Ackman Effect Hinders a Consumer Staples ETF

Shares of nutritional supplements distributor Herbalife (HLF) were spotted lower by 11.3% in late trading Monday on volume that was more than seven times the daily average after the stock’s most notorious bear made some choice comments about the controversial company.

Pershing Square Capital Management CEO Bill Ackman told CNBC, “You’re going to learn why Herbalife is going to collapse. This will be the most important presentation that I have made in my career.”

Herbalife has a market value of $5.3 billion, which is small relative to many other consumer staples companies. As a result, the stock is not a marquee component of many ETFs, staples or otherwise. However, Herbalife’s Monday plunge did have a fairly noticeable impact on the First Trust Consumer Staples AlphaDEX Fund (FXG) .

Although Herbalife is not a top-10 holding in FXG, the ETF’s 3.1% weight to the stock is the largest among ETFs. FXG was off almost 1% on volume that was more than triple the daily average in late trading Monday. By comparison, the Consumer Staples Select Sector SPDR (XLP) was off just half a percent. XLP, the largest staples ETF, features no Herbalife exposure. [Staples ETFs Prove Sturdy Again]

According to S&P Capital IQ data, just two ETFs, the Guggenheim Russell MidCap Equal Weight ETF (EWRM) and the Guggenheim Russell 1000 Equal Weight ETF (EWRI) , feature Herbalife as a top-10 holding. However, no stock accounts for more than 0.4% of either of those ETFs.

FXG has been down this road before. The ETF endured a modest intraday loss in March after the the Federal Trade Commission opened a formal investigation into Herbalife’s business practices. At that time, Herbalife was FXG’s ninth-largest holding. [Herbalife's FTC Flap Highlights Advantages of ETFs]

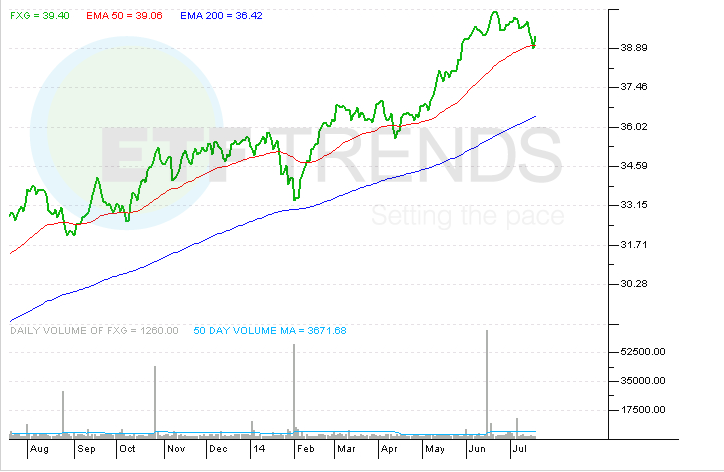

First Trust Consumer Staples AlphaDEX Fund