Adaptimmune (ADAP) Rises as GSK Transfers T-Cell Therapy IND

Adaptimmune Therapeutics plc ADAP announced that British drugmaker GSK plc GSK has transferred the investigational new drug (IND) for T-cell therapy, letetresgene autoluecel (lete-cel), for the pivotal IGNYTE-ESO study to it. Shares of Adaptimmune were up 11.7% following the announcement of the news on Nov 29.

The phase II IGNYTE-ESO study is evaluating the safety, efficacy and tolerability of lete-cel for the treatment of patients with synovial sarcoma or myxoid/round cell liposarcoma (MRCLS) who have received prior treatment with anthracycline.

In October 2023, ADAP reported data from a protocol-defined interim analysis of the pivotal IGNYTE-ESO study on lete-cel for treating synovial sarcoma or MRCLS.

Data from the interim analysis demonstrated that 40% of patients treated with lete-cel had confirmed clinical responses per the independent review.

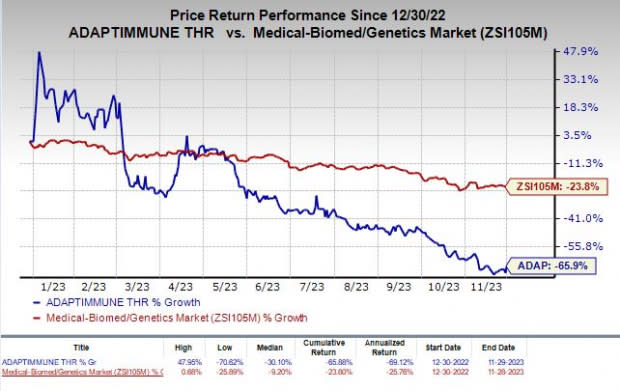

Shares of Adaptimmune have declined 65.9% so far this year compared with the industry’s decrease of 23.8%.

Image Source: Zacks Investment Research

Lete-cel was initially developed by Adaptimmune and was further developed under a collaboration and license agreement with GSK.

We remind investors that in April 2023, ADAP entered into a transition agreement with GSK to ensure the return of rights and materials of the PRAME and NY-ESO cell therapy programs – its proprietary cell therapy programs.

Following the agreement, Adaptimmune received an undisclosed amount of upfront payment from GSK. It is entitled to receive milestone-based payments totaling £30 million for the transfer of the clinical studies related to the NY-ESO targeted programs.

Adaptimmune entered into the collaboration and license agreement with GSK for the development, manufacture and commercialization of T-cell receptors therapeutic candidates in 2014.

In the absence of a marketed product, the successful development of its pipeline candidates and cell therapies in the sarcoma franchise remains the key focus of this clinical-stage biopharmaceutical company.

Zacks Rank & Stocks to Consider

Adaptimmune currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are CytomX Therapeutics, Inc. CTMX and Puma Biotechnology, Inc. PBYI, sporting a Zacks Rank #1 (Strong Buy) each.You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics’ 2023 loss per share have narrowed from 37 cents to 6 cents. Meanwhile, loss per share estimates for 2024 have narrowed from 51 cents to 21 cents. Year to date, shares of CTMX have lost 16.9%.

Earnings of CytomX Therapeutics beat estimates in three of the last four quarters while missing the same on the remaining occasion. CTMX delivered a four-quarter average earnings surprise of 45.44%.

In the past 60 days, estimates for Puma Biotechnology’s 2023 earnings per share have improved from 67 cents to 73 cents. During the same period, earnings per share estimates for 2024 have moved up from 55 cents to 62 cents. Year to date, shares of PBYI have lost 8.3%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Adaptimmune Therapeutics PLC (ADAP) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report