptive therapy feasible for any interested Radixact customer.

Per Limbus AI’s management, embedding its AI-based technology, Limbus Contour, into the Cenos online adaptive solution is expected to provide accurate and fast contouring, essential to real-world clinical implementation of adaptive treatment.

Industry Prospects

Per a report by Precedence Research, the global radiation therapy market was estimated at $7.25 billion in 2022 and is anticipated to reach $14.89 billion by 2032 at a CAGR of 8%. Factors like the increased prevalence of cancer, the growing adoption of radiotherapy in cancer treatment and technological advancements are likely to drive the market.

Given the market potential, the latest product offering is expected to provide a significant boost to Accuray’s business globally.

Recent Developments

This month, Accuray opened its new global training facility, the Accuray Center for Education, located at its corporate headquarters in Madison, WI.

Last month, Accuray received the FDA’s approval for its VitalHold breast package on the Radixact System. The VitalHold technology is expected to be available to customers in the United States, European Union and other regions, subject to regulatory approvals.

The same month, Accuray reported its fourth-quarter fiscal 2023 results, wherein it registered a solid overall top line. Robust Product and Services revenues and performances in the majority of geographies were also seen. The uptick in gross orders and the global installed was registered. Continued strong demand for Accuray’s Radixact innovations, including ClearRT, Synchrony and VitalHold, was also recorded by Accuray.

Price Performance

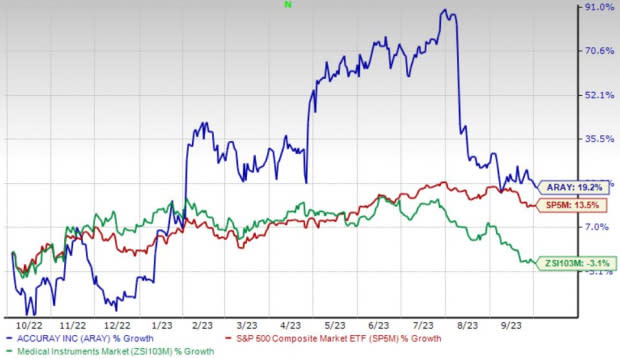

Shares of Accuray have gained 19.2% in the past year against the industry’s 3.1% decline. The S&P 500 has witnessed 13.5% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Accuray carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, McKesson Corporation MCK and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 6.4% against the industry’s 6.9% decline over the past year.

McKesson, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 8.1%.

McKesson has gained 23.1% compared with the industry’s 13.9% rise over the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 18.5% against the industry’s 3.1% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report