Activists Seek to Repair Advance Auto Parts

In his latest bid to help a struggling company regain its footing, Daniel Loeb (Trades, Portfolio)'s Third Point, along with fellow activist firm Saddle Point, disclosed earlier this week it reached an agreement with Advance Auto Parts Inc. (NYSE:AAP) for a stake and three board seats. While the size of the stake has yet to be disclosed, CNBC reported that sources noted Third Point began building it in 2023.

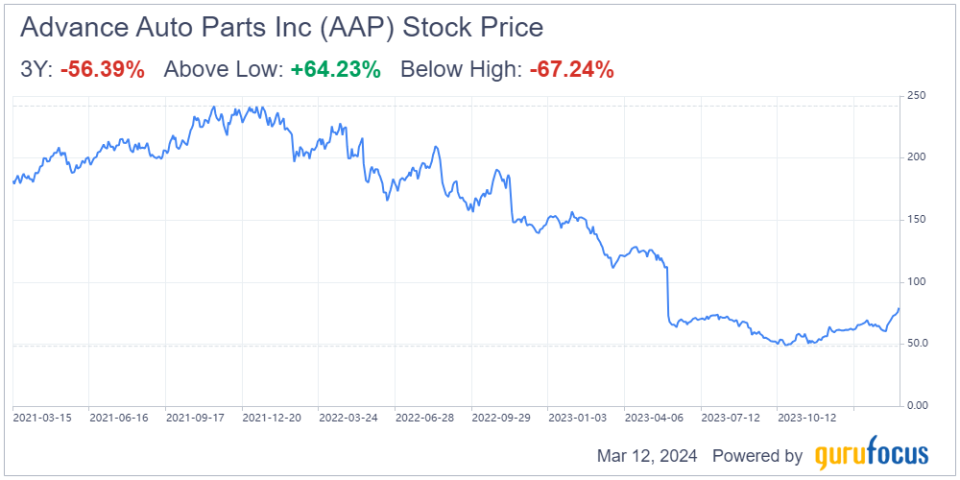

Picking stocks using an event-driven, value-oriented approach, the guru's New York-based firm is known for entering activist positions in underperforming companies with a catalyst that will help unlock value for shareholders. The aftermarket auto parts supplier appears to fit these criteria as its stock has languished after reaching a high in early 2022.

The root of the company's recent woes lies in elevated material, labor and transportation costs, which forced it to cut its forecast and dividend last year.

In an effort turn things around, Advance Auto appointed a new CEO, Shane O'Kelly, in August and is in the process of trying to sell Worldpac, a wholesale distributor of original equipment automotive parts.

Board shakeup

The board changes are another step in trying to get back on track. Effective immediately, A. Brent Windom, Gregory L. Smith and Thomas W. Seboldt have joined Advance Auto's board as independent directors, expanding it temporarily to 12 members.

All three appointees have automotive supply chain and merchandising expertise. For instance, Windom is a former CEO of Uni-Select, a distributor of automotive refinish, industrial coatings and automotive aftermarket parts. Smith is an executive vice president at medical device company Medtronic (NYSE:MDT), overseeing global operations and supply chains. As for Seboldt, he spent the majority of his career with O'Reilly Automotive Inc. (NASDAQ:ORLY), one of the company's main competitors.

In a statement, Loeb expressed his optimism for Advance Auto's prospects under their guidance.

These three directors bring essential operational experience and industry expertise to support Shane as he executes on an ambitious agenda, he said. With fresh perspectives in the C-suite and board room and a long runway for growth, we believe Advance is well positioned to create meaningful value for shareholders.

The new board members will also stand for election at the company's upcoming annual meeting in May.

About Advance Auto

Founded in 1932, the Raleigh, North Carolina-based automotive aftermarket parts provider serves both professional and do-it-yourself customers. While it primarily operates in the U.S., it also has locations in Canada, Puerto Rico and the U.S. Virgin Islands.

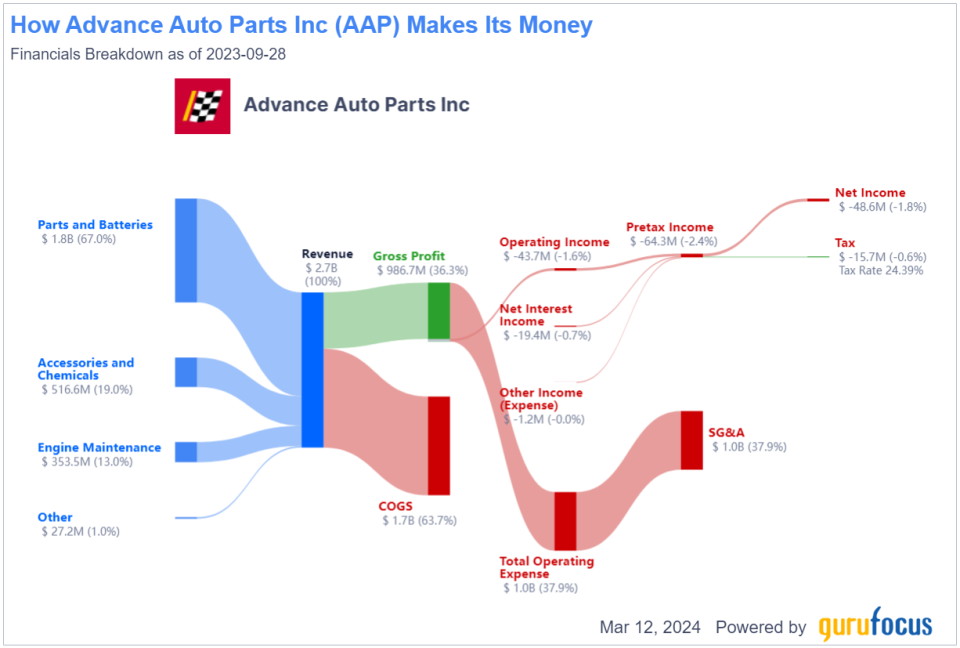

Its business is divided into four segments, the largest of which is Parts & Batteries. The business generated 67% of the company's total sales in the third quarter of 2023.

Earnings and financial overview

Advance Auto reported its fourth-quarter and full-year 2023 financial results on Feb. 28.

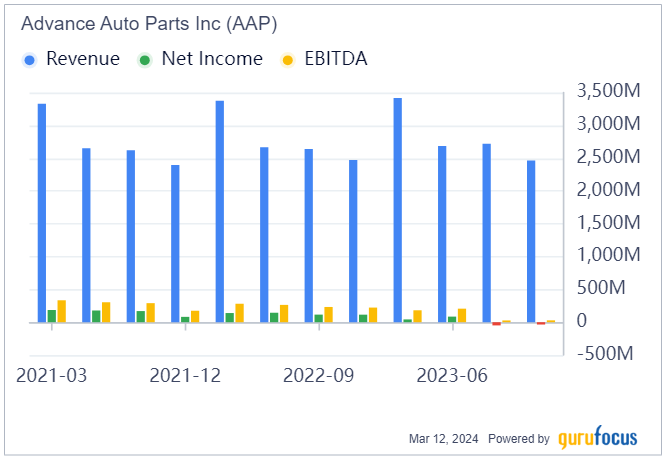

For the three months ended Dec. 31, the company posted revenue of $2.50 billion, which declined 0.40% from the prior-year quarter. Comparable store sales fell 1.40%. Advance Auto also recorded a net loss of $35 million, or 59 cents per share, and Ebitda of $29 million. All three figures were down from a year ago.

As for the full year, the company recorded a 1.20% increase in revenue from 2022 to $11.30 billion, though same-store sales declined 0.30%. Its net income of $30 million, or 50 cents per share, was also lower compared to the previous year. Ebitda came in lower at $426 million.

In a statement, O'Kelly noted Advance Auto's performance for the year was well below our expectations. As such, the company is now focused on instilling greater discipline and accountability in its operations.

As it works to get back on track, the company is expecting between $11.30 billion and $11.40 billion in revenue for 2024 and diluted earnings per share in the range of $3.75 to $4.25.

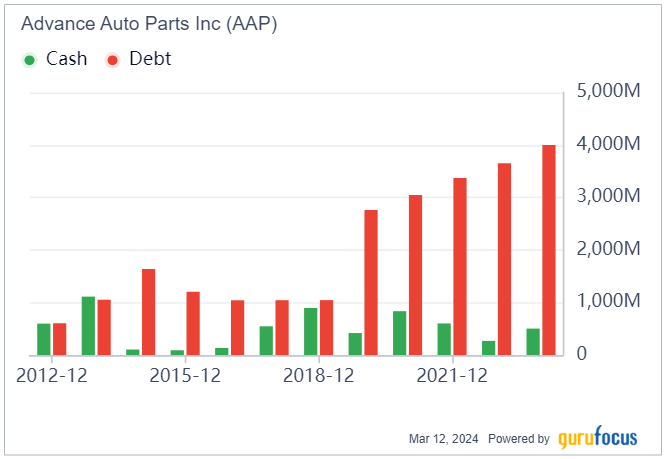

On the balance sheet, the company recorded $503 million in cash, cash equivalents and short-term investments and $4 billion in long-term debt. In addition to the cash-to-debt ratio of 0.13 indicating Advance is unable to pay off its debt using cash on hand, it has a low interest coverage ratio of 1.50.

Further, GuruFocus has found the Altman Z-Score is low at 1.34, implying the company is at risk of bankruptcy in the next several years. The Piotroski F-Score of 6 out of 9, however, means its operations are typical for a stable company.

The company's board of directors also declared a quarterly dividend of 25 cents per share, which will be distributed on April 26 to shareholders of record as of April 12. The dividend yield is 2.83% and the payout ratio is 2.70.

Valuation

Sporting a $4.72 billion market cap, shares of Advance Auto were up nearly 5% at around $79.41 on Tuesday with a price-earnings ratio of 107.30, a price-book ratio of 1.87 and price-sales ratio of 0.42.

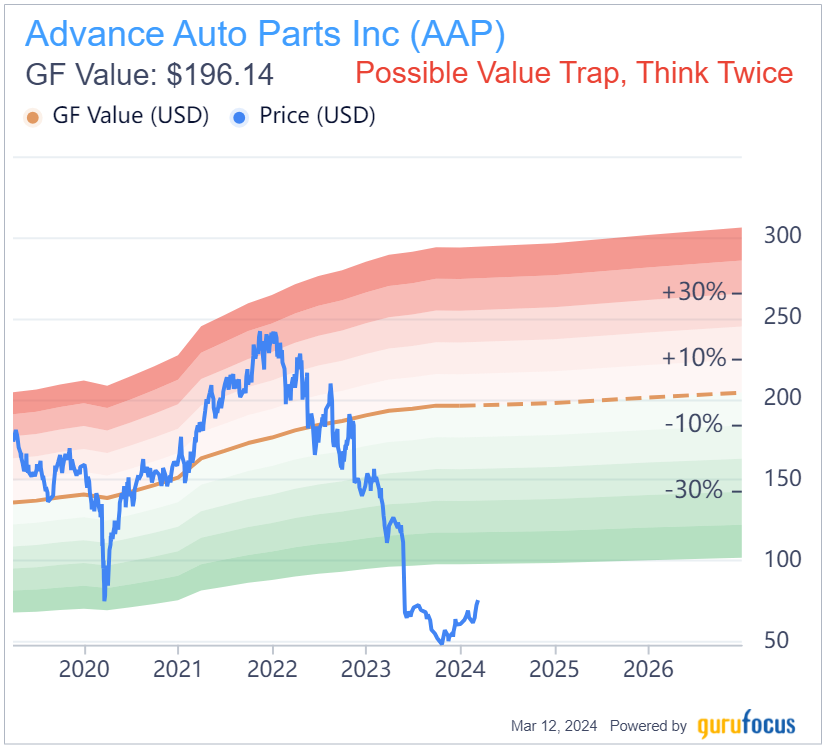

Due to its financial issues, the GF Value Line suggests the stock may be a value trap currently.

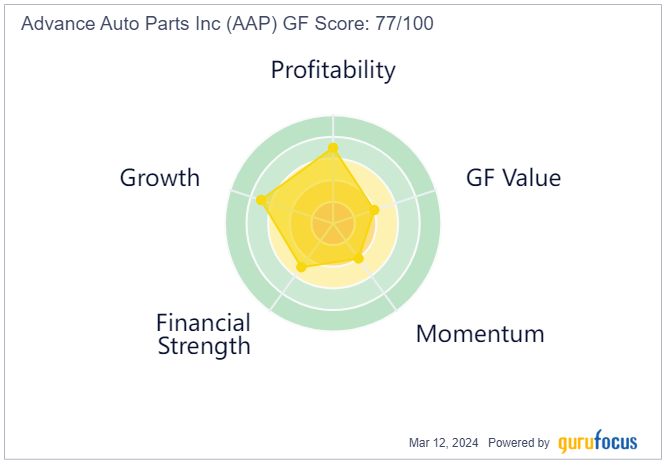

Further, the GF Score of 77 out of 100 indicates the company is likely to have average performance going forward based on its high profitability and growth ratings despite the more moderate ranks for financial strength, value and momentum.

Final thoughts

While Advance Auto has taken a severe tumble, its shares have recovered year to date due to progress in its turnaround efforts and the recent activist involvement. As such, investors may want to consider taking a closer look at the company's prospects.

This article first appeared on GuruFocus.