Should You Be Adding Cass Information Systems (NASDAQ:CASS) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Cass Information Systems (NASDAQ:CASS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Cass Information Systems

How Quickly Is Cass Information Systems Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Cass Information Systems managed to grow EPS by 4.4% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

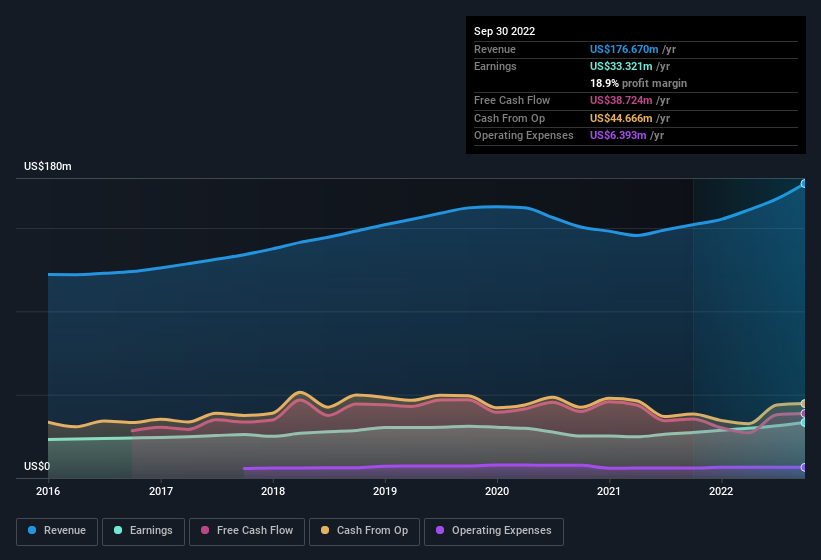

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Cass Information Systems' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Cass Information Systems maintained stable EBIT margins over the last year, all while growing revenue 16% to US$177m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Cass Information Systems Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Cass Information Systems shares, in the last year. Add in the fact that Martin Resch, the President & COO of the company, paid US$18k for shares at around US$35.70 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Cass Information Systems.

Along with the insider buying, another encouraging sign for Cass Information Systems is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$16m worth of its stock. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 2.8%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Cass Information Systems' CEO, Eric Brunngraber, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$200m and US$800m, like Cass Information Systems, the median CEO pay is around US$2.8m.

Cass Information Systems' CEO took home a total compensation package worth US$2.4m in the year leading up to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Cass Information Systems Deserve A Spot On Your Watchlist?

One positive for Cass Information Systems is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Cass Information Systems.

Keen growth investors love to see insider buying. Thankfully, Cass Information Systems isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here