Should You Be Adding First Capital (NASDAQ:FCAP) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like First Capital (NASDAQ:FCAP), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide First Capital with the means to add long-term value to shareholders.

See our latest analysis for First Capital

How Quickly Is First Capital Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years First Capital grew its EPS by 11% per year. That's a pretty good rate, if the company can sustain it.

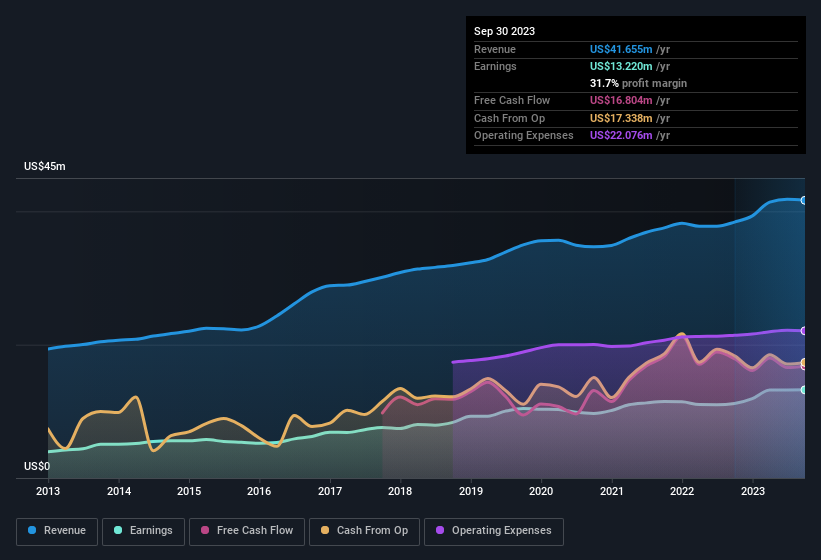

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of First Capital's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note First Capital achieved similar EBIT margins to last year, revenue grew by a solid 8.5% to US$42m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since First Capital is no giant, with a market capitalisation of US$88m, you should definitely check its cash and debt before getting too excited about its prospects.

Are First Capital Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

A great takeaway for shareholders is that company insiders within First Capital have collectively spent US$46k acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling. Zooming in, we can see that the biggest insider purchase was by company insider Jill Saegesser for US$24k worth of shares, at about US$26.52 per share.

Recent insider purchases of First Capital stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. Our analysis has discovered that the median total compensation for the CEOs of companies like First Capital with market caps under US$200m is about US$749k.

First Capital's CEO took home a total compensation package of US$252k in the year prior to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is First Capital Worth Keeping An Eye On?

As previously touched on, First Capital is a growing business, which is encouraging. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. All things considered, First Capital is certainly displaying its merits and is worthy of taking research to the next step. You still need to take note of risks, for example - First Capital has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, First Capital isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.