Add Alamos Gold as the Share Price Falls

- By Alberto Abaterusso

On the back of an unchanged U.S. federal funds rate and an inverting Treasury yield curve, gold was up 2.6% to $1,316.30 per ounce at close on Tuesday on the London Bullion Market, bringing the cumulative average price to $1,303.97, or 2.8% higher than in 2018.

Warning! GuruFocus has detected 5 Warning Signs with AGI. Click here to check it out.

The intrinsic value of AGI

Source: GuruFocus.com

The VanEck Vectors Gold Miners exchange-traded fund (GDX) has risen 10.7% over the same period, closing at $23.35 on Tuesday. The ETF is a benchmark for the mining industry.

Investors can maximize their returns by investing in companies that outperform the ETF. One such company is Alamos Gold Inc. (AGI), whose share price has topped VanEck by an impressive 40% year to date.

The Toronto-based intermediate gold miner expects to produce between 480,000 and 520,000 ounces of gold in 2019, which is in line with 2018 production of 505,000 ounces. The production will be made at a lower all-in sustaining cost of $920 to $960 per ounce of gold, compared to prior revised guidance of $990 per ounce.

The Mulatos mine in Mexico as well as the Island Gold complex mines and the Young-Davidson mine in Ontario are expected to continue delivering strong performance, underpinning production growth and reducing operating costs. This is a short-term catalyst that, together with rising commodity prices, should drive the share price higher over the next several weeks.

The production should stabilize at roughly 500,000 ounces in 2019 and 2020. For 2021, production is projected to increase to 600,000 ounces of gold, driven by contributions from the fully operating Kirazli mine in Turkey.

As a debt-free company, the miner can rely on a solid balance sheet that, as of Dec. 31, had approximately $214 million in cash on hand and short-term securities.

The company's operations can guarantee cash inflows of nearly $280 million every year when the precious metal is trading at $1,265 to $1,270 an ounce.

Last December, the exploration team estimated Alamos Gold had 9.7 million ounces of gold hosted in proven and probable mineral reserves, globally grading 1.51 grams per ton of ore.

Considering 390.4 million shares outstanding, the output level for 2019 and a year-to-date cumulative average gold price of $1,304 per ounce, Tuesday's closing price of $5.44 is 3.1 times higher than the true value.

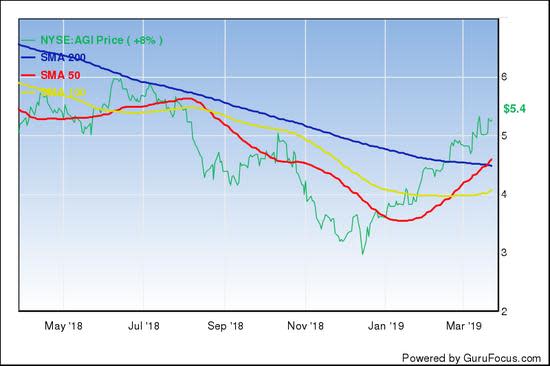

I would, therefore, wait for a significant drop in the market value before adding shares of Alamos Gold to any position. The stock is trading substantially higher than the 200, 100 and 50-day simple moving average lines.

The closing share price, which rose 8% over the 52 weeks through March 26, was 86.2% above the 52-week low of $2.9 and just 13.5% below the 52-week high of $6.13. The market capitalization is $2.12 billion.

The price-book ratio is 0.82 versus an industry median of 1.62 and the enterprise value-to-earnings before interest, taxes, depreciation and amortization ratio is 22.13 versus the industry median of 8.71.

The 14-day relative strength index of 69.43 suggests the stock is approaching oversold levels.

Wall Street issued an overweight recommendation rating, meaning Alamos Gold is expected to outperform either the industry or the overall market within 52 weeks. The average price target is $6.6 per share, which is 21.3% upside from current levels.

In addition, Alamos Gold will pay a quarterly dividend of one cent cash per share on March 29 to shareholders of record as of March 15. The forward dividend yield is 0.74% versus an industry median of 3.14%.

Disclosure: I have no positions in any securities mentioned.

Read more here:

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with AGI. Click here to check it out.

The intrinsic value of AGI