Acuity Brands: A Decade of Growth, Profitability and Potential

Over the past decade, Acuity Brands Inc (NYSE:AYI) has exhibited significant fluctuations in its stock price performance. Between 2014 and 2016, the company's shares increased from $114 to $272.50 per share. Subsequently, it experienced a declining trend to $83.30 per share in May 2020.

As of the time of writing, Acuity Brands' share price has rebounded to $240 per share, nearing its peak value from 2016. Looking at the longer time horizon, since 2005, the company has provided its shareholders with a respectable 12.40% compounded annualized gain. Let's have a closer look to determine whether the stock presents a compelling investment opportunity at its current price.

Growing revenue and consistent profitability with high ROIC

Acuity Brands provides cutting-edge lighting and building management solutions, operating in two main business segments: Acuity Brands Lighting and Light Controls (ABL) and the Intelligent Spaces Group (ISG). ABL is the biggest revenue contributor, generating $3.7 billion in 2023 sales and accounting for 94.20% of total revenue. ISG is a much smaller segment with $252.7 million in 2023 revenue, representing 6.40% of the total. Both segments enjoyed double-digit operating profit margins. ABL's operating profit margin is 13.70%, while ISG's operating margin came in at 12.70% in 2023.

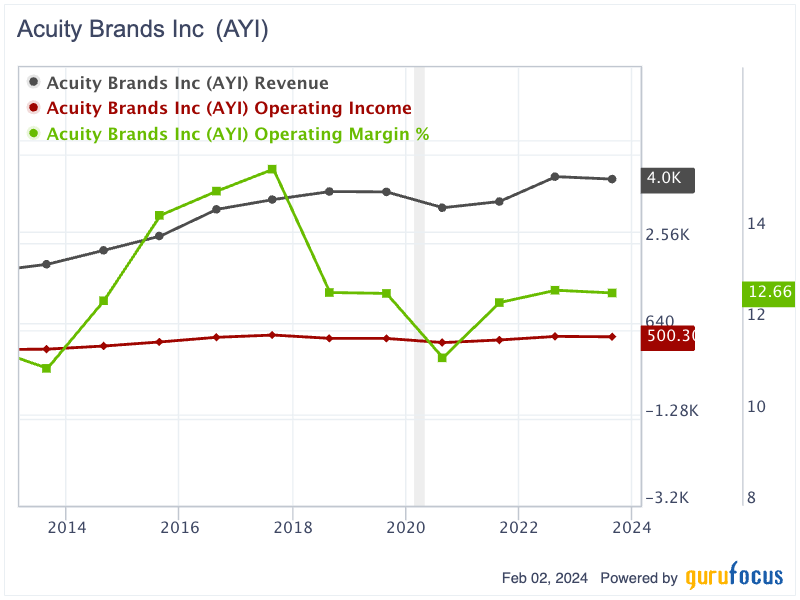

Over the past 10 years, the company's revenue has been on the rise, experiencing 90% growth from $2.10 billion in 2013 to nearly $4 billion in 2023. Its operating income has increased significantly from $230 million in 2013 to $538.80 million in 2017, then declined to $373.90 million in 2020 before increasing to $500 million in 2023. The operating income has always stayed in the middle-digit range, between 11% and 15.37%, demonstrating the stability and profitability of the business.

Warren Buffett (Trades, Portfolio) has highlighted the essence of successful long-term investing. He said:

"What we really want to do is to buy a business that's a great business, which means that business is going to earn a high return on capital employed for a long period of time, and where we think the management will treat us right."

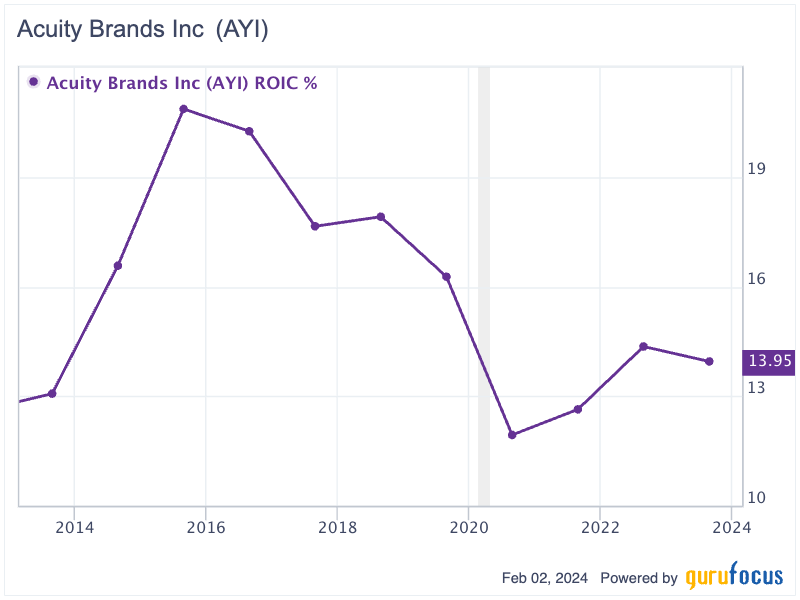

This principle underscores the importance of investing in companies that consistently generate high returns on invested capital. Acuity Brands seems to fit well in the investors' long-term portfolio, as mentioned by Buffett, as the company has maintained double-digit returns on ROIC over the past decade. Despite some fluctuations, its ROIC has remained within a commendable range of approximately 12% to 21%. Specifically, in 2023, Acuity Brands achieved a ROIC of nearly 14%.

Robust cash flow generation

Acuity Brands has been a strong cash generator, as evidenced by increasing operating cash flow and free cash flow. Over the past 10 years, despite experiencing a decline from 2020 to 2022 due to the Covid-19 pandemic, the company's operating cash flow has shown an upward trend. It grew from $132.30 million in 2013 to $578.1 million in 2023. Similarly, free cash flow also followed a comparable trajectory, increasing from $91.70 million in 2013 to $511.40 million in 2023. This growth translates into an impressive 10-year compounded annual growth rate of 18.75%.

Conservative capital structure

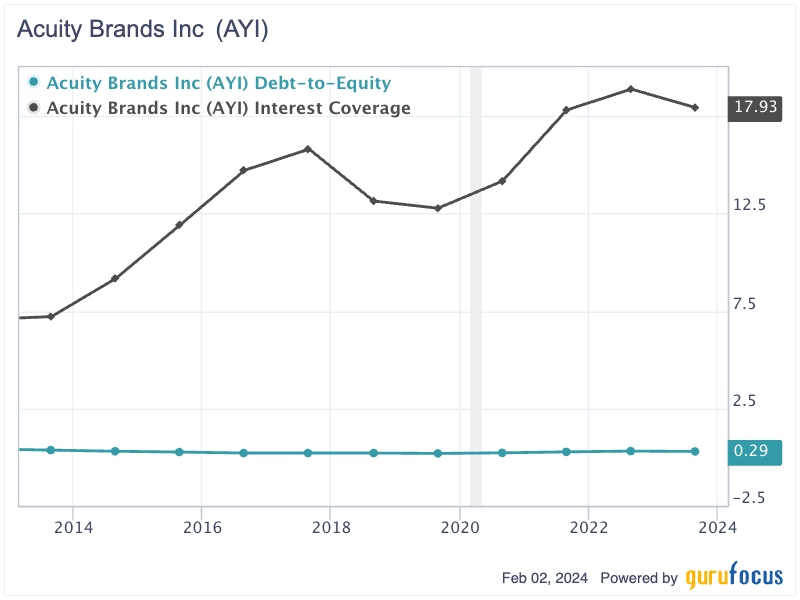

Acuity Brands has achieved consistent profitability with a high ROIC while maintaining a conservative capital structure. As of November, the company reported over $2 billion in shareholders' equity, including $513.30 million in cash and cash equivalents. Its interest-bearing debt and operating lease liabilities were modestly recorded at only $585 million. Consequently, the debt-to-equity ratio was a low 0.29, while net debt stood at $71.70 million.

The company boasts a strong track record of maintaining a robust balance sheet. The debt-to-equity ratio has consistently ranged between 0.19 and 0.36 in the past decade. Moreover, the interest coverage ratio, which indicates the company's ability to cover interest payments on its outstanding debt, has shown significant improvement, increasing from 7.21 in 2013 to 17.93 in 2023. This growth has demonstrated that Acuity Brands is generating considerably more earnings relative to its interest obligations, indicating the substantial improvement in its financial stability.

Potential upside

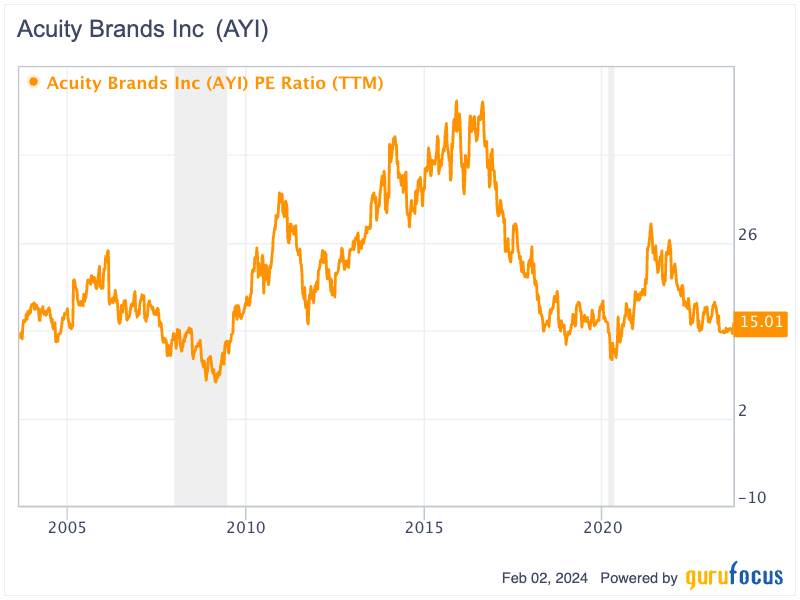

Over the past 20 years, the earnings multiple of Acuity Brands has varied significantly, ranging from 6.90 to 45.41. Presently, the market values the company at 15 times earnings, which is below the 20-year average earnings multiple of 21.60. As of the latest projections for 2024, Acuity Brands is anticipated to achieve earnings per share of $14.80. Using the average multiple of 21.60 times, the estimated value would be nearly $320 per share.

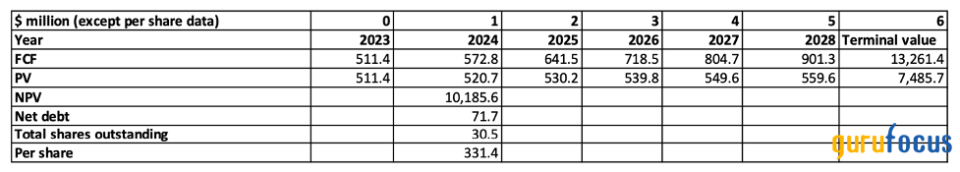

Let's also apply a discounted free cash flow model to value the company. Assuming a conservative growth rate of 12% over the next five yearssignificantly less than its 10-year average growth rate of 18.75%followed by a terminal growth rate of 3% and applying a 10% discount rate suggests that Acuity Brands is worth $331 per share.

Source: Author's table

This analysis suggests the intrinsic value of Acuity Brands offers potential upside of 33% to 37.50% compared to its current market price, indicating the stock is currently undervalued.

Key takeaway

Acuity Brands has proven to be a robust investment proposition, characterized by its impressive growth in revenue, sustained profitability and strong cash flow generation over the past decade. The company's impressive operational and financial metrics, including a high return on invested capital and a conservative capital structure, reflect its resilience and potential for continued success.

The valuation analysis, incorporating earnings multiples and discounted free cash flow models, suggests Acuity Brands is undervalued at its current market price, offering a promising opportunity for investors seeking to capitalize on its future growth and profitability. Considering its strong fundamentals and the potential upside in its stock price, the company stands out as an attractive long-term investment.

This article first appeared on GuruFocus.