Acuity Brands (AYI) Gains From Product Vitality Amid High Cost

Acuity Brands, Inc. AYI is benefiting from product vitality, acquisitions and divestitures along with cost-efficiency initiatives.

Recently, AYI reported second-quarter fiscal 2023 (ended Feb 28, 2023) results, wherein earnings surpassed the Zacks Consensus Estimate by 20.5% and grew 19.1% year over year. Revenues increased 3.8% year over year.

Earnings estimates for fiscal 2023 have moved north to $13.69 per share from $13.48 over the past 30 days, depicting analysts' optimism over the company’s growth prospects.

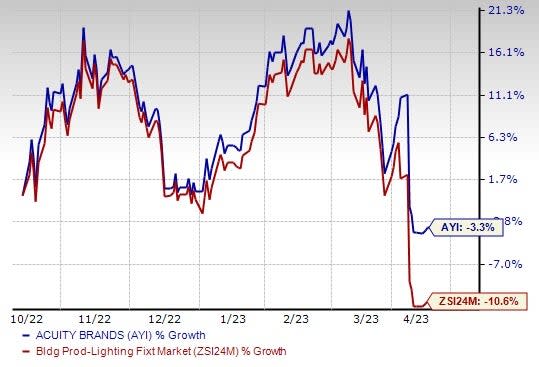

However, this manufacturer and distributor of lighting fixtures and related components is facing high production cost and inflation that is restricting its growth. Shares of AYI have declined 3.3% over the past six months compared with the Zacks Building Products - Lighting industry’s decline of 10.6%.

Image Source: Zacks Investment Research

Let us consider the factors broadly.

Tailwinds

Acuity Brands’ diversified portfolio of innovative lighting control solutions and energy-efficient luminaries bodes well for the company. The company’s focus on innovation through product vitality and increasing service levels for the benefit of customers has delivered strong results. Acuity Brands’ vitality efforts include improvements to existing products and the introduction of new ones. The company mainly focuses on three areas — strategic supplier relationships, empowerment of teams to prioritize access and speed over cost on available components and redesigning of products according to the available components by its highly-skilled engineers. In its NEXT 23 press conference, it introduced various products, including the new nLight AIR System Input Device and nLight AIR rPOD Micro.

Acuity Brands is committed to expanding its geographic borders and product portfolio through acquisitions and joint ventures. Also, it is engaged in portfolio optimization through divestitures to drive growth. Although there were no acquisitions during the first six months of fiscal 2023, it sold Sunoptics prismatic skylights business during the first quarter of fiscal 2023.

Acuity has taken actions to reduce costs, including the realignment of headcount with current volumes, a freeze on all non-essential employee travel, efforts to decrease discretionary spending and planned reductions in its real estate footprint. In the fiscal second quarter, the adjusted EBITDA rose 6.5% to $144.8 million from the year-ago period. Adjusted operating profit was $133.3 million, implying an increase of 5% from the prior-year figure.

Headwinds

Acuity Brands has been facing high costs in its production activities for quite some time now. Energy-efficient lighting products like LED fixtures need extensive research and development and hence involve costs. Again, inflation and higher cost of the inputs and labor are most likely to dampen its overall results. The company is going through supply chain challenges and rising cost of some components. Although the incremental cost of the technology is relatively low, real cost of installation of that technology is still growing.

Zacks Rank & Key Picks

AYI currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some better-ranked stocks that investors may consider from the Zacks Construction sector.

Altair Engineering Inc. ALTR currently sports a Zacks Rank #1. ALTR has a trailing four-quarter earnings surprise of 135.8%, on average. Shares of the company have gained 61.6% in the past six months.

The Zacks Consensus Estimate for ALTR’s 2023 sales and EPS indicates growth of 7.8% and 11.2%, respectively, from the previous year’s reported levels.

CRH plc CRH currently carries a Zacks Rank #2 (Buy). Shares of CRH have gained 52.4% in the past six months. The long-term earnings growth rate is anticipated to be 10.2%.

The Zacks Consensus Estimate for CRH’s 2023 sales and EPS indicates growth of 6% and 9.2%, respectively, from the previous year’s reported levels.

AECOM ACM currently carries a Zacks Rank #2. ACM has a trailing four-quarter earnings surprise of 5.2%, on average. Shares of the company have gained 20.1% in the past six months.

The Zacks Consensus Estimate for ACM’s fiscal 2023 sales and EPS indicates growth of 3.9% and 5.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report