Should You Be Adding Croma Security Solutions Group (LON:CSSG) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Croma Security Solutions Group (LON:CSSG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Croma Security Solutions Group with the means to add long-term value to shareholders.

View our latest analysis for Croma Security Solutions Group

Croma Security Solutions Group's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Croma Security Solutions Group's EPS went from UK£0.0042 to UK£0.24 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

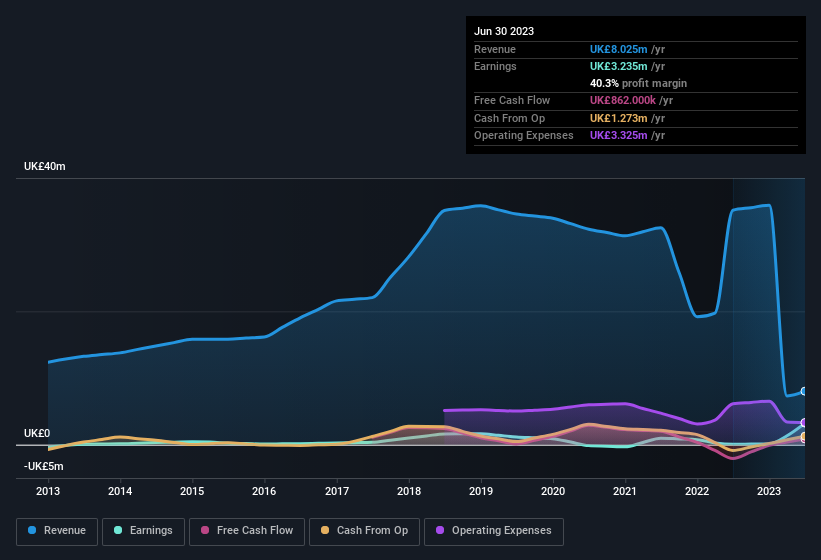

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Croma Security Solutions Group's EBIT margins have actually improved by 4.6 percentage points in the last year, to reach 5.3%, but, on the flip side, revenue was down 77%. While not disastrous, these figures could be better.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Croma Security Solutions Group isn't a huge company, given its market capitalisation of UK£8.4m. That makes it extra important to check on its balance sheet strength.

Are Croma Security Solutions Group Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Croma Security Solutions Group will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Although, with Croma Security Solutions Group being valued at UK£8.4m, this is a small company we're talking about. That means insiders only have UK£3.5m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Croma Security Solutions Group with market caps under UK£163m is about UK£284k.

The Croma Security Solutions Group CEO received UK£254k in compensation for the year ending June 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Croma Security Solutions Group Deserve A Spot On Your Watchlist?

Croma Security Solutions Group's earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Croma Security Solutions Group is worth considering carefully. You should always think about risks though. Case in point, we've spotted 5 warning signs for Croma Security Solutions Group you should be aware of, and 2 of them are a bit concerning.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.