Aclaris (ACRS) Lead Drug Fails Rheumatoid Arthritis Study

Shares of Aclaris Therapeutics ACRS lost 86.4% in one trading day on Nov 13 after management announced top-line results from a phase IIb study (ATI-450-RA-202). The study evaluated its lead pipeline candidate, zunsemetinib inrheumatoid arthritis (“RA”) indication.

The ATI-450-RA-202 study evaluated two doses of zunsemetinib (20mg and 50mg) combined with methotrexate (MTX) against the combination of placebo and MTX in patients with moderate to severe RA who have had an inadequate response to MTX alone. The study failed to achieve its primary or secondary efficacy endpoints following 12 weeks of treatment at both doses of the drug.

Study participants who received either of the two doses of zunsemetinib did not show any notable differences across any measures of efficacy compared with placebo. No significant safety findings were observed.

Based on overall results from the study, Aclaris decided to discontinue further development of zunsemetinib, including halting enrollment in the ongoing Phase IIa study on zunsemetinib in psoriatic arthritis indication.

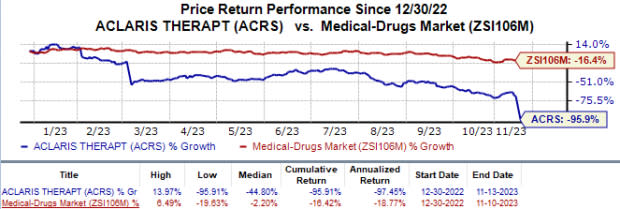

Shares of Aclaris Therapeutics have plunged 95.9% year to date compared with the industry’s 16.4% decline.

Image Source: Zacks Investment Research

This is the second clinical setback faced by management this year with regard to zunsemetinib. Earlier in March, Aclaris reported preliminary top-line data from a phase IIa study on zunsemetinib in hidradenitis suppurativa (“HS”) indication, which failed to achieve its primary and secondary efficacy endpoints.

Following the decision to discontinue the development of zunsemetinib, Aclaris will focus on the development of its other pipeline candidates, namely ATI-1777 (for atopic dermatitis), ATI-2138 (for T-cell mediated autoimmune diseases) and ATI-2231 (for pancreatic cancer and breast cancer).

Before 2023-end, Aclaris expects to report top-line data from a phase IIa study on ATI-1777 in moderate to severe atopic dermatitis. Management plans to start a mid-stage study on ATI-2138 in ulcerative colitis early next year.

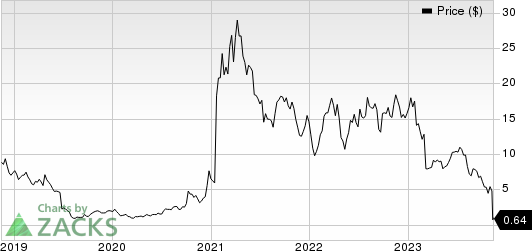

Aclaris Therapeutics, Inc. Price

Aclaris Therapeutics, Inc. price | Aclaris Therapeutics, Inc. Quote

Zacks Rank & Other Stocks to Consider

Aclaris currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include Apellis Pharmaceuticals APLS, Avid Bioservices CDMO and Biohaven BHVN, also carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apellis Pharmaceuticals’ loss estimates for 2023 have narrowed from $4.89 to $4.59 per share in the past 60 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.78 to $1.92. Year to date, Apellis Pharmaceuticals’ shares have lost 11.6%.

Apellis Pharmaceuticals beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing a negative earnings surprise of 3.91% on average. In the last reported quarter, APLS reported a negative earnings surprise of 39.29%.

In the past 60 days, estimates for Avid Bioservices’ 2023 loss per share have narrowed from 15 cents to 5 cents. During the same period, the earnings estimates per share for 2024 have risen from 13 cents to 21 cents. Shares of CDMO are down 63.5% in the year-to-date period.

Earnings of Avid Bioservices beat estimates in three of the last four quarters while meeting the mark on one occasion, witnessing an average earnings surprise of 181.25%. In the last reported quarter, Avid’s earnings beat estimates by 100.00%.

Biohaven’s loss estimate has narrowed from $4.99 to $4.93 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $4.81 to $4.79. Shares of BHVN have surged 107.3% in the year-to-date period.

The earnings of Biohaven beat estimates in two of the last four quarters while missing the mark on the other two occasions, posting a negative average earnings surprise of 29.37%. Biohaven’s earnings missed estimates by 6.45%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aclaris Therapeutics, Inc. (ACRS) : Free Stock Analysis Report

Biohaven Ltd. (BHVN) : Free Stock Analysis Report

Avid Bioservices, Inc. (CDMO) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report