Should You Be Adding Cochlear (ASX:COH) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Cochlear (ASX:COH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Cochlear

How Fast Is Cochlear Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Cochlear has grown EPS by 34% per year, compound, in the last three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

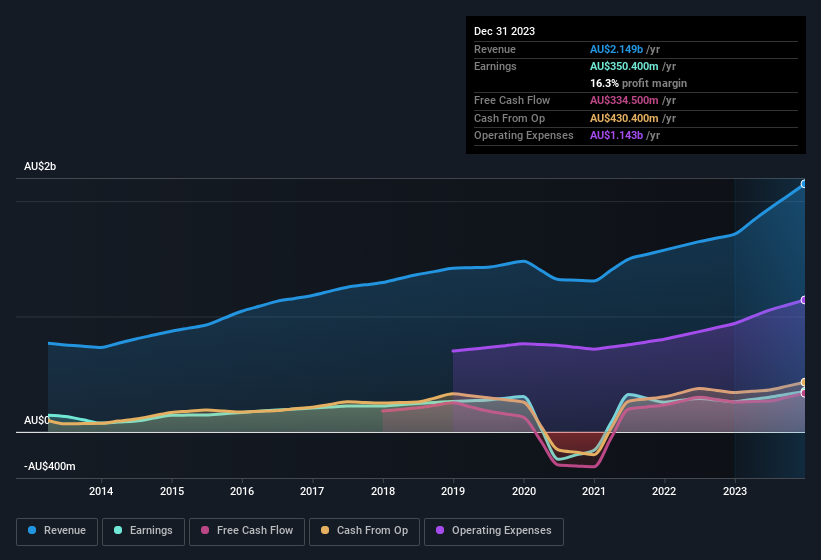

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Cochlear remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to AU$2.1b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Cochlear's future EPS 100% free.

Are Cochlear Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Cochlear insiders refrain from selling stock during the year, but they also spent AU$256k buying it. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Director Christine McLoughlin for AU$68k worth of shares, at about AU$271 per share.

Along with the insider buying, another encouraging sign for Cochlear is that insiders, as a group, have a considerable shareholding. Holding AU$87m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

Does Cochlear Deserve A Spot On Your Watchlist?

You can't deny that Cochlear has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Cochlear's ROE with industry peers (and the market at large).

The good news is that Cochlear is not the only growth stock with insider buying. Here's a list of growth-focused companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.