Is AdaptHealth (AHCO) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is AdaptHealth Corp (NASDAQ:AHCO). The stock, which is currently priced at $9.72, recorded a loss of 4.14% in a day and a 3-month decrease of 2.61%. The stock's fair valuation is $24.17, as indicated by its GF Value.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. It is calculated based on historical multiples that the stock has traded at, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance. We believe the GF Value Line is the fair value that the stock should be traded at. If the stock price is significantly below the GF Value Line, its future return will likely be higher.

A Closer Look at the Risks

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with AdaptHealth should not be ignored. These risks are primarily reflected through its low Altman Z-score of 1.02. These indicators suggest that AdaptHealth, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Decoding the Altman Z-Score

Before delving into the details, let's understand what the Altman Z-score entails. The Z-Score is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

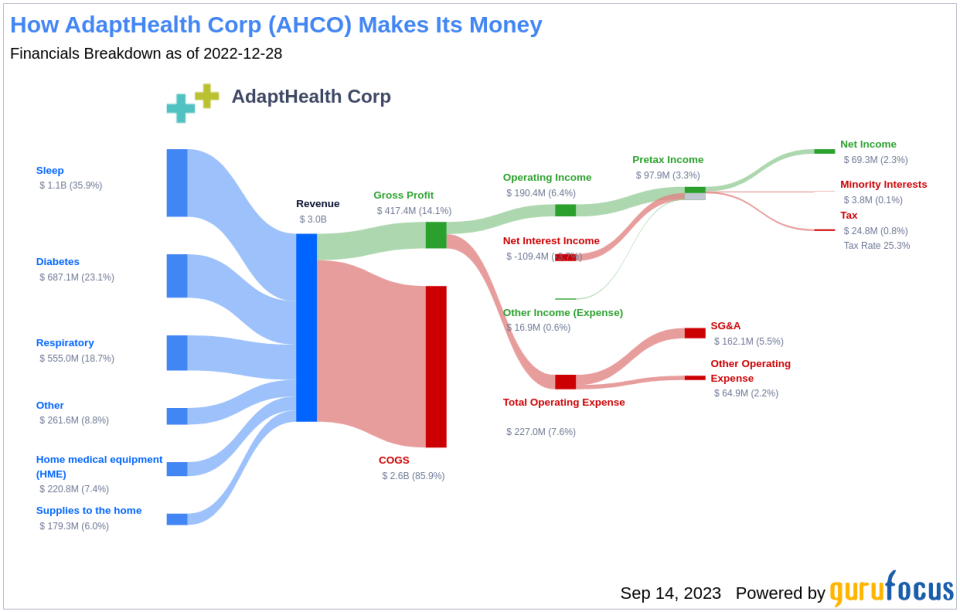

A Snapshot of AdaptHealth's Operations

AdaptHealth Corp is engaged in providing patient-centered, healthcare-at-home solutions including home medical equipment (HME), medical supplies, and related services. It focuses on providing sleep therapy equipment, supplies, and related services to individuals suffering from obstructive sleep apnea (OSA), medical devices and supplies to patients for the treatment of diabetes, home medical equipment to patients discharged from acute care and other facilities, and other HME devices and supplies on behalf of chronically ill patients with wound care, urological, incontinence, ostomy and nutritional supply needs.

AdaptHealth's Low Altman Z-Score: A Breakdown of Key Drivers

A dissection of AdaptHealth's Altman Z-score reveals that the company's financial health may be weak, suggesting possible financial distress.

Operational Efficiency Concerns

When it comes to operational efficiency, a vital indicator for AdaptHealth is its asset turnover. The data: 2021: 0.65; 2022: 0.53; 2023: 0.58 from the past three years suggests a decreasing trend in this ratio. The asset turnover ratio reflects how effectively a company is using its assets to generate sales. Therefore, a drop in this ratio can signify reduced operational efficiency, potentially due to underutilization of assets or decreased market demand for the company's products or services. This shift in AdaptHealth's asset turnover underlines the need for the company to reassess its operational strategies to optimize asset usage and boost sales.

Conclusion

Despite the seemingly undervalued state of AdaptHealth (NASDAQ:AHCO), the low Altman Z-Score and decreasing asset turnover ratio suggest potential financial distress and operational inefficiency. These factors indicate that AdaptHealth might be a value trap, thus necessitating careful consideration and thorough due diligence before making an investment decision.

GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .

This article first appeared on GuruFocus.