Acme United Corp (ACU) Stock Price Soars by 21.30% Over the Past Three Months

Acme United Corp (ACU), a leading supplier in the Consumer Packaged Goods industry, has seen a significant increase in its stock price over the past three months. The company's stock price has risen from $25.78 to $31, marking a 21.30% increase. However, the past week has seen a slight decrease of 8.20%. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $37.73, indicating that the stock is 'Modestly Undervalued'. This is a slight increase from the past GF Value of $37.01, which suggested that the stock was 'Significantly Undervalued'. The company's market capitalization stands at $110.609 million.

Company Overview

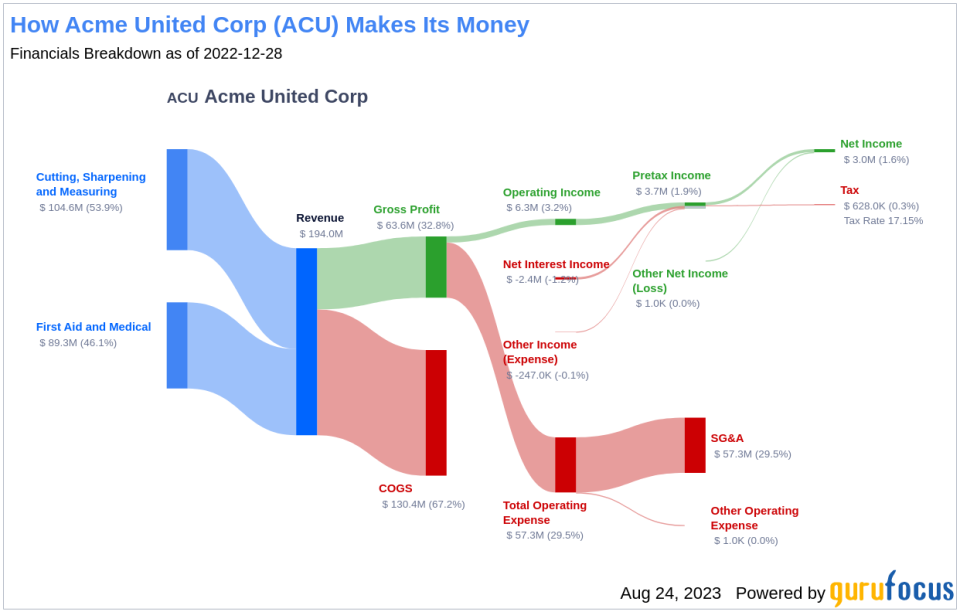

Acme United Corp is a renowned supplier of first aid and medical products, cutting technology, and other products to various markets including school, home, office, hardware, sporting goods, and industrial markets. The company's principal products sold across all segments are first aid kits and medical products, scissors, shears, knives, rulers, pencil sharpeners, and sharpening tools. The company operates in the United States, Canada, and Europe, with the majority of its revenue derived from the United States.

Profitability Analysis

Acme United Corp has a Profitability Rank of 9/10, indicating a high level of profitability. The company's Operating Margin is 4.33%, which is better than 47.63% of companies in the same industry. The company's ROE, ROA, and ROIC are 4.86%, 2.33%, and 4.63% respectively, all of which are above average compared to other companies in the industry. The company has consistently shown profitability over the past 10 years, better than 99.94% of companies.

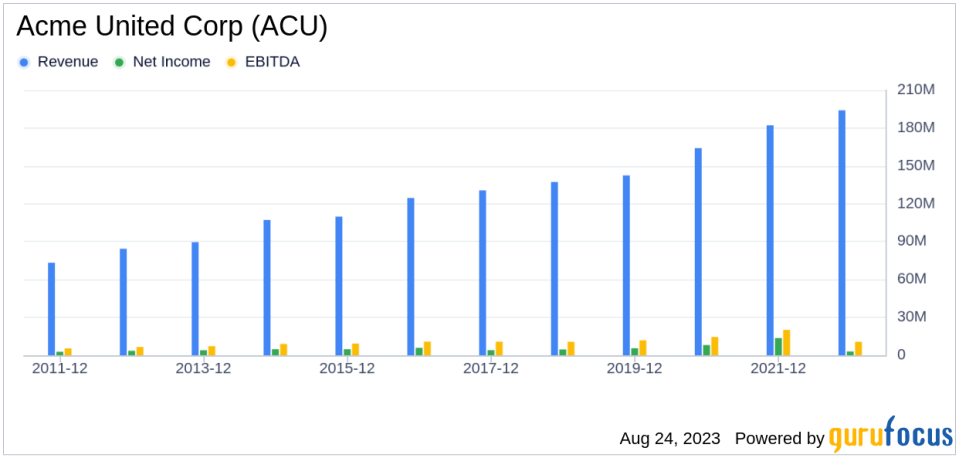

Growth Prospects

The company's Growth Rank is 9/10, indicating strong growth potential. The company's 3-year and 5-year revenue growth rates per share are 8.10% and 7.80% respectively, better than over half of the companies in the same industry. However, the company's 3-year and 5-year EPS without NRI growth rates show mixed results, with a decrease of 20.00% over the past three years but an increase of 5.50% over the past five years.

Major Stock Holders

The top three holders of the company's stock are Chuck Royce (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Diamond Hill Capital (Trades, Portfolio). Chuck Royce (Trades, Portfolio) holds 141,115 shares, accounting for 3.98% of the total shares. Jim Simons (Trades, Portfolio) holds 125,607 shares, accounting for 3.52% of the total shares. Diamond Hill Capital (Trades, Portfolio) holds 9,041 shares, accounting for 0.25% of the total shares.

Competitor Analysis

Acme United Corp faces competition from Grove Collaborative Holdings Inc (NYSE:GROV) with a market capitalization of $121.859 million, Peregrine Industries Inc (PGID) with a market capitalization of $15.626 million, and Naples Soap Co Inc (NASO) with a market capitalization of $40.232 million.

Conclusion

In conclusion, Acme United Corp has shown strong performance over the past three months with a significant increase in its stock price. The company's profitability and growth ranks indicate a high level of profitability and strong growth potential. However, the company faces competition from other companies in the Consumer Packaged Goods industry. Despite the competition, the company's consistent profitability and strong growth potential make it a promising investment.

This article first appeared on GuruFocus.