Acushnet Holdings Corp.’s (NYSE:GOLF) Investment Returns Are Lagging Its Industry

Today we’ll evaluate Acushnet Holdings Corp. (NYSE:GOLF) to determine whether it could have potential as an investment idea. To be precise, we’ll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

First up, we’ll look at what ROCE is and how we calculate it. Then we’ll compare its ROCE to similar companies. Last but not least, we’ll look at what impact its current liabilities have on its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE is a measure of a company’s yearly pre-tax profit (its return), relative to the capital employed in the business. Generally speaking a higher ROCE is better. Overall, it is a valuable metric that has its flaws. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since ‘No two businesses are exactly alike.’

So, How Do We Calculate ROCE?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for Acushnet Holdings:

0.12 = US$168m ÷ (US$1.7b – US$295m) (Based on the trailing twelve months to December 2018.)

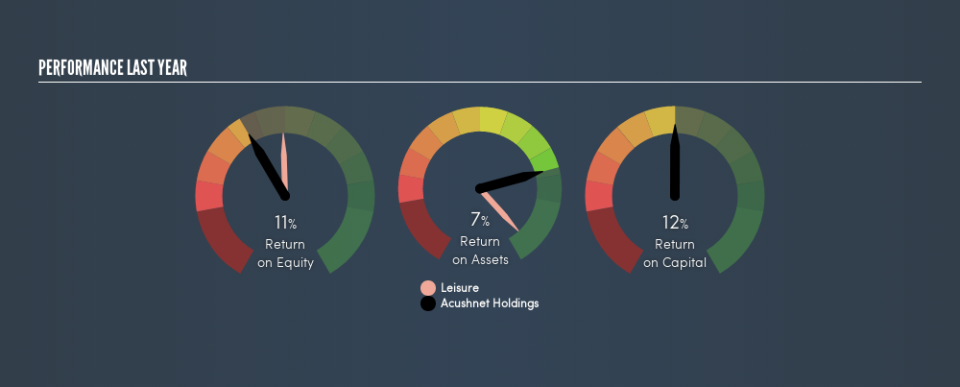

So, Acushnet Holdings has an ROCE of 12%.

Check out our latest analysis for Acushnet Holdings

Does Acushnet Holdings Have A Good ROCE?

ROCE can be useful when making comparisons, such as between similar companies. Using our data, Acushnet Holdings’s ROCE appears to be significantly below the 16% average in the Leisure industry. This performance could be negative if sustained, as it suggests the business may underperform its industry. Independently of how Acushnet Holdings compares to its industry, its ROCE in absolute terms appears decent, and the company may be worthy of closer investigation.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. This is because ROCE only looks at one year, instead of considering returns across a whole cycle. Since the future is so important for investors, you should check out our free report on analyst forecasts for Acushnet Holdings.

What Are Current Liabilities, And How Do They Affect Acushnet Holdings’s ROCE?

Short term (or current) liabilities, are things like supplier invoices, overdrafts, or tax bills that need to be paid within 12 months. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To counteract this, we check if a company has high current liabilities, relative to its total assets.

Acushnet Holdings has total assets of US$1.7b and current liabilities of US$295m. Therefore its current liabilities are equivalent to approximately 17% of its total assets. Current liabilities are minimal, limiting the impact on ROCE.

The Bottom Line On Acushnet Holdings’s ROCE

Overall, Acushnet Holdings has a decent ROCE and could be worthy of further research. You might be able to find a better buy than Acushnet Holdings. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.