ACI Worldwide Inc (ACIW) Reports Strong Earnings Growth and Operational Efficiency in Q4 2023

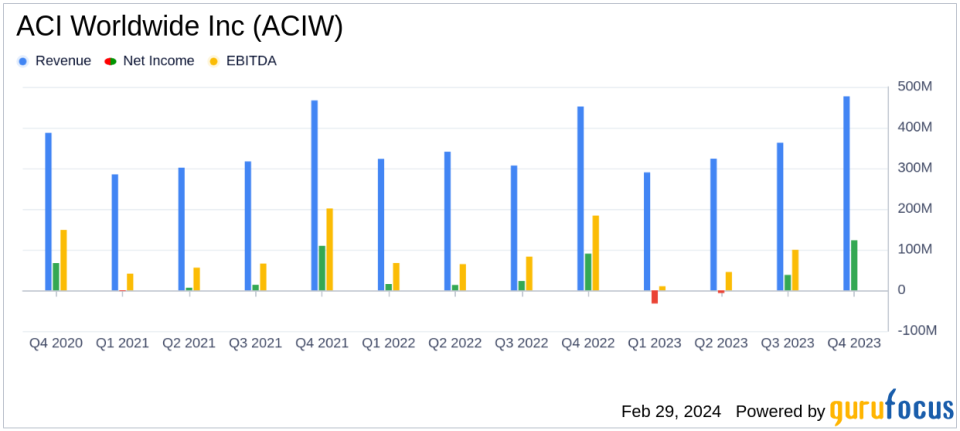

Revenue Growth: Q4 revenue increased by 5% to $477 million, with full-year revenue up 5% to $1.45 billion.

Net Income: Q4 net income soared by 36% to $123 million, contributing to a 7% increase in full-year net income to $122 million.

EBITDA Performance: Adjusted EBITDA for Q4 rose by 8% to $210 million, with a 10% increase to $395 million for the full year.

Operational Cash Flow: Cash flow from operating activities grew significantly by 107% in Q4 to $86 million and by 18% for the full year to $169 million.

Share Repurchase: ACIW repurchased 1 million shares for $28 million in Q4 and an additional 2 million shares year-to-date in 2024 for $62 million.

Debt Management: Net debt leverage ratio improved to 2.2x, down from 2.4x in the previous quarter.

2024 Outlook: Revenue growth projected to be between 7-9% for 2024, with adjusted EBITDA expected to range from $418 million to $428 million.

On February 29, 2024, ACI Worldwide Inc (NASDAQ:ACIW), a global leader in mission-critical, real-time payments software, released its 8-K filing, disclosing financial results for the quarter and full year ended December 31, 2023. The company, known for its comprehensive suite of software products that facilitate electronic payments, operates across the Americas, EMEA, and Asia-Pacific regions, primarily serving financial institutions.

ACIW's Q4 performance highlighted a robust 5% revenue growth, reaching $477 million, and a notable 36% increase in net income to $123 million. The company's focus on recurring revenue streams paid off with a 7% increase, signaling a strong and stable financial position. Adjusted EBITDA for the quarter also grew by 8% to $210 million, reflecting improved operational efficiency.

For the full year, ACIW reported a 5% revenue increase to $1.45 billion, adjusted for foreign currency fluctuations and divestitures. The recurring revenue for the year was up by 8%, totaling $1.1 billion. The company's net income for the year was $122 million, a 7% increase from the previous year, after adjusting for the gain on the divestiture of its Corporate Online Banking business. Total adjusted EBITDA for the year was $395 million, a 10% increase from 2022.

ACIW's balance sheet remains healthy with $164 million in cash and a reduced net debt leverage ratio of 2.2x. The company's proactive capital management included the repurchase of 3 million shares for a total of $90 million in capital over the reported period and into 2024.

Looking ahead, ACIW provided guidance for 2024, expecting revenue growth between 7% to 9% and adjusted EBITDA to be in the range of $418 million to $428 million. This outlook reflects the company's confidence in its growth trajectory and operational strategies.

ACIW's earnings report demonstrates the company's continued commitment to growth and operational excellence. With a strong financial foundation and strategic initiatives in place, ACIW is well-positioned to capitalize on the expanding demand for electronic payment solutions and to deliver value to its shareholders.

For more detailed financial information and future updates, investors are encouraged to follow ACIW's progress and consider the potential opportunities it presents in the evolving digital payments landscape.

Explore the complete 8-K earnings release (here) from ACI Worldwide Inc for further details.

This article first appeared on GuruFocus.