Adaptive Biotechnologies Corp (ADPT) Faces Revenue Decline Amid Growth in MRD Segment

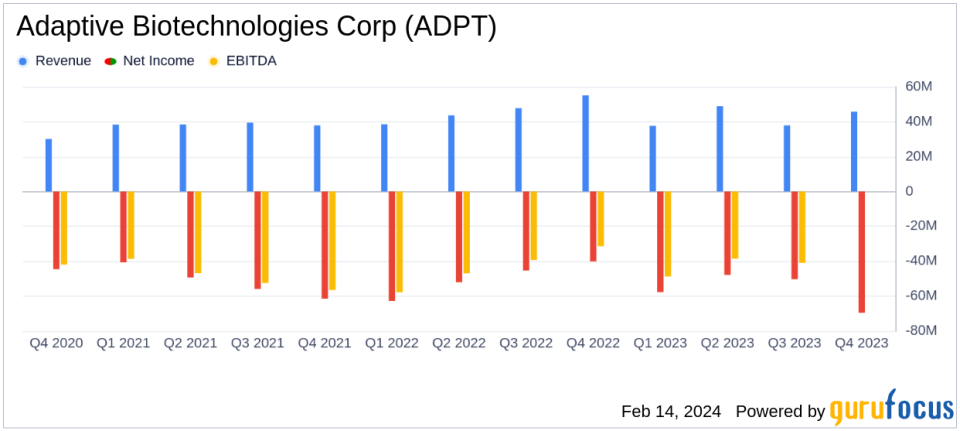

Revenue: Q4 revenue decreased by 17% year-over-year to $45.8 million; full year revenue declined by 8% to $170.3 million.

MRD Business: Q4 MRD revenue increased by 9% to $30.8 million; full year MRD revenue grew 18% to $102.7 million.

Net Loss: Q4 net loss widened to $69.5 million from $40.2 million year-over-year; full year net loss increased to $225.3 million from $200.4 million.

Adjusted EBITDA: Q4 adjusted EBITDA loss worsened to $24.7 million from $19.6 million; full year adjusted EBITDA loss improved slightly to $116.4 million from $121.6 million.

Test Volume: clonoSEQ test volume surged by 49% in Q4 and 53% year-over-year.

Financial Guidance: 2024 MRD business revenue projected to be between $130 million and $140 million; operating expenses expected to be between $360 million and $370 million.

Liquidity: Cash, cash equivalents, and marketable securities totaled $346.4 million as of December 31, 2023.

On February 14, 2024, Adaptive Biotechnologies Corp (NASDAQ:ADPT) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its pioneering work in immune-driven medicine, reported a mixed financial performance with significant growth in its Minimal Residual Disease (MRD) business but an overall decline in revenue and an increase in net loss.

Company Overview

Adaptive Biotechnologies Corp is at the forefront of immune-driven medicine, leveraging the adaptive immune system's biology to revolutionize disease diagnosis and treatment. Its flagship clinical diagnostic product, clonoSEQ, is an FDA-authorized test for detecting and monitoring minimal residual disease (MRD) in various lymphoid cancers.

Financial Performance and Challenges

Despite a 53% increase in clonoSEQ test volume, Adaptive Biotechnologies experienced a 17% year-over-year decline in fourth-quarter revenue to $45.8 million and an 8% decrease in full-year revenue to $170.3 million. The MRD business saw a 9% and 18% increase in revenue for the quarter and full year, respectively, but this was overshadowed by a reduction in GNE amortization in the Immune Medicine (IM) business. The company's net loss also expanded to $69.5 million for the quarter and $225.3 million for the full year, compared to $40.2 million and $200.4 million in the prior year, respectively.

Operating expenses, including a significant $25.4 million lease impairment charge, rose by 24% to $116.9 million for the quarter. However, excluding this charge, operating expenses actually decreased by 3% compared to the previous year's quarter. The company's adjusted EBITDA loss for the quarter was $24.7 million, worsening from a $19.6 million loss in the prior year's quarter. For the full year, the adjusted EBITDA loss improved slightly to $116.4 million from $121.6 million.

Strategic Developments and Outlook

Adaptive Biotechnologies has made strategic moves, including a partnership with Flatiron Health to integrate clonoSEQ into the OncoEMR system and securing an IND for its first cell therapy product candidate. The company continues its strategic review with the aim of maximizing the value of its MRD and Immune Medicine businesses.

For 2024, Adaptive Biotechnologies expects MRD business revenue to be between $130 million and $140 million, with full-year operating expenses projected between $360 million and $370 million. The company's liquidity remains strong, with $346.4 million in cash, cash equivalents, and marketable securities as of the end of 2023.

Adaptive Biotechnologies' performance reflects the dynamic nature of the biotechnology industry, where significant investments in research and development are essential for long-term success. The growth in the MRD segment is a positive sign, indicating the company's potential to capitalize on its innovative diagnostic products. However, the overall revenue decline and increased net loss highlight the challenges the company faces in translating its scientific advancements into profitable growth.

Investors and stakeholders will be closely monitoring Adaptive Biotechnologies' strategic initiatives and financial discipline as it navigates the competitive landscape of immune-driven medicine.

For more detailed information and analysis, interested parties are encouraged to join the company's conference call or access the webcast on the investor relations section of Adaptive Biotechnologies' website.

Explore the complete 8-K earnings release (here) from Adaptive Biotechnologies Corp for further details.

This article first appeared on GuruFocus.