ACNB Corp (ACNB) Reports Decline in Q4 Net Income Amid Investment Portfolio Repositioning

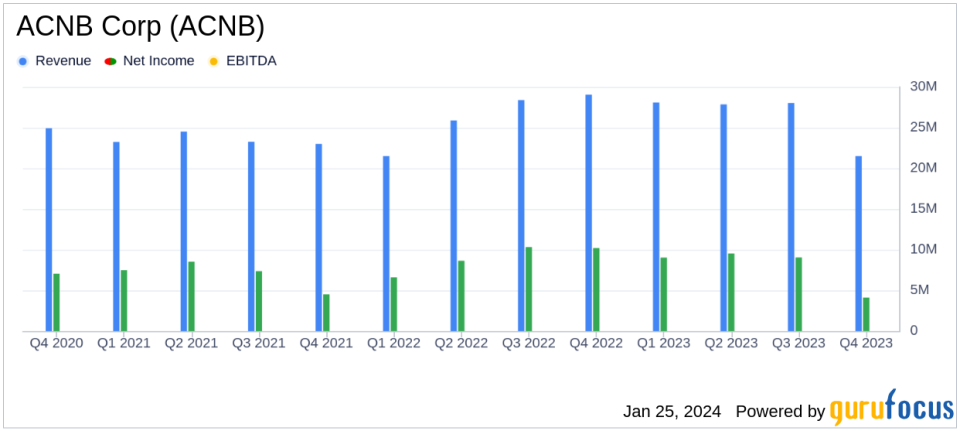

Net Income: Q4 net income fell to $4.1 million, a significant drop from $10.2 million in Q4 2022.

Earnings Per Share (EPS): Diluted EPS for Q4 stood at $0.48, compared to $1.20 in the same quarter the previous year.

Net Interest Margin: Full-year net interest margin improved to 4.07% from 3.36% in 2022.

Loan Growth: Total loans increased by 5.8% year-over-year, reaching $1.63 billion.

Efficiency Ratio: Efficiency ratio for the year worsened to 57.78% from 55.81% in 2022.

Dividends: Declared a quarterly cash dividend of $0.30 per share, a 7.1% increase over the same quarter of 2023.

Stock Repurchases: ACNB repurchased 61,066 shares of common stock at a cost of $2.0 million in 2023.

On January 25, 2024, ACNB Corp (NASDAQ:ACNB) released its 8-K filing, detailing the financial results for the fourth quarter and the full year of 2023. The corporation, a financial holding company for ACNB Bank and ACNB Insurance Services, Inc., reported a decrease in net income for both the fourth quarter and the year-end compared to the same periods in the previous year. The decline in net income was primarily due to the repositioning of the investment securities portfolio, which resulted in an after-tax loss of approximately $3.5 million.

ACNB Corp provides banking, insurance, and financial services through its wholly-owned subsidiaries. The corporation operates two reporting segments: the Bank and ACNB Insurance Services. The Bank includes ACNB Bank and related financial services, while ACNB Insurance Services offers a wide range of insurance products to both commercial and individual clients.

The corporation's performance in 2023 was marked by a solid return on average assets of 1.32% and a return on average equity of 12.23% for the year. Excluding the impact of the investment securities portfolio repositioning, these figures would have been 1.47% and 13.57%, respectively. The full-year net interest margin showed an improvement, reflecting higher interest rates and a more profitable lending environment.

Despite these positive aspects, ACNB faced challenges, including a decrease in noninterest income due to the securities portfolio repositioning and an increase in noninterest expenses. The efficiency ratio, which measures the cost of generating revenue, also deteriorated slightly, indicating higher costs relative to income.

ACNB's financial achievements in 2023 included meaningful loan growth, particularly in the commercial loan portfolio, and an improved tangible common equity to tangible assets ratio, which increased from 7.71% at the end of 2022 to 9.48% at the end of 2023. These achievements highlight the corporation's ability to grow its core business and strengthen its balance sheet.

James P. Helt, ACNB Corporation President & Chief Executive Officer, commented on the year's performance, stating:

"The financial services industry was challenged in 2023 with considerable market uncertainty and turmoil. However, ACNB Corporation continued to focus on fundamental community banking principals and we are pleased to share our positive operating results. [...] These corporate strengths provided us the opportunity at the end of 2023 to reposition our investment securities portfolio to improve our future interest income by approximately $1.9 million over the next 12 months."

Looking forward, ACNB Corp aims to maintain its independent financial services provider status by building relationships and finding solutions for customers. The corporation's management and board of directors are committed to navigating the challenges and opportunities of 2024 with a focus on growth and profitability.

For a detailed view of ACNB Corp's financial performance, including balance sheets and income statements, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from ACNB Corp for further details.

This article first appeared on GuruFocus.