Should You Be Adding Codorus Valley Bancorp (NASDAQ:CVLY) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Codorus Valley Bancorp (NASDAQ:CVLY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Codorus Valley Bancorp

How Quickly Is Codorus Valley Bancorp Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Codorus Valley Bancorp's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 44%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

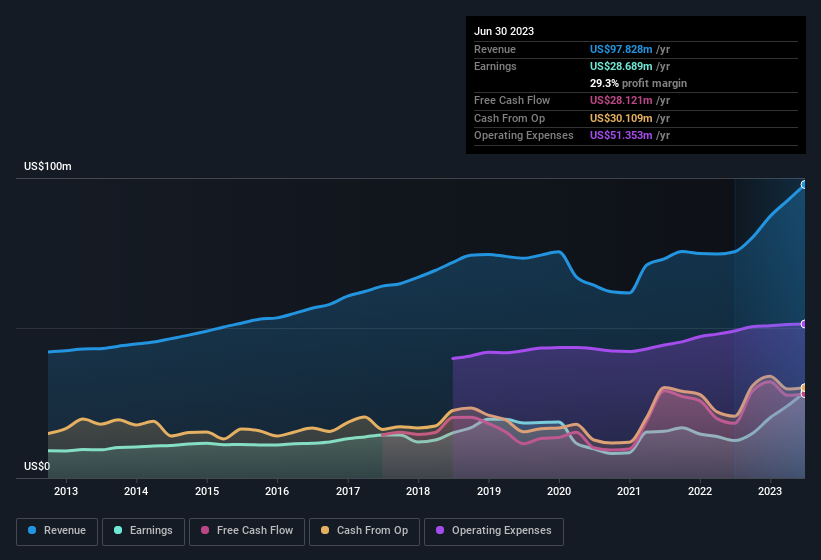

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Codorus Valley Bancorp's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Codorus Valley Bancorp remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 30% to US$98m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Codorus Valley Bancorp isn't a huge company, given its market capitalisation of US$195m. That makes it extra important to check on its balance sheet strength.

Are Codorus Valley Bancorp Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Codorus Valley Bancorp will be more than happy to see insiders committing themselves to the company, spending US$344k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Independent Director Scott Fainor for US$71k worth of shares, at about US$19.68 per share.

It's reassuring that Codorus Valley Bancorp insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations between US$100m and US$400m, like Codorus Valley Bancorp, the median CEO pay is around US$1.6m.

Codorus Valley Bancorp offered total compensation worth US$991k to its CEO in the year to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Codorus Valley Bancorp Deserve A Spot On Your Watchlist?

Codorus Valley Bancorp's earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Codorus Valley Bancorp is at an inflection point, given the EPS growth. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Codorus Valley Bancorp (including 1 which makes us a bit uncomfortable).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Codorus Valley Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.