Adbri (ASX:ABC) investors are sitting on a loss of 60% if they invested five years ago

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Adbri Limited (ASX:ABC) share price is a whole 66% lower. We certainly feel for shareholders who bought near the top. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Adbri

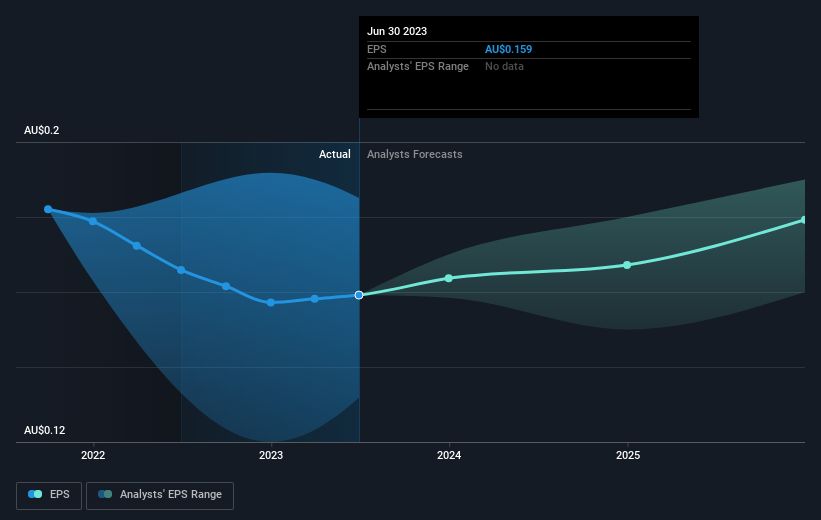

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both Adbri's share price and EPS declined; the latter at a rate of 12% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 19% per year, over the period. This implies that the market was previously too optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Adbri's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Adbri's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Adbri's TSR of was a loss of 60% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Adbri shareholders have received returns of 8.7% over twelve months, which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 10%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for Adbri. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Adbri has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.