Icahn launches proxy fight at Illumina, seeks board seats

By Bhanvi Satija and Svea Herbst-Bayliss

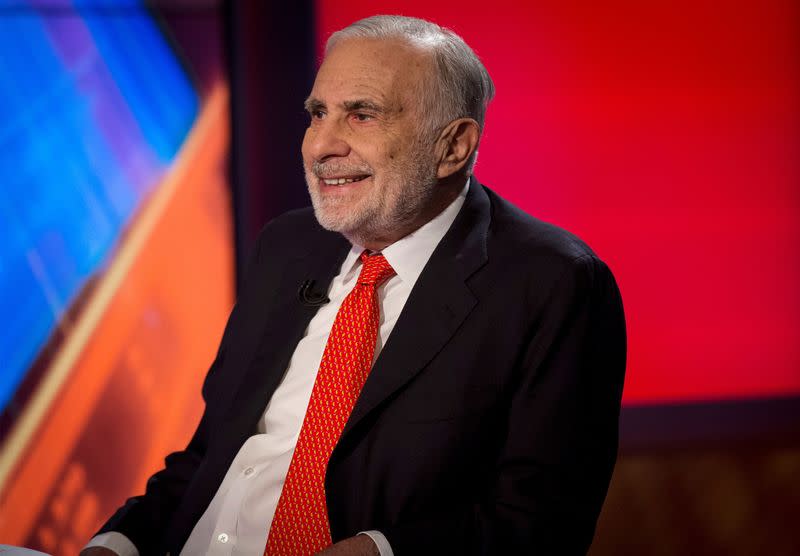

(Reuters) -Billionaire investor Carl Icahn is pushing for three board seats at Illumina, criticizing the biotechnology company's acquisition of a cancer test developer that cost investors $50 billion.

Icahn, who owns 1.4% of Illumina, told other investors in a letter on Monday that he plans to nominate three director candidates to the company's nine person board, after weeks of private discussions with the company "failed to gain traction."

Illumina in 2021 closed a deal to buy Grail, which develops cancer detection tests, in spite of antitrust opposition from the Federal Trade Commission in the United States and the European Union.

Icahn wants the board seats for fear that Illumina's current directors will "pursue Grail until the end of time without regard to the amount of value destruction they leave in their wake." The decision to close the deal in the face of European regulators objections "created a staggering amount of risk," he wrote in the letter.

The Icahn candidates - Vincent Intrieri, Jesse Lynn and Andrew Teno - would help keep Illumina from "sinking further."

Illumina said CEO Francis deSouza and board chair John Thompson spoke with Icahn several times, and that his candidates were interviewed. But the company determined they lack "relevant skills and experience."

"Icahn was explicit and unyielding in his demand that any resolution should give him outsized influence and control," the company said in a statement.

The company also said that Icahn's letter does not recognize the value Grail can bring to Illumina shareholders.

Illumina's size shrunk from roughly $70 billion to $30 billion in market capitalization as investors worried about the takeover. On Monday, the stock jumped 16%.

The European Union in December unveiled details of a planned order which would force Illumina to unwind its $7.1 billion acquisition of Grail, fearing the deal would hurt consumer choice. While Illumina is appealing the planned order, it is also exploring options for next steps if the EU indeed forces it to divest Grail, it said.

Icahn said he fears the company could lose $800 million in operating costs annually if the Grail deal is not unwound.

Icahn's sabre rattling at Illumina lays the ground work for one of the year's most high profile proxy contests after Nelson Peltz ended his contest for a seat at Disney and Daniel Loeb reached and agreement with Bath & Body Works. A handful of activists are still pressuring Salesforce to make changes.

At age 87, the billionaire remains one of the industry's most feared activist investors after having taken on iconic American companies including CVR Energy and Netflix over decades as an investor.

(Reporting by Bhanvi Satija in Bengaluru and Svea Herbst-Bayliss in Rhode Island; Editing by Anil D'Silva, Devika Syamnath and Maju Samuel)