Should You Be Adding Encompass Health (NYSE:EHC) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Encompass Health (NYSE:EHC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Encompass Health

Encompass Health's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Encompass Health has grown EPS by 4.8% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

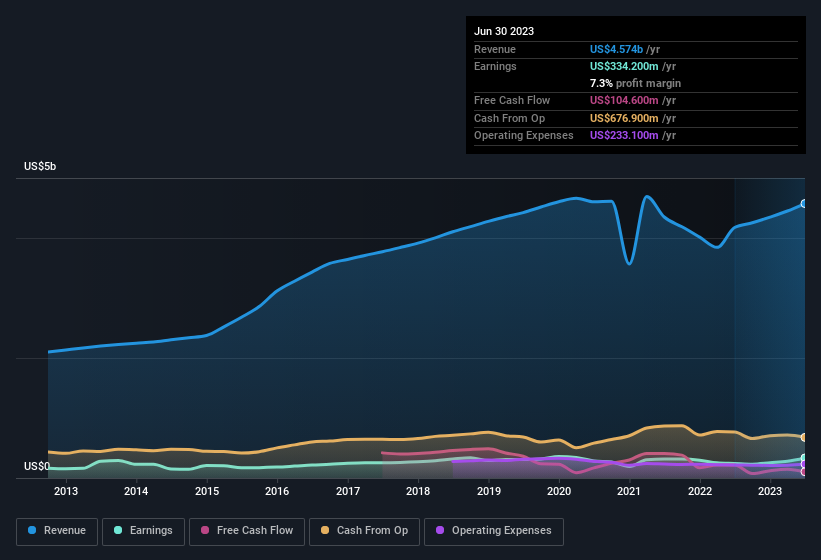

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Encompass Health maintained stable EBIT margins over the last year, all while growing revenue 9.6% to US$4.6b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Encompass Health's future profits.

Are Encompass Health Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Director, Gregory Carmichael, paid US$100k to buy shares at an average price of US$54.67. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

On top of the insider buying, it's good to see that Encompass Health insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$154m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Encompass Health Worth Keeping An Eye On?

As previously touched on, Encompass Health is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. Still, you should learn about the 1 warning sign we've spotted with Encompass Health.

Keen growth investors love to see insider buying. Thankfully, Encompass Health isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.